Video | Managing Anti Money Laundering (AML) and Compliance for your Money Service Business

To ensure the smooth and secure operation of your business, it’s essential to be diligent in navigating AML requirements while remaining compliant with the latest regulations in your operational regions. In our third instalment of the ‘How to Start Series,’ Ibrahim delves into one of the fundamental pillars of your Money Service Business (MSB): Anti-Money Laundering (AML) and Compliance, he guides you through the essential steps such as:

- Implementing a risk-based strategy tailored to your products/services.

- Establishing a comprehensive AML and compliance framework, including its key components

- Selecting the appropriate software technology that has the right capability to support your needs

Find out the insightful strategies to safeguard your MSB against potential threats, watch the full video now.

Ready to dive deeper into launching your own MSB?

Contact our expert consulting team at RemitONE today and organise a free 30-minute consultation. Let us guide you towards success and help you get your money service business up and running as fast as possible. Schedule a free consultation with our experts:

IPR Training: AML and Compliance for Money Service Businesses Key Takeaways

In a rapidly evolving financial landscape, combating money laundering (AML) and ensuring compliance has become highly essential for money service businesses (MSBs). Two weeks ago, we hosted our second Innovation in Payments and Remittances (IPR) training session, focusing on AML and compliance strategies tailored to the unique needs of MSBs.

In this article, we’ll delve deeper into the key highlights discussed during the session for you to gain key insights from.

If you couldn’t attend the live sessions, don’t worry as you can still sign up at a reduced rate and access them on-demand.

It’s a great opportunity to enhance your expertise, earn CPD points, and secure a certification. You can register online here: https://payments2023.ipr-events.com/register

Now let’s dive right in and explore some of the key takeaways from the 2-day sessions.

1. Differentiating Terrorist Financing and Money Laundering: Recognising Patterns

Distinguishing between Terrorist Financing and Money laundering is vital in developing targeted prevention strategies. The training session highlighted that while both activities involve illicit financial transactions, they often exhibit different characteristics. Terrorist financing can be sourced through legitimate funding, unlike money laundering where its origin is from criminal activities and financial crime.

Money laundering frequently involves larger amounts aimed at concealing the illegal origins of funds whilst Terrorist financing comprises of small, discrete transactions intended to avoid suspicion.

Noticing these unusual large or small transactions can be a key indicator of potential terrorist financing, allowing businesses to act quickly and prevent the flow of funds to harmful causes.

Furthermore, MSBs should set up appropriate monitoring mechanisms and transaction thresholds to better identify and report suspicious activities that align with the specific patterns of these crimes. This way MSBs can reduce the likelihood of criminal activity being carried out through their business.

2. Structured KYC Procedures: Gateway to prevent Money Laundering risks

As the starting point for any business relationship, a structured and rigorous KYC process enables MSBs to verify the identity of their customers, assess the legitimacy of their transactions, and detect potential red flags. By obtaining and verifying relevant information such as customer identification, source of funds, and purpose of transactions, MSBs can create a comprehensive customer profile that aids in identifying suspicious activities. Effective KYC practices also enable MSBs to establish a strong foundation for ongoing due diligence and monitoring.

Recognising that every MSB operates within a distinct operational context, it’s crucial to design risk assessments that address the specific needs and characteristics of each business. This approach ensures that potential vulnerabilities are identified and addressed effectively. By analysing factors such as transaction volume, customer profiles, geographic scope, and business relationships, MSBs can develop risk assessment frameworks that accurately reflect their exposure to money laundering and other financial crimes.

RemitONE’s Compliance Manager™ (COM) features a set of compliance features to ensure enhanced detection of fraudulent money. Some of the features include:

- Linked Transaction Detection: will detect multiple transactions sent by the same remitter to different beneficiaries or multiple remitters to the same beneficiary. This will help you notice any suspicious activity you need to alert authorities of immediately.

- NameMatch™: Eliminating the need for manual cross-referencing against international sanction lists, our technology streamlines the process, ensuring greater efficiency. The system cross-checks against multiple sanction lists and accommodates the addition of custom lists. Moreover, seamless integration with external Compliance List Services, such as Reuters’ WorldCheck, Experian, and GBG, widens the spectrum of available lists, encompassing PEP lists as well.

- Dynamic risk scoring: Conduct personalised risk assessments utilising assigned scores ranging from 0 to 100 for Remitters and Beneficiaries. This score continually adjusts in response to a range of variables, encompassing factors like source country, nationality, individual versus corporate affiliations, and name screening outcomes.

If you’re interested to integrate COM™ into your system contact us at sales@remitone.com.

3. A Compliance Officer/MLRO is crucial

Delving deeper, Ibrahim emphasised the fundamental role of a Compliance Officer or Money Laundering Reporting Officer (MLRO) in combatting money laundering. There are four essential components he advised to keep in mind when selecting the right candidate:

- Qualifications: The compliance officer must possess a strong foundation, supported by relevant qualifications and certifications. Their background should reflect a deep understanding of AML practices to effectively help them navigate the complexities of compliance. They should have a minimum of one year of practical experience in the field and hold credentials related to AML/compliance, endorsed by international standard organisations.

- Championing Independence: Independence is key as the compliance officer controls AML policies, risk assessment, internal controls, and training. Furthermore, their decision-making process should remain uninfluenced by other team members, as external interference can cloud their perspective and make them compromise compliance.

- Dedication Demanded: the compliance officer should be a dedicated, full-time member of the team to ensure a high level of monitoring. While certain operational aspects can be outsourced, the oversight and management of these functions, particularly in jurisdictions like the UK, remain firmly the responsibility of the compliance officer.

Sign up for IPR Training Sessions – Offering CPD Points and Certification

We have more exciting upcoming events you can sign up for. Discover the full schedule of events and reserve your spot now at: https://www.ipr-events.com/.

Remember, tickets are limited and allocated on a first-come, first-served basis. To ensure your participation please secure your seats early.

Don’t miss out on these exclusive opportunities to expand your knowledge, connect with industry experts, and stay at the forefront of cutting-edge developments.

We look forward to seeing you in our IPR training sessions!

Video | Finding the Right Licence for Your Money Service Business

In the second instalment of our informative “How to Start Series,” Ibrahim takes a deep dive into the crucial topic of licences and their significance when establishing your very own money transfer business. Obtaining the suitable licence is significant, as it legitimises your venture, safeguards your customers, and builds trust within the market.

In this video, Ibrahim explains the various licences applicable to money transfer businesses, shedding light on their distinct features and requirements. Understanding the types of licences available is vital to ensuring a smooth and legally compliant operation in this industry.

Ready to dive deeper into launching your own MSB?

Contact our expert consulting team at RemitONE today and organise a free 30-minute consultation. Let us guide you towards success and help you get your money service business up and running as fast as possible. Schedule a free consultation with our experts:

Building Operational Resilience in a Digital Industry: Security, KYC and Compliance

Operational resilience has become a critical concept for businesses in the digital age, where disruptions can occur at any moment, and the impact can be significant. To ensure operations are delivered through disruption, organisations need to be prepared, adaptable, and ready to respond to any unforeseen events whilst staying compliant and secure, but how? We gathered our experts to discuss exactly that.

Moderator:

- Oussama Kseibati, Associate Sales Director, RemitONE

Our panellists include:

- Kathy Tomasofsky, Executive Director, MSBA

- Richard Spink, Sales Director – Channels & Partnerships, GBG

- Ibrahim Muhammad, Payments Consultant, Finxplor

- Nadeem Qureshi, CTO, USI Money

What is Operational Intelligence?

Before we dive into the key pillars, let’s first define operational intelligence.

Operational intelligence refers to an organisation’s ability to adapt and adjust operations during disruptions, ensuring they are well-prepared for unexpected situations. It differs from disaster recovery and business continuity plans, as it focuses on proactive measures for operational optimisation rather than reactive responses to disruptions.

What are the key pillars of operational resilience?

Based on the inputs from Nadeem and Ibrahim, the key pillars of operational resilience are as follows:

- Prevention: Proactive measures taken to prevent or minimise the impact of disruptions or shocks to business operations.

- Preparation: Having proper measures in place to respond to any unforeseen events, including identification of critical business services, and ensuring they cause the least disruption to the ecosystem.

- Robustness: Measures taken to minimise the risks and interruptions caused by the occurrence, and to ensure continuity of operations.

- Recovery: Ability to recover effectively and efficiently.

- Adaptation: The ability to adapt to changes in the environment and to be resilient in the face of challenges and uncertainty.

- Learning: Continuous learning and improvement from past experiences.

To sum this up, having a complete framework in place to protect consumers, ensures market integrity, and safeguards vulnerable customers, which is key for operational resilience.

Why is it important to have operational resilience?

Operational resilience has always been important, especially in recent years, where the recent pandemic has brought it into sharp focus. It forced organisations to adapt quickly and left a lasting impact on the business world. Some changes include the organisation’s employees working from home and amending their supply chain processes.

This also meant regulatory bodies like the Financial Conduct Authority (FCA) had to be more vigilant and ensure that firms are capable and ready to handle such unplanned situations. Similarly, companies themselves have a responsibility to have measures in place to ensure that they are prepared for anything that comes their way.

So, what are some of these measures? Employee safety is a top priority, as well as ensuring that all people processes are up-to-date and robust. Companies should aim to have agile systems in place to enable them to pivot quickly when needed, and investing in up-to-date technology is a smart move to ensure you’re able to operate seamlessly even in the face of disruption.

Kathy pointed out that some American companies do not pay attention to small details such as training staff on email scams and viruses. Therefore, establishing new procedures is vital to continually evolve the businesses safely. This also builds good business practices and saves time and effort in the long run, as you’ll already have procedures in place to deal with unexpected interruptions. Being prepared also helps identify potential risks and plan accordingly, minimising damage when things go wrong.

But the benefits go beyond just risk reduction. By ensuring that every department within your organisation is on board, you’re creating a culture of readiness and adaptability that can help your business thrive in the ever-changing landscape.

What challenges do firms face in developing the required framework for operational resilience?

One main challenge Nadeem addresses is the struggle many organisations face when trying to grasp the meaning of operational resilience – they often view it as another part of their continuity or disaster recovery plans when it is, in fact, a distinct and complementary approach.

Another common misconception is that companies need to create a whole new department and invest a considerable number of resources, time, and money into operational resilience. In reality, it’s more about building on existing policies and improving them in stages over time. It involves identifying gaps, assessing risks, and continuously evolving and adapting to new challenges. Companies also fail to reassess if the technology they have access to or are currently working on is both robust and future-proof.

Ibrahim also identified post-pandemic issues that businesses are still dealing with, such as developing the required framework for operational resilience in the post-pandemic scenario. These include sudden shifts in how business is conducted, which can lead to losing key resources, an inability to serve customers through offices, and financial constraints. Additionally, there are regulatory requirements that need to be addressed, adding further operational burden to businesses.

What is digital ID? Why is digital ID necessary? How does it impact KYC and AML?

Digital ID is verifying one’s identity, confirming they are who they claim to be. Know Your Customer (KYC) is a process that does not require physical confirmation of the customer’s identity. Instead, it confirms that the details provided by the customer appear to be legitimate and consistent with the service they are trying to access.

Anti Money Laundering checks (AML) go a step further than KYC and involve compliance with regulations. AML checks look for any potential association with financial crimes or politically exposed individuals.

There is a growing interest in digital identity programs, leading to their implementation in countries such as Estonia, Sweden, and some African nations. However, digital identity as a topic is tied up with politics, making it a complex issue. In countries where digital identity is in use, it has been largely successful; on the other hand, many countries have not been as successful due to a lack of political will. Despite this, the demand for digital identity is increasing, and it is likely that we will see more implementation and integration of it in the future.

Richard predicts that the future of online identity verification will revolutionise the way we sign up for services. By linking AML compliance tokens to an individual’s digital ID, personal information such as age and address will be securely stored in a vault, allowing only the necessary information to be shared. This will streamline the process of accessing services whilst maintaining security and privacy.

Kathy acknowledges that the adoption of digital ID systems in the US may face political opposition due to concerns over data ownership and privacy. Despite this, there is recognition that such systems are necessary for effective AML programs, as digital money is becoming more common. Therefore, finding a way to implement digital ID systems while addressing data ownership and privacy concerns is crucial for maintaining operational resilience in the financial sector. A collaborative engagement between significant people from diverse departments can channel various viewpoints.

How can we simplify KYC identity verification (IDV) checks for key players?

The KYC IDV checks for key players could be simplified through digital verification, but regulation varies across the world, leading to a fragmented system. For instance, the UAE uses facial recognition tied to government ID, while Spain and Italy do video-capturing conversations, however, this may not be as scalable as they’re reliant on call centres. While in the UK, US, and Australia, the process is more data-driven, causing less friction for consumers. To address these challenges, governments and tech companies should exchange data, but the lack of trust often prevents the two parties from forging together, making them hesitant to collaborate.

Moreover, the use of innovative technologies such as social media biometrics, semantic analysis, and APIs for open banking can help cut down the process. Reviewing current procedures and incorporating relevant touchpoints and online portals can also streamline the process, making it more agile. The slow implementation of digital IDV must also be addressed to meet customer expectations set by fintech innovation. The UAE pass app is an example of the successful simplification of KYC, allowing users to verify their IDs and sign and share documents digitally in a secure manner.

What are the main challenges facing Money Transfer Operators (MTOs) regarding compliance and regulation?

Some of the main challenges according to Nadeem include insufficient time spent investigating constant shifts, lack of periodic policy reviews, and the need for third-party audits to provide external viewpoints for improvement frameworks. These challenges highlight the importance of staying on top of regulatory changes and maintaining compliance.

Richard also adds that businesses demand a global solution that works everywhere, which is challenging due to different regulations in each country, as highlighted previously. ID documentation and databases also vary in the information provided, making it difficult to create a universal solution that delivers transparency and granularity.

Does the challenge of varying regulations over multiple jurisdictions impede or enable innovation?

The existence of various regulations across multiple jurisdictions enables more innovation. Although the technology exists, the problem lies in finding organisations that can be trusted to deliver such solutions. In fact, many innovations arise from people facing daily challenges and finding new solutions. In today’s constantly evolving regulatory landscape, it’s important for businesses to accept it as the new norm and raise their standards to gain a competitive edge. One successful example of this is open banking in the UK, which was made possible by regulatory changes and has opened opportunities for innovative financial products and services.

In summary, having operational resilience is crucial for businesses to not only survive but thrive in today’s fast-paced digital environment. By being prepared, adaptable, and ready to respond to any unexpected events, businesses can reduce risk, save time and money, and ensure their operations continue smoothly.

What next?

At RemitONE, we endeavour to provide the most compliant technology and licensing solutions, alongside expert advice on how to remain compliant when starting or scaling your business.

RemitONE’s Compliance Manager™ has been evaluated by leading regulators and used by top-tier banks and MTOs. Our NameMatch™ application checks remitter names against international AML block-lists including CIA World Leaders, DFAT Canada, DFAT Australia, EU Sanctions, FIU Netherlands, HM Treasury, MAS, SECO, UN 1267, MAS and much more. We link up with a variety of PEPs and Sanctions lists worldwide.

For AML and Compliance support, or to hear more about how the RemitONE solutions can support your business, get in touch at sales@remitone.com

Video: Saving the Crucial Role of Agents and Banks in the Remittance Industry

Brought to you by RemitONE, the Innovation in Payments and Remittances (IPR) Global Hybrid event took place on 19-20 October 2022 and included a series of fantastic discussions.

Wallets have been on the rise in recent years which has forced banks to embrace technological advancements to keep up with the pace of digital innovations in the remittance industry. In this panel, we uncover the driving forces behind this change and the possible impact it may have on banks, agents, and the overall money transfer landscape in the coming years.

Moderator:

- Ababacar Seck, Managing Director – Africa, RemitONE

Our panellists include:

- Sharon Gibson, CEO, JMMB Money Transfer

- Leon Isaacs, Founder and CEO, DMA Global

- George Boateng, COO, Unity Link

Why are pay-out transactions shifting to wallets?

There’s been an increase in the popularity of pay-out transactions through wallets, due to their accessibility and simplicity. This upward trend is particularly prominent in Asia and Africa. For example, in Ghana, the mobile money market reached $121.8 Billion in 2022 and is expected to grow to $590.7 Billion by 2028. George believes the reason behind this is attributed to factors such as convenience, as wallets are more easily within reach than banks, and overall save time and effort.

Leon also reinforces, wallets are often preferable as they’re easy to use which means people don’t require additional assistance. Other drivers are, the senders have more options, people have become more digitally savvy and most notably, it’s cheaper. Another key benefit of wallets is their increased security due to tokenization, which is a unique identification number attached to any personal information such as account numbers.

However, it’s not the same in every region. Sharon shares that in Jamaica there’s only one institute that offers mobile wallets, but that could change very soon. The recent launch of CBDC can possibly encourage more institutions to embrace digital wallets.

How can banks and traditional agents cope in the digital era?

Leon states in many cases it’s rare for agents or banks to be solely a remittance business. While they may have their core purpose, they should adapt and diversify their services to progress ahead in the competitive market. Sharon suggests that banks can collaborate with more agents to offer their products and services and satisfy client needs, however, there need to be adequate technology capabilities in place for it to be a success.

Data shows that customers prefer the physical contact of agents as they instil trust and provide clear guidance when a problem occurs, as opposed to communicating with a bot. A study even found that 64% of customers commented that they could not solve a problem when using mobile apps to transfer money. Overall, agents play a crucial role in building customer trust and loyalty especially as a large proportion of transactions are still carried out in stores and not through digital means, which proves they still hold a strong position.

There are different considerations for the send and receiving end for agents. The pandemic did accelerate a surge in people adopting digital payments and transactions which resulted in a lesser need for people to visit agents, and it’s likely that this will continue. As for the pay-out side, there is potential for agents to educate customers as online accessibility varies in countries where people are still hesitant about online banking and money transfers – this creates a good chance for agents to bridge the gap by acting as the intermediaries between clients and digital payments. Customers already trust these agents, which makes it more probable for them to adopt changes with the agents’ help.

Leveraging technology is another technique agents can utilise to enhance efficiency and strengthen their role further. For instance, many people have formed personal relationships with agents but sometimes lack financial literacy. In such cases, agents can take advantage of innovations such as card readers to increase customer security and reinforce the trust clients have in them. This can solidify the bond between the agent and client as well.

MNOs are taking over transactions led by banks, is this healthy? What does this mean for the future of final inclusion?

There is no denying that competition drives innovation and MNOs gaining the lead has pressured banks to also step up their game to progress ahead. MNOs often educate the underbanked on how to use their products, an area where banks are lacking. There’s also greater flexibility with MNOs, as people can instantly access their digital funds from the comfort of their homes without the need for documentation and physical visits to the bank, helping them to save precious time.

MNOs particularly boast a good distribution of agents across both send and pay-out. However, their products excel in locations where there is a vast digital presence (although they still have a huge potential to increase penetration of financial services, which will continue to encourage financial inclusion). In locations where there is good digital infrastructure, the need for agents to pay out cash is also lessened, this creates a window of opportunity for them to diversify their products and services. One example is M-pesa in Africa, where digital wallets are the primary method of payment. As a result, customers rarely use physical cash, which suggests that people will only need to visit a branch for a specific need unrelated to money transfers or cash-outs.

The changing face of remittance clients requires a new approach, how can MTOs keep on top of the needs of clients and how will this affect the business model?

In contrast to the past, migrants are more skilled individuals and therefore less reliant on agents, demonstrating increased digital literacy. As a result, the power balance has shifted to the customers, with the internet providing easy access for them to quickly switch to other companies if they are unsatisfied with the service.

Clients also tend to focus more on convenience, such as banking being available everywhere at any time and more demand for receiving immediate results. This places a heavy burden on banks – they often have to increase their costs to expand their workforce and enhance their operations more robustly. However, with the increasing popularity of social media, email, live chat and phone, it becomes challenging for the banks to meet the demand – this can lead to dissatisfaction, complaints and negative reviews, overall damaging the brand’s reputation.

To minimise this problem, Sharon proposes a collaborative relationship between banks and agents, to exchange knowledge and expertise and gain a thorough understanding of the client’s needs. Leon explains that companies need to rethink their strategies to maintain a close connection with clients whilst keeping pace with their changing needs. However, a positive takeaway is that customers are benefiting from having their needs finally met and the industry continues to thrive.

Can technology help agents preserve their role?

Whilst technology can be costly, it can be a useful tool to streamline operations more effectively. One way is gathering accurate data in a more interactive way instead of relying on traditional surveys. Social media platforms like Twitter polls can help analyse consumer behaviour, identifying factors which motivate them to pick specific agents over others.

As the rapid surge of digitalisation continues, more businesses are having to adapt. At RemitONE, we play a pivotal role in helping banks shift to the online realm. Our software empowers agents to provide customers with user-friendly portals whilst providing an array of options for them to choose from, such as airtime top-ups, prepaid card services and more. By utilising our industry-leading software, you can increase your transaction rates whilst maintaining top-notch security through our AML and KYC checks. This results in a seamless process from send to pay-out. You can also gain access to our global network of clients and partners that we have built over decades for you to access right away, saving you time, cost and headache.

Interested in powering up your business? Get in touch with our experts to provide your customers with a secure, convenient, and exceptional money-transfer experience.

Tap into our experts and schedule a free consultation.

References

https://www.imarcgroup.com/ghana-mobile-money-market

https://www.westernunion.com/blog/en/leery-of-how-digital-wallets-work-let-us-break-it-down-for-you/

Online Event: Innovation in Payments and Remittances 2022 – Europe, Middle East and Africa

Top 5 takeaways from the RemitONE Compliance for Money Transfers panel at IMTC EMEA 2021

Earlier in the year, a few of the key players in the remittance industry digitally gathered together to discuss a wide range of key topics within the field of money transfer compliance in a panel hosted by RemitONE. The panel included deep dives into anti-money laundering practices, responding to suspicious activity, OFAC compliance (Office of Foreign Assets Control), and much more.

Moderator:

Oussama Kseibati, Head of Services at RemitONE

Panellists:

- Ibrahim Muhammad, Independent Payments Consultant, Al Fardan

- Nadeem Qureshi, CTO, USI Money

To condense the panel into a few paragraphs would be a tricky task indeed, so we’ve decided to focus on five of the key takeaways that our panellists settled on during their discussion.

1. Cybercrime requires a threefold solution – Ibrahim

There are two different types of financial crime. Broadly speaking, on one hand, there are crimes related to money laundering, terrorist financing, fraud and cybercrime. On the other hand, there is financial crime related to bribery and corruption. When it comes to the money service sector it’s the former type of crime that’s been on the rise recently, thanks to the pandemic and the increased digitisation of companies.

How do we prevent these attacks? It’s a threefold solution. First, companies need to ensure the right people are in charge of their systems – this means people with a clear understanding of risk assessment. Second, they need to put well-documented processes in place, guided by policies and procedures. And finally, the systems need to be robust enough to identify, prevent and deter financial crime.

2. Plugins have made all the difference – Nadeem

The availability of plugins is gradually taking us away from an environment of weekly updates and into a more active, real-time environment. What used to take weeks can now take place in the space of days or even hours, with lists being updated and names being added constantly.

Working with something which is real-time means it’s so much easier to identify a weakness faster. These days you have customers registering and processing within a matter of minutes. But as we’re working towards that more efficient way of processing, it’s vital that the system is robust and is set to your needs as opposed to the system needs.

3. There are two sides to the story – Oussama

There are two main sides to the new compliance regulations that we’re seeing. It’s not just where you yourself operate, it might also be where and whom you’re sending to. What kind of regulations do they have and what are their maximum receive amounts, for example?

We have to understand this because there’s an ever-changing landscape right now with new rules and regulations being set all the time. Unless you’re on top of those changes, then you’re always going to be putting yourself at risk when partnering with someone. It’s also worth noting that a lot of the regulations come from the central banks and they will have their own lists and connections that you’ll need to take into account.

4. Transaction monitoring and risk profiling are key – Ibrahim

Transaction monitoring is a key part of KYC and should always be an ongoing process. When we onboard the customer, that doesn’t necessarily mean we’ve 100% verified them. It’s the ongoing transactional behaviour of the customer that allows us to do that and this is where profiling plays such an important role.

You need to do a proper risk profile or categorisation based on the transactional behaviour of your customers and categorise these customers into different risk profiles at both the customer level and the transactional level. Of course, there are multiple systems, including RemitONE’s, that can facilitate the onboarding process and ensure that the customers are who they claim to be. But they can also track where money is going so that, for example, if the destination country is high-risk then additional checks can be put in place and appropriate limits can be set.

5. Creating an effective monitoring programme is all about asking the right questions – Nadeem

The first thing to do when building a transaction monitoring programme is to really look at whether you’re a B2B, B2C or B2B2C service. Once you can answer that question and are able to identify your customers, it’s much easier to break everything down. After this, you need to answer the question of the dual jurisdiction process – the rules and regulations in the sending and receiving countries.

Finally, once the system is configured, you need to ask whether or not it needs to be looked at a little deeper. Because so often you’ll rush to go live and there will be a tech anomaly that was overlooked or a parameter that wasn’t set right. Once you can confidently answer all of these questions, only then can you create something in terms of a robust framework, whether it’s for monitoring or compliance.

We’d like to extend a huge thanks to Ibrahim, Nadeem and Oussama for their time and insights.

What next?

Now that you’ve read our article we want to help you get the most out of it and deep dive into the trends and predictions shared.

Tap into our experts and schedule a free 30min consultation.

Video: Perspectives on Digital ID – What the future may look like (eKYC and AML)

Continuing our recent discussions exploring some of the challenges and opportunities being faced by the remittance sector in these uncertain times, RemitONE hosted a webinar on the 24th of June 2021 regarding the ever-shifting perspectives on digital ID in the remittance sector, particularly in light of the COVID-19 pandemic. The panel was made up of experts from both RemitONE and our friends and partners in other global companies. In case you missed the webinar, here is a summary of the key insights.

Webinar moderator:

Saiful Alom, Head of R&D at RemitONE

Panellists:

- Richard Spink, Sales Director of Channel and Partnerships, GBG

- Osama Al Rahma, Head of Business Development, Emirates Bank

- Reynell Badoe, Payments Manager, Stanbic Bank

Why is digital ID important?

Osama Al Rahma: Digital ID is of course incredibly important through its use of KYC (know your customer) and the ability to identify the customer. In fact, it’s largely through the use of digital ID that we have been able to protect the financial regime from crime on a wide scale. The shift towards digital already started pre-pandemic and has only increased in recent months. No longer are banks encouraging the use of traditional brick and mortar branches. Instead, they are relying heavily on their digital offerings, which by default means that the ability to identify the genuine user of such services is more effective. We’re also seeing a shift to digital with eKYC (electronic know your customer) on a much larger scale when it comes to remittances. This will allow us access to machine learning with Artificial Intelligence, which is incredibly powerful when integrated with real-time streaming. Using this technology, we’ll be able to conduct more diligent processes within transaction screening and monitor the behaviour of certain users in greater depth. For the sake of financial security on the compliance side, this is incredibly important.

Richard Spink: At the end of the day, digital ID reduces compliance costs so it’s always going to be important from a purely financial perspective. However, there is no widely regarded standard for digital ID so far, at least as far as MTOs are concerned. What MTOs have generally been using as the core tenants of their ID is proof of identity and proof of address, which are attributes that can be used by financial services around the world. Of course, a standard would be ideal, but as there are so many different regulations in different countries, this is unlikely to happen anytime soon. As an aside, it’s worth noting that while Revolut has a lot of customers, they’re not profiting very well and the reason they’re not making enough money is supposedly due to the cost of compliance. Digital ID will help businesses globally and save money on the process of knowing who their customers are and the cost of compliance as a result. And I think the technology to do this already exists.

Saiful Alom: It would be ideal if there was a way to digitally identify a person, ensuring that they have met all KYC and AML needs. However, due to the world we live in, there are a lot of complications to work around.

What is the adoption of digital ID like in your respective markets and has COVID accelerated your options?

Reynell Badoe: From a Ghanaian perspective, if you look at the stats, the number of people with access to the internet is proportional to the number of people with access to so-called big data. Having access to the internet means giving up your information and as a result, you also have access to financial services and remittances. It’s a worthwhile trade-off for most. However, there are 1.2 billion people in Africa, and only a handful have access to the internet. While COVID certainly things and meant there had to be a quick adoption of digital money transfer channels from traditional methods, we still have a lot of catching up to do digitally. With regards to how? The pandemic has meant more people have had to use data platforms and open mobile wallets, creating a digital shift of necessity, so the groundwork has already been laid.

Have there been any challenges in terms of Trust Private Security?

Osama Al Rahma: Trust, privacy and security are the three main pillars when it comes to finance and that will never change. The challenge is that by the time that technology evolves, different unforeseen issues tend to arise. For example, using AI for facial recognition might be incredibly convenient when it comes to opening your phone with a glance but the negative consequence is that it is another means for fraud to occur. When we speak up about this, we need validity.

Saiful Alom: In terms of Trust Privacy Security, this is a concern for all of us as consumers – particularly seeing as online services have been adopted at such a large consumer scale since lockdown began. Trust has increased in these online services and so consumers use them more regularly. However, there are many issues to consider and chief among them is privacy. Because your data is a lot more venerable now and consumers transferring money online may question how secure their transactions really are, and if it can be hacked or breached.

Is digital ID a potential solution or a problem to identity fraud?

Richard Spink: If you’re lending money, then I think that there is certainly high risk. It’s a different process to opening up a bank account or sending money on behalf of someone else. The key thing is to ensure you are actually sending that money to the correct person and thankfully, there are more reliable tools that are able to detect these issues now. It comes down to the organisation’s fraud screening processes. The question is how much information are you able to acquire and what does that fraud screening process look like? The standard answer is that there is no silver bullet – there isn’t one organisation that has everything available to run the process at zero risk. However, in the same way, there is always risk in a face-to-face transaction too. As we all know. “Good friction” is necessary for both scenarios. What has changed in the digital process is that it is now acceptable to present an identity, run that process with a mobile phone and check for duplicates. In the future, things will get even more secure with the use of biometric technology and face recognition, thumbprint recognition and the ability to check a chip on a passport. This last process is something we’ve started working with recently. In all, there is a lot more information that is available when trying to detect fraud these days, however, the same rule still applies: you need to decide what information you want to capture and make a decision on it.

The government has been known to over-regulate and stifle innovation. Do you think that we have the right balance when it comes to trust vs innovation?

Reynell Badoe: I think that the government has a lot of responsibility to provide the basic and necessary requirements and nothing more. On the issue of trust, we’ve seen leakages in the past – breaches of customer information from companies. So, on a consumer level, there is the issue of trust to contend with, as people are sceptical as to whether or not their information is safe. An example of this is free apps – technically they’re not “free” in the sense that you give up some aspects of your digital ID data in exchange for access to that app. I’d say the question is: can the information be used against me in the future? In terms of innovation, there’s a need for better services – we need a safer place to operate without having to worry about any of these concerns and challenges. There needs to be a fine balance between regulation and opening up certain aspects of digital ID.

Where does the government sit within this space in terms of digital ID?

Osama Al Rahma: When it comes to the government, it comes down to the level of leadership of that nation and their perspective on digital transformation. They then need to lay down the military frameworks, the standards and the security aspects in order to develop a secure environment. It’s been said that once you introduce digital financial services then it’s not a case of if you will encounter fraudsters but when. There is a lot of truth to this adage, as I have seen myself when we launched a remittance app and immediately fraud occurring on a massive scale. The reality is that if you are not well-enough equipped in different aspects, you will likely encounter problems. One of those aspects is having clear risk mitigation policies, and the second is to use advanced technology to identify such risks. A third aspect, meanwhile, is knowledge and awareness. Most issues I’ve seen actually involve the consumer allowing the phishing to happen due to his lack of knowledge on how scams can occur. It’s all about protecting your consumers.

What advice would you give to MTOs and banks who are thinking of adopting digital ID within their processes?

Richard Spink: My advice would be to keep things simple and understand the regulation before you talk to a business like us. Everyone will give you different advice on regulation. In my world, I need to understand the regulation of the market the jurisdiction is operating in. For example, if your business is registered in Germany, the German financial regulation is very specific on how want that ID verification process to run. In fact, they want it done via video. But this isn’t the case for the whole of the EU. So, although the EU is one trading block, in theory, in practice there are different processes required depending on where your business is regulated. I’d also recommend considering what you need to do to confirm that someone is who they say they are. In my experience, finding proof of address is the hardest process and yet it’s required by most regulators. My experience in the last ten years shows that the proof of address data is large in quantity however there is still nowhere near enough to satisfy the global coverage.

What are the critical questions you will ask an ID verification provider?

Osama Al Rahma: Before asking the questions, develop your own strategy and consider what you will want in the near future, including your offerings, products and other engagements with the consumers as this will dictate the type of provider you want to consider. On one hand, look at the flexibility of upscaling the technology, as you want someone to partner with as opposed to a short-term solution that will leave you stuck with a legacy system that will hinder your ability to enhance your offerings in the future. On the other, look at the ability of the service provider – have they got a system that is dynamic enough to cope with the constantly shifting regulatory requirements?

What do you think this space will look like in two to five years?

Reynell Badoe: At this point, it’s all speculation, especially with the speed at which technology is advancing. For example, things that one would have expected to happen in a decade could happen as soon as next year. At this point, there’s already a lot of personal information online both knowingly or unknowingly. Now, people are less concerned about giving away their data and are more concerned about where it’s going. For example, if there’s a new online financial institution that people are gravitating towards then I, as a customer, would want to find out a bit more before parting with my information. This has led to the use of federated IDs where I can sign in to a website using my existing Google account because I would naturally be more comfortable leaving my limited information with Google as opposed to this relatively unknown third party. I personally expect to see a lot more use of federated IDs in the future.

How do you see the rate of digital adoption in sending and receiving markets, in terms of duration, post-pandemic and pre-pandemic?

Osama Al Rahma: During the pandemic, I think the main shift was that consumers released how digital engagement was beneficial to them. Why do you think China was able to so effectively control COVID-19? It’s because of their AI and biometrics. They were able to use this to track and trace the people who had been in touch with an infected person and find out which areas they were prominent in. The only positive, economic growth in 2020, in comparison to other developed countries, was China and one of the primary reasons was this biometric ability. This is already being applied elsewhere today – going through an airport completely contactless, for example. With regards to the future, the adoption of these new methods should be reviewed seriously by all financial companies. It might be a slow burn but always look at how they will impact your business model and how you will be able to use them to your advantage in the future.

What next?

Now that you’ve read our article we want to help you get the most out of it and deep dive into the trends and predictions shared.

Tap into our experts and schedule a free consultation.

RemitONE integrates with payment gateway Vyne

RemitONE, the leading global, technology and business services firm for the remittance world, today announces its integration with Vyne, the specialist account-to-account payments platform.

The deal gives RemitONE’s 100+ remittance clients instant access to Vyne’s payment solution, becoming the fastest, most cost-effective way for their customers including Payment Institutions (PIs) and Money Service Businesses (MSBs) to send remittances globally.

Vyne uses Open Banking to move money in real-time between bank accounts, bypassing long-established but now outdated card networks and their associated fees. Vyne’s single integration means RemitONE’s clients can access the benefits of Open Banking including more secure, cost-effective, faster payments. With transaction times cut from days to seconds, RemitONE’s clients’ customers can send money abroad quicker than ever.

Because Vyne allows customers to make payments directly from their own verified bank account, “know your customer” (KYC) checks and “Secure Customer Authentication” (SCA) fraud authentication can be carried out quickly and seamlessly, reducing friction and vastly improving the customer experience.

Aamer Abedi, Chief Marketing Officer at RemitONE, says: “RemitONE is always seeking the most innovative payment products for our clients. The technical ease of Vyne’s payments platform allows MSBs to get up and running quickly, and offer their customers an efficient, robust and cost-effective way to transfer money. 10% of our MSBs took the first steps to integrate with Vyne within two weeks of the integration going live, with more client MSBs wanting to take advantage of Vyne’s Open Banking Solution every day.”

Karl MacGregor, CEO at Vyne, says: “The international money transfer market is booming. Globalisation and the rise in digitalisation means there’s an increasing need to send money abroad as quickly, easily, and cost-effectively as possible. This integration combines the power of RemitONE’s renowned money transfer solution and global network, with the easy integration, instant settlement, and fraud resilience of Vyne’s payments platform. Together we are opening access to a new way to pay, allowing remittance businesses to offer the significant competitive advantage of safer transfers and more seamless customer experiences.”

Take advantage of the RemitONE and Vyne partnership by contacting marketing@remitone.com

About RemitONE

RemitONE is the leading provider of money transfer software solutions for banks, telcos, and money transfer operators (MTOs) worldwide. Organisations of all sizes use the RemitONE platform to run their remittance operations with ease and efficiency by reaching out to their customers via multiple channels including agent, online and mobile. For more information on RemitONE, please email marketing@remitone.com

AML and CFT Guide for Money Transfer Start-Ups

Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT), are terms mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent, detect, and report money laundering and terrorist financing activities.

Every regulated entity should have appropriate AML as well as CFT checks and controls in line with the regulatory framework of the jurisdiction where the entity operates from.

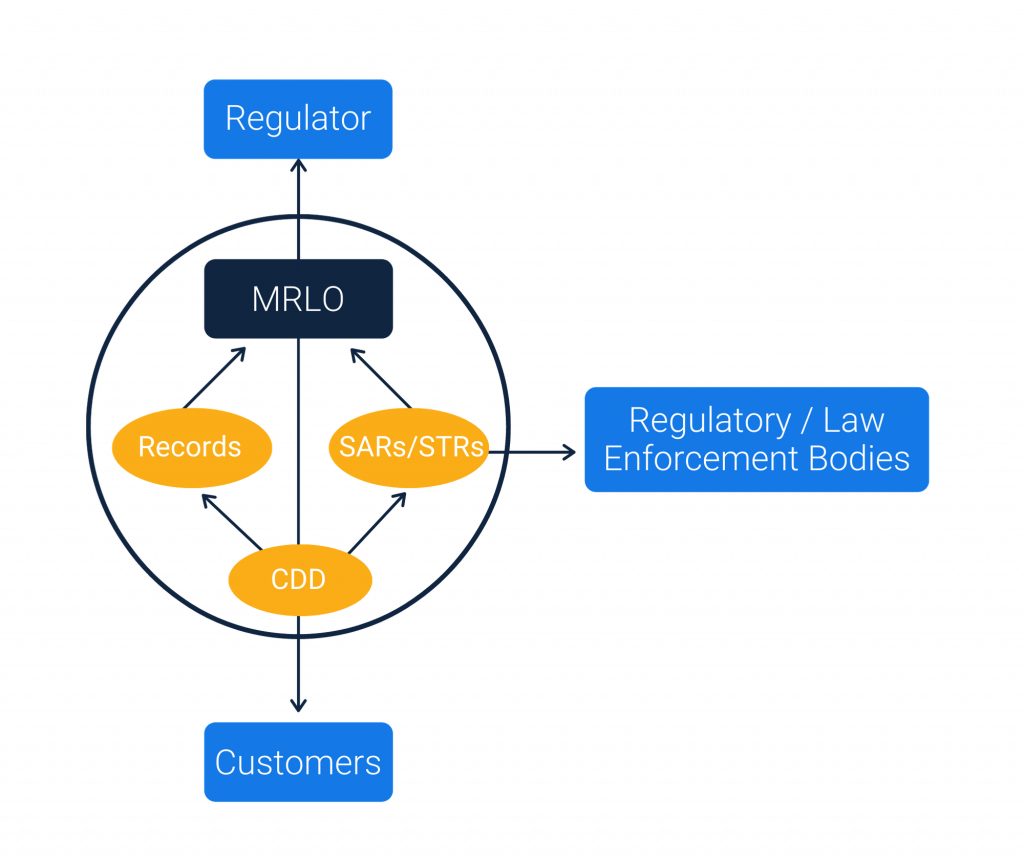

To make it easier for Start-Ups, please find below the diagram of the AML/CFT Ecosystem:

The ecosystem shown above shows the five core responsibilities of Money Transfer Start-Ups:

1. Onboard a Money Laundering Reporting Officer (MLRO)

First and foremost, all start-ups must have a dedicated Money Laundering Reporting Officer (MLRO) who is responsible for managing all compliance activities within the organisation. Depending upon the type and size of the business, there could be one or more members within the compliance team.

Aside from the MLRO, it is important that other stakeholders such as Directors, Senior Managers and even Shareholders familiarise themselves with the Payment Services and AML regulations within the jurisdiction where the business is registered.

2. Customer Due Diligence (CDD)

Each entity is responsible to identify the customers that they deal with. This step is known as the Know Your Customer (KYC). The MLRO has to identify the checks and controls that need to be in place to capture all the information needed from the customers as part of the KYC process.

Apart from KYC, the entity must also maintain the Customer Due Diligence which is mainly to do with checking the customers registering against the watch lists and the transaction patterns of the customers.

3. Suspicious Activity Reporting (SAR)

The entity is required to conduct appropriate investigations whenever an event such as a transaction monitoring alert or a sanctions match occurs. The MLRO has to validate such investigations further and need to report to the local regulatory bodies in the form of Suspicious Activity Reporting (SAR) or Suspicious Transaction Reporting (STR).

4. Record Keeping

The entity is responsible to maintain records of all their customers and transactions for a minimum period of 5 years or as per the guidelines of the local regulatory bodies. The MLRO has to ensure that the data captured from customers for identification and transaction purposes are stored securely and accessible to the authorized individuals of the entity whenever needed. Apart from customers and transactions data, the entity should also maintain the records of all the SARs/STRs.

5. Registering and Reporting to Regulators

The entity is responsible to have the registration done with the relevant regulatory bodies in the jurisdiction where the entity operates from. The entity should also be aware of all the reporting obligations in order to submit reports related to the customers or transactions data to the relevant regulatory bodies in the jurisdiction.

Whether you are a start-up or an established Money Service Business, it is very important that the AML policies and procedures are clearly incorporated within your business model. For more information, advice and support, please contact us.

RemitONE provides proven compliance products for Money Service Businesses and Central Banks and would be delighted to help your business. Contact marketing@remitone.com or call +44 (0) 208 099 5795.