Has COVID catalysed the digital transformation of the remittance industry? November 13, 2020

COVID-19 has fundamentally changed a lot this year. In the case of the money transfer industry, the immediate impact has not been a positive one. The World Bank has predicted that global remittances are set to decline by 20% as a direct result of the pandemic. Something needs to be done and it’s the young and nimble money transfer operators (MTOs) that are best equipped to create a new digital path in a world where physical contact is restricted.

The evidence of digital transformation

Digital transformation has been slowly changing the remittance sector for decades now and COVID has hastened that transformation. The fact is, where digital was once an option it’s now a necessity and that has completely changed the game for all banking sectors.

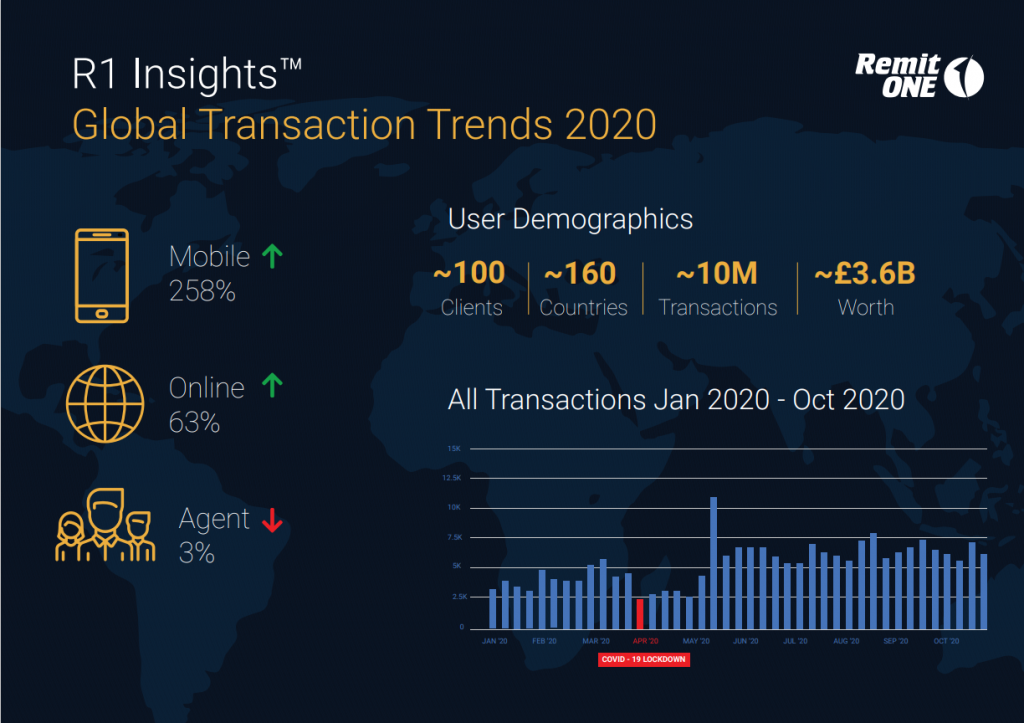

According to recent RemitONE transaction data trends, there has been a major acceleration of digital channel use during the pandemic. The use of physical agents, meanwhile, is down, which might seem insignificant but points to a drastic overall shift in consumer habit.

Throughout history, it’s the sectors that have been able to adapt to the times that have weathered the storms and retained their relevance. With the recession caused by COVID-19 taking a toll on the ability to send money home and remittance flows projected to decline even further by 14% in 2021, an easier, cheaper remittance solution has never been more vital.

Digital money transfer

Studies have proven that remittance not only helps to alleviate poverty in developing countries but can also lead to an increase in domestic spending. If there’s one thing we need right now it’s for people to be spending more. Digital-first MTOs are the ones ready to offer the most robust and accessible easy-to-use remittance services with fair and reliable exchange rates.

Of course, this is not a change that can happen overnight. Historically speaking, migrant communities would rely on physical money transfer services and these services have, as a result, become pillars of the community. Indeed, it’s estimated that the recipients of many international remittances are unbanked, which might go some way towards explaining why 90% of remittances currently begin and end with cash.

Does this mean it’s up to remittance operators to prove their worth and make themselves more accessible? Because digital operators that use the latest remittance software are not faster and only more affordable due to the obvious lack of overheads but have been proven to be better at evaluating customer experience and security.

Digital acceleration beyond the pandemic

It’s no exaggeration to suggest that COVID-19 changed the world overnight, but the impact on the migrant community has been under-reported. For months now, foreign travel has been almost impossible, which means migrant families have been unable to visit their families. What’s more, the pandemic has amplified the pressures migrants face in striking a balance between supporting themselves and supporting their families back home. For these families, digitally native money transfer operators will play a crucial role in redefining remittance and money transfer for a post-COVID world.

There are several benefits of digital transformation for the remittance sector for both legacy and upstart operators. Through the use of money transfer software on desktop computers and via smartphone apps, it’s never been easier and faster for customers to keep a reliable track of their remittance journey. The pandemic might have offered an opportunity for operators to use this software to foster trust and build new customer bases that keep communities connected and able to hold each other up.

This is proven by the growth of M-Pesa as the predominant payment method in Kenya. This is a digital solution that manifested because a traditional banking ecosystem was simply not accessible for a majority of Kenyans. That digital alternative quickly became the preferred option when users realised how powerful, easy, and convenient it was. Ultimately, it’s a safer, faster, and easier service that should help shoulder some of the stress that migrant families currently find themselves under.

Conclusion

Consumer preference has been shifting away from cash for years now and with many cash-based remittance solutions forced to close due to COVID-19, the future is definitely in digital. What money transfer operators and other fintech organisations need to understand is that this represents an incredible opportunity for them to prove their worth.

Borders might be closed but migrant workers still depend on remittance and if they’re going to make that switch from their old inflexible and outdated conventional means to more accessible solutions, they might need a bit of a gentle push.

To discuss your online offering with our team of experts please contact marketing@remitone.com

Related Posts

-

How to Build a Leaner, Smarter Money Service Business in 2025

In an era of rapid regulatory change, rising customer expectations, and digital disruption, how can money service businesses (MSBs)—companies that…

May 22, 2025 -

Trump’s Threats to Cross-Border Payments: What It Means for Your Business

It’s been a short while since Trump stormed back into office, and he’s already shaken things up with his hard-hitting…

May 22, 2025 -

Unlock Faster, More Secure Payments with RemitONE’s Open Banking Solution

We’re excited to introduce the latest enhancement to our RemitONE Money Transfer Platform: the RemitONE Open Banking Solution. Competitively priced…

January 31, 2025 -

How to Expand Your SEND Operations in the UK and Europe—Without the Regulatory Hassle

The remittance market in Europe is valued at €133.7 billion annually, with the UK market contributing an additional £23 billion.

January 31, 2025 -

The Top 5 Cross-Border Payment Trends That Shaped 2024

What a year it’s been for the world of payments! From breakthroughs in tech to surprising shifts in consumer behaviour,…

December 19, 2024 -

How Banks Can Reclaim Their Role in Cross-Border Payments with RemitONE

Banks, once the cornerstone of international payments, are finding themselves sidelined. Senders and receivers have now joined forces, pushing banks…

December 18, 2024