IPR Global 2024 Highlights: Industry Leaders Unite to Shape the Future of Cross-Border Payments

Last month, we hosted our annual Innovation in Payments and Remittances (IPR) Global 2024 event, where top industry leaders and companies gathered across the cross-border payments industry to network, exchange ideas, and share their expertise. Known for fostering innovation and collaboration, IPR Global connected money transfer operators, banks, industry experts, and more to explore the latest trends and challenges to drive and innovate the industry.

Global Representation and Diversity

IPR Global was even bigger this year, with over 280 attendees across 20+ regions. Our dynamic speaker lineups truly showcased our commitment to diversity, bringing together representatives from around the world, which sparked engaging discussions and offered fresh perspectives on global financial challenges.

The two-day conference was packed with a dynamic mix of keynote speeches, networking opportunities, and panel discussions. Attendees gained valuable insights into emerging technologies, regulatory landscapes, and market trends shaping the future of cross-border payments.

Some key takeaways included:

- How blockchain and cryptocurrencies are making transfers faster and more cost-effective

- Strategies for enhancing financial inclusion in underserved markets

- How to leverage AI for fraud prevention and compliance

The event was wrapped up with our prestigious IPR Awards ceremony, where we acknowledged and celebrated the outstanding achievements in innovation, customer service, and social impact across the sector.

Attendee Experience

“As a 40-year industry executive in the International Payments space I found IPR to be a vital and valuable event for remittance providers around the world. The content was spot on around industry insight, trends, challenges, and opportunities. Ding’s involvement at IPR was solidified by the commitment from money transfer operators around the world that our offering is essential to support their revenue growth and product expansion capabilities.” – Bob Dowd, Senior VP, Ding

“It’s the collaborative environment and the open forum where we can all share ideas that truly makes IPR a great experience and a fantastic event to be a part of.” – Holly Crowell, Financial Services Partnership Manager, Worldpay

Sponsor Support

IPR Global 2024 was made possible by the industry-leading sponsors, including Visa Direct, Worldpay, Nium, Vyne, and many more. Their contributions not only elevated the event experience but also demonstrated the collaborative spirit driving that is propelling the industry forward.

Looking Ahead: IPR Global 2025

Building on this year’s success, RemitONE is thrilled to announce that IPR 2025 will be expanding to the rapidly growing region of Riyadh, Saudi Arabia. IPR Global, Riyadh will offer even greater opportunities for industry professionals to connect, grow, and collaboratively shape the future of cross-border payments like never before.

For more information about IPR Global, Riyadh 2025 or to express interest in attending, sponsoring, or speaking, please contact: sales@remitone.com

Join us as we continue to drive innovation and collaboration in the world of international payments and remittances.

RemitONE and Stanbic Bank Partner to Accelerate Cross-Border Payments across Africa

September 2024: RemitONE, a global leader in cross-border payment technology solutions, is pleased to announce a strategic partnership with Stanbic Bank, one of Ghana’s largest banks and most prominent financial institutions. This collaboration will leverage RemitONE’s cutting-edge payment infrastructure to enhance Stanbic Bank’s cross-border payment services, empowering customers across Africa.

In response to the growing demand for seamless and affordable cross-border payments, Stanbic Bank has prioritised enhancing its money transfer services as part of its broader business expansion strategy. By partnering with RemitONE, Stanbic Bank aims to modernise its money transfer offerings and provide its customers with a more accessible, secure, and efficient money transfer experience.

By integrating RemitONE’s state-of-the-art digital payment technology into its online and mobile banking platforms, Stanbic Bank will offer customers an unparalleled money transfer experience – starting with transfers in Ghana and Nigeria, and soon extending to other Western, Eastern and Southern African countries.

The partnership between RemitONE and Stanbic Bank is expected to deliver substantial benefits to both individual customers and the broader financial ecosystem in Africa. Customers can look forward to a streamlined and cost-effective cross-border payment experience, while the collaboration will also contribute to the overall growth and development of the African remittance market.

About RemitONE

RemitONE is the leading provider of money transfer software solutions for banks, telcos, and money transfer operators (MTOs) worldwide. Organisations of all sizes use the RemitONE platforms to run their money transfer operations with ease and efficiency by reaching out to their customers via multiple channels including agent, online and mobile.

For more information on RemitONE, please email sales@remitone.com.

Innovation in Payments and Remittances (IPR) Global 2024 Award Winners!

Earlier in the month, we gathered the top global companies in the Remittance and Payments space in our annual IPR Global 2024 event. On day two, we hosted our award ceremony to honour the game-changers and trailblazers who are pushing the industry forward in exciting new ways.

The RemitONE team is excited to unveil the winners who took home the trophy, along with the honourable mentions — those who came close and deserve recognition for their impressive efforts:

Company of the Year 2024

Winner: Flutterwave

Honourable mention: Jamuna Bank PLC. Bangladesh

Social Impact Award 2024

Winner: Ding

Honourable mention: United Bank Limited

Exceptional Customer Experience Award 2024

Winner: Cauridor

Honourable mention: Neo Money Transfer

Start-up of the Year Award 2024

Winner: Sikoia

Honourable mention: WeWire

Innovation Award 2024

Winner: Uniteller Financial Services

Honourable mention: Tiketi Rafiki

All entries were thoroughly evaluated by our esteemed judges comprised of global senior experts in the payments and remittance industry:

- Leon Isaacs, CEO & Founder, DMA Global

- Kathryn Tomasofsky, Executive Director, MSBA

- Osama Al Rahma, Advisor, Board of Foreign Exchange & Remittance Group (FERG)

- Veronica Studsgaard, Founder & Chairman, IAMTN

After the initial assessment, the award finalists were unveiled in August 2024. This was followed by the second stage, during which the judging panel reviewed all the finalist entries and selected the winners in each category through an anonymous scoring method.

From left to right pictured: (Top left) Alpha Diallo, Marta Pillon and Rob Ayers, (Top middle) Lindsay Lehr, Bob Dowd and Olivia Biviano, (Top right) Alberta Guerra and Lindsay Lehr, (Bottom left) Leon Isaacs, Sid Gautam, Shikesha Panton, Noel Ozoemena and Sadat Choudhury, (Bottom right) Bob Dowd, Olivia Biviano, Alpha Diallo, Marta Pillon, Albert Guerra, Noel Ozoemena and Shikesha Panton.

About Innovation in Payments and Remittances (IPR)

In 2018, RemitONE launched Innovation in Payments and Remittances (IPR) to bring together various industry supply chain members to drive positive change. Through events and research reports, IPR unites senior business leaders dedicated to enhancing the industry, enabling them to think big, share best practices, engage, learn, discover, create opportunities and shape change. With the power of collective insight, we can push innovation and industry growth boundaries and benefit from better outcomes.

The IPR events are organised throughout the year to help industry stakeholders, visionaries and business leaders make informed decisions that ultimately benefit the consumers.

About RemitONE

RemitONE is the leading provider of end-to-end money transfer solutions for banks, money transfer operators (MTOs) and fintech start-ups worldwide. Our award-winning money transfer, compliance software products and consulting services – including MSB licensing, bank account provisioning and connections to our clients and partners – are tailored for the global money transfer market.

Organisations of all sizes use our platforms to run their remittance operations with ease and efficiency by reaching out to their customers via multiple channels, including agent, online and mobile.

For more information, or to access all the photos from the IPR Awards ceremony, please contact marketing@remitone.com

Bank of Ceylon (UK) Limited and RemitONE Join Forces to Revolutionise UK-Sri Lanka Cross-Border Payments

September 2024: Bank of Ceylon (UK) Limited, a fully owned subsidiary of Bank of Ceylon Sri Lanka has prudently partnered with RemitONE, a global leader in cross-border payment technology solutions. This strategic alliance is expected to significantly improve Bank of Ceylon’s competitiveness in the UK-Sri Lanka corridor, heralding a new era in their 80-year history. The collaboration marks a pivotal moment in the bank’s ongoing efforts to digitalise its services and meet the evolving needs of its international customer base. The collaboration is particularly momentous as the bank approaches its 75th anniversary on 1st October 2024, marking a significant milestone in its longstanding legacy.

The partnership addresses Bank of Ceylon’s pressing need for an enhanced online presence and expanded customer reach. By adopting RemitONE’s cross-border payment software, the bank is set to advance its technological capabilities and offer a more streamlined, user-friendly service to its loyal customers.

For RemitONE, this collaboration represents a strategic expansion into the South Asian market, reinforcing its position as an innovator in cross-border payment solutions. The partnership underscores both entities’ commitment to embracing digital transformation in the rapidly evolving financial services sector and helping facilitate money transfers for customers at affordable rates.

As international cross-border payments continue to play a crucial role in Sri Lanka’s economy, this partnership is set to deliver substantial benefits to both individual customers and the broader financial ecosystem. Soon, Bank of Ceylon customers can look forward to a more accessible, secure, and seamless money transfer experience.

About RemitONE

RemitONE is the leading provider of money transfer software solutions for banks, telcos, and money transfer operators (MTOs) worldwide. Organisations of all sizes use the RemitONE platforms to run their money transfer operations with ease and efficiency by reaching out to their customers via multiple channels including agent, online and mobile.

For more information on RemitONE, please email sales@remitone.com.

Innovation in Payments and Remittances (IPR) Global 2024 Awards | Finalists Announced!

We are thrilled to announce our finalists for this year’s IPR Awards. The IPR Awards is a prestigious event celebrating the exceptional achievements of the money transfer and payments community’s best and brightest.

This year, we introduced five unique award categories including:

- Innovation Award

- Exceptional Customer Experience Award

- Company of the Year

- Social Impact Award

- Start-Up of the Year

IPR Award Ceremony

Get ready for an unforgettable evening at the IPR Global 2024 Awards Ceremony in London on Tuesday, 17th September! Join us as we celebrate excellence in our industry with the much-anticipated announcement of our prestigious award winners.

Enjoy a vibrant standing reception with delightful drinks, delectable canapés, and the chance to connect with top professionals in the field. This is your moment to connect with industry leaders and be part of a night that promises excitement, recognition, and inspiration.

Don’t miss out on this special opportunity—secure your ticket before they’re gone: https://global2024.ipr-events.com/register

Congratulations to all the shortlisted companies

Innovation Award

- Tiketi Rafiki

- UniTeller Financial Services

- LASCO Financial Services Limited

- Neo Money Transfer

- eSIM Go

- Jaudi (Transfapay)

Exceptional Customer Experience Award

- Relianz Forex Limited

- Ebixcash World Money Limited

- Cauridor

- Neo Money Transfer

Company of the Year

- SUNRATE

- JAMUNA BANK PLC, Bangladesh

- Flutterwave

- Remit Choice

Social Impact Award

- Xpress Payment Solutions Limited

- SIAO Partners

- Ding

- SolutionsAe, Inc

- United Bank Limited

Start-Up of the Year

- WeWire

- Sikoia

Congratulations once again to all the finalists! We look forward to seeing you at the IPR event, where we’ll be announcing the winners.

If you haven’t already, register here to secure your spot: https://global2024.ipr-events.com/register

Flutterwave: Simplifying Cross-Border Settlement for Multinationals in Africa

This article is brought to you in partnership with Flutterwave, written by Sid Gautam, SVP–Enterprise at Flutterwave.

Having trouble transferring money for your business from Africa across borders? You’re not alone. International business transactions can seem like an overwhelming task due to the hidden fees and complications that are frequently involved with cross-border settlements. No more worries, Flutterwave provides an easy and cost-effective answer to your international settlement needs.

Recently named Fast Company’s Most Innovative Company in Europe, Middle East, and Africa, Flutterwave stands out as Africa’s leading payments technology company, providing an efficient and transparent cross-border payment solution. The company has established a solid reputation with over 630 million transactions worth more than $31 billion in total payment volume, and 20 million+ API calls per day.

Seamless Onboarding Processes

On the eight-year journey of simplifying payments for multinationals in Africa and beyond, Flutterwave has learned and we have adapted our onboarding processes to be straightforward with 24/7 support always available throughout the process. Our Know Your Business (KYB) process is enhanced to get you set up quickly and efficiently. This follows with other important mechanisms needed to ensure your operations are live and running in no time within stipulated regulatory requirements.

Extensive Reach and Settlement Expertise

Leveraging an extensive payment infrastructure network spanning over 30 African countries with a presence in the UK, US, and EU, Flutterwave is the cross-border payment partner of choice in Africa. Our settlement solution facilitates seamless payment operations for multinationals across Africa and African businesses growing globally.

Currently, we serve merchants across several industries: payments, hospitality, ride-hailing, aviation, gaming, logistics, and digital infrastructure to mention a few. With support for multiple currencies as well as local and international payment methods such as mobile money, bank transfers, cards, and Google Pay, your larger enterprise will be in the capable hands of our cross-border payment solutions facilitating fast, transparent, and cost-effective payment solutions.

Regulatory Compliance and Maximum Security

At Flutterwave, operation excellence and minimizing counterparty risk are our top priorities. Strict adherence to regulatory compliance through owned licenses and a network of partners across several countries within and outside Africa means cross-border transactions are settled within relevant payment policies and regulations. To ensure maximum security for merchants’ data and funds, we have risk and compliance systems and teams across several countries carrying out extensive compliance checks to mitigate anti-money laundering (AML) and combating the financing of terrorism (CFT) risks.

We also invest heavily in payment infrastructure security such as maintaining the highest PCI-DSS & ISO 27001 certifications, in line with global best practices. This ensures that whether managing B2B first-party treasury flows or third-party supplier payouts, Flutterwave’s cross-border payments adapt to specific business needs legally and securely.

In Conclusion: with Flutterwave, enterprises can streamline their cross-border settlements, ensuring speed, transparency, and cost-effectiveness. Join global merchants such as Uber, Worldpay, Piggyvest, Bamboo, Air Peace, Microsoft, and Flywire running their cross-border settlement efficiently and securely from Africa to the world and vice versa. Let’s talk!

Revolutionising Money Transfers: 4 Key Trends Shaping the Future

This article is brought to you in partnership with Worldpay, written by Kunal Choudhary, Money Transfers Strategy Lead at Worldpay.

The landscape of international money transfers is going through a shift, driven by evolving consumer expectations and technological advancements. For money service businesses (MSBs), staying ahead of these changes could be key to success.

Let’s explore these trends and how Worldpay could help businesses navigate this transformation.

- The need for speed

In today’s hyper-connected world, consumers need convenience, speed and security when it comes to moving their money. A recent study revealed that over three-quarters of consumers (77%) now expect instant payments1. Money transfers are often time sensitive, so long waits for funds to clear may mean switching to an alternative provider. This shift in expectations is compelling MSBs to revamp their infrastructure to facilitate fast transfers while adhering to complex international regulations.

As a leading payment processor2, we could help you to provide the quick, secure, and cost-effective money transfers your consumers are looking for. By incorporating our decades of expertise and authentication solutions, you can expand your reach and offer faster transfers around the world.

- Digital wallets on the rise

Industry projections suggest that by 2027, digital wallets are projected to account for almost half ($25 trillion) of global transaction value3. This surge is fuelled not only by the ease of paying with just one tap, but also by the built-in two-factor authentication and tokenisation, this payment method offers.

One in five financial services customers would switch platforms if their preferred payment method was unavailable4. That’s why it’s important to incorporate secure and flexible options that meet those needs and help with enhancing loyalty. Worldpay’s solutions could facilitate direct integration between MSB platforms and popular wallet apps, simplifying orchestration and compliance while enabling a dynamic user experience.

- The Personalisation Paradigm

Today’s consumers are increasingly looking for tailored experiences that reflect their individual needs and preferences3. One-size-fits-all approaches are no longer sufficient.

To keep pace with consumers, MSBs might look into innovative technology such as artificial intelligence (AI) as a route to personalisation. AI could empower merchants to understand and predict customer needs better, offer customised solutions, and of course, automate. Worldpay is harnessing AI and machine learning together with extensive transaction and biometric data to help you make intelligent decisions in real-time.

- The Fraud Prevention Imperative

With the volume of digital transactions rising5, the risk of fraud is also becoming a major concern6. Ensuring a safe environment for online money transfers is becoming a top priority for maintaining customer trust and compliance with regulations.

Worldpay’s fraud solutions use rich data from 52bn annual transactions to help detect and predict fraudulent activity to help protect consumers.

Embracing the Future

The money transfer industry stands at a crossroads, with emerging technologies and shifting consumer preferences reshaping the landscape. MSBs that can successfully navigate these trends – offering rapid transfers, embracing digital wallets, personalising experiences, and fortifying fraud protection – might be best positioned to thrive in this dynamic market.

Collaborating with an experienced payment provider could be a game-changer for MSBs looking to stay competitive. By tapping into advanced solutions and deep industry expertise, businesses can accelerate their transformation and deliver the smooth, secure, and personalised experiences that modern consumers expect.

To chat to one of Worldpay’s experts today, please visit https://www.worldpay.com

Sources:

- UK expectations on digital payments sky-high | Tink blog

- The Current Issue – Nilson Report

- The Global Payments Report 2024 | Worldpay

- https://offers.worldpayglobal.com/fully-covered-insurance-report.html

- Global non-cash transaction volumes set to reach 1.3 trillion in 2023 – Capgemini

- Cyberattacks threaten global financial stability, IMF warns | World Economic Forum (weforum.org)

Meet Worldpay at IPR Global 2024

Meet Platinum sponsors, Worldpay at IPR Global this September. Don’t miss out on this unmatched opportunity to connect with their team.

Get your tickets today, spaces are limited: https://global2024.ipr-events.com/

Empower Your Bank with RemitONE’s Cutting-Edge White Label Mobile App

The banking landscape is evolving faster than ever, and so are your customers’ needs. To meet their demands, you need a mobile app that not only keeps pace with these changes but also sets the standard for innovation and customisation.

With RemitONE’s white label mobile app, your bank can quickly launch a customised money transfer app on both iOS and Android platforms with minimal hassle.

Key Benefits:

Increase Revenue: Convert non-account holders into loyal customers and increase your revenue streams with additional services.

Expand Market Reach: Access new markets by leveraging connections with International Money Transfer Operators in the RemitONE EcoSystem™.

Flexible Integration: Connect seamlessly to your preferred payment gateways to keep your operations running smoothly.

Versatile E-Wallets: Issue e-wallets, allowing customers to top up their own accounts or send money to beneficiaries’ mobile wallets.

Quick Registration & Onboarding: Provide a smooth and efficient customer experience from start to finish to keep them returning.

If you’re looking stay ahead of the evolving digital landscape, get in touch today: sales@remitone.com.

Add a mobile plan to the digital wallet to generate loyalty, value and relevance

This article is brought to you in partnership with eSIM Go, written by Mitchell Fordham, Chief Revenue Officer & Co-founder at eSIM Go.

Payment brands, neobanks and other fintechs are continuously seeking innovative ways to foster loyalty, drive account registrations, and reduce customer acquisition costs (CAC). More and more have found it in a new category of digital service – eSIM mobile data and phone plans – that complements existing payment services and adds value to premium subscriptions.

The limited value of traditional loyalty perks and rewards

Consumer banking and payment services have entertained all kinds of perks and loyalty rewards with varying success. The more bizarre examples of waffle irons, garden tools and even hunting rifles tend to emanate from bricks and mortar institutions, while neobanks and digital payments providers gravitate towards virtual, subscription-based add-ons. These are either useful (e.g. gym membership), delightful (e.g. cinema tickets, free coffee) or a judicious mixture of both that also imbues feelings of safety, trust and permanence (e.g. personal or travel insurance).

It sounds great in theory, but the value quickly drains out of these for two reasons: 1) they aren’t necessarily essential, and 2) it isn’t obvious how they benefit the customer relationship.

Mobile data and phone plans, by contrast, not only create this additional value but also act as both a flywheel for perpetually evolving value and a conduit for a more complete, trusted and personalised customer relationship.

A digital connection that ties digital customers to your digital brand experience

eSIMs are virtual SIM cards, and this subtle change in telco technology makes it significantly easier for fintechs to not only offer mobile plans as an added customer perk, but to do so under their own brand. Having been held back by the historic constraints of plastic SIM card distribution and support infrastructure, payment providers and neobanks like Western Union and others have moved to capitalise on this digital evolution in mobile. The smartest are viewing this as a channel for achieving customer loyalty and other business objectives – understanding that it’s more than just a revenue generator.

All this is happening at a time when consumers have never been more reliant upon data connectivity both at home and especially when traveling abroad.

eSIMs in action

Western Union launched its eSIM offering in March, in partnership with eSIM Go. For them, equipping digital wallet customers with global connectivity possibilities serves the dual purpose of traveling with ease and optimising access to digital banking services from anywhere. Western Union eSIMs give customers hassle-free access to wallet-friendly data roaming, either to use on their next foreign trip or to effortlessly send to family and friends living abroad.

At the launch of the service, Western Union’s Head of Global Ecosystem Partnerships, James Osterloh, said: “We are delighted that, with this innovative service we enable our digital wallet customers to have full control over their connectivity needs as well as their finances, adding further value when they use our product.”

What connectivity does for customer acquisition and loyalty

eSIMs help consumers ‘beat the system’ and avoid expensive data roaming charges when traveling abroad. They also fit snugly within traditional loyalty schemes, representing an achievable reward that scales from less than $5 to over $100 per redemption.

The impetus for a branded eSIM service might begin as a subscription perk providing added value to customers, but it’s always got that scope to go on and open new avenues for continuous engagement. That’s because connectivity is a license to connect. It’s a new touchpoint; a bridge that, with permission, you can meet in the middle with your customers. Not only enabling them to use connectivity-reliant digital payment services more frequently, but also – for example – allowing fintech providers to harness valuable data on customer behaviour and preferences to use in delivering hyper-personalised content and offers.

It’s a future worth exploring. Rest assured, your competitors already are, and your customers won’t be far behind.

Meet eSIM Go at IPR Global 2024

Meet Platinum sponsors, eSIM Go at IPR Global this September. Don’t miss out on the unique opportunity to connect with top decision-makers and industry giants.

Spaces are limited, get tickets today: https://global2024.ipr-events.com/

The Evolution and Impact of Digital Remittances

This article is brought to you in partnership with Visa.

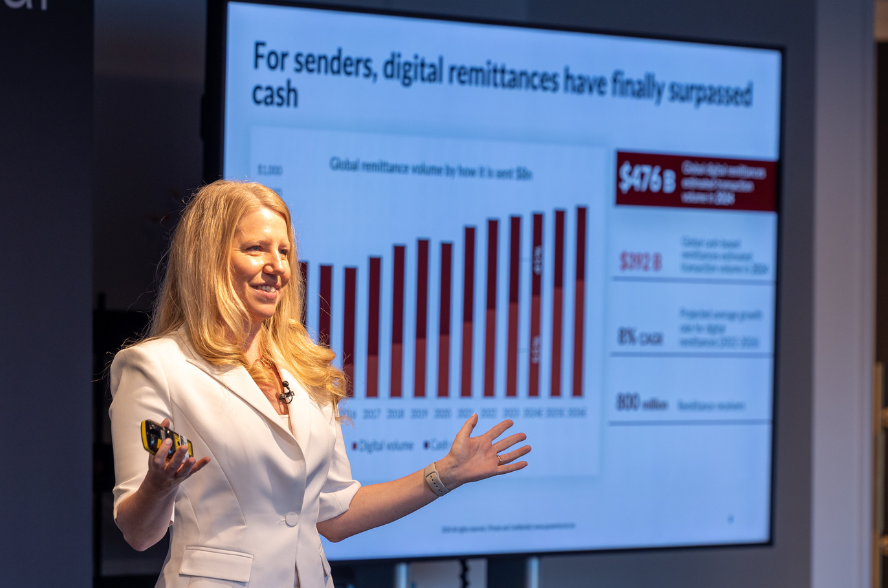

The landscape of cross-border remittances has undergone a significant transformation over the past few

decades, moving away from being high-friction, expensive, and low transparency to being near real-time,

more cost-efficient, and more transparent.

The advent of digital remittance services has revolutionised this landscape. To enable this evolution, the

payments industry continues to make significant strides in the types of innovative solutions, the various

use cases, and the speed and costs of remittance services. This shift is reshaping how money is sent and

received globally, impacting millions of lives and economies.

The Digital Transformation

Digital remittances are now at the forefront of the industry, driven by advancements in mobile

technology and connectivity. Visa’s “Money Travels: Digital Remittances Adoption” Report found that

digital remittances are the preferred method among consumers across all surveyed countries, with 53%

of consumers turning to digital apps to send and receive funds around the world. According to the World

Bank, digital remittances are nearly 2% cheaper than cash remittances, which is a significant saving for

those sending money cross-border on a regular basis.

The benefits of digital remittances extend beyond just cost savings. These platforms offer speed, security,

and convenience, ensuring that funds are transferred quickly and safely. Of the estimated 200 million

migrants who send funds to their collective 800 million family members back home, many are turning to

digital methods, because app-based digital payments are considered the most secure means for sending

funds abroad1. This is particularly crucial for families who rely on remittances for everyday needs like

food, education, and medical expenses.

Economic and Social Impact

When these payments are digital, they provide an additional boost to economic empowerment and

financial inclusion. With advances in digital payments, families benefit from the lower cost of sending or

receiving money abroad. They can have money available in near real-time so that they can spend it

immediately on what they need. With the right guardrails in place, remittance firms and lenders can

work together to extend credit based on customer behaviour, increasing access to financial services that

immigrants lack when they first move.

While remittances can improve the living conditions of those back home, they also fuel growth rates of

receiving economies. 29 countries received over 10 percent of their gross domestic product (GDP) in

remittances in 20221, while seven received over 25 percent of their GDP this way2.

Future Prospects and Challenges

Despite the advancements, challenges remain. Many payment corridors still lack basic infrastructure like

electricity and internet connectivity, which is a barrier for millions in digitising their cross-border

payments.

Innovation within Fintechs and banks, the transformation of global remitters and capabilities of solutions

developed by global payment networks are focused on helping to bring seamless, secure, and rapid

digital remittances within reach. Expanded choices are also important in how digitally enabled migrant

workers can more easily compare providers and costs to choose the best options for their families. Visa

Direct, Visa’s real-time money movement network, is powering many of these new solutions by helping

facilitate the fast delivery of funds directly to cards, bank accounts, and wallets around the world3.

The evolution of cross-border remittances from traditional methods to digital platforms has had a

transformative impact on global economies and communities. As digital adoption continues to rise, it

holds the potential to further empower individuals and drive economic growth, provided the challenges

of digital infrastructure are addressed. The future of remittances is undeniably digital, promising greater

efficiency, security, and inclusion for millions around the world.

1Money Travels: 2023 Digital Remittances Adoption Report (visa.com)

3 Actual fund availability depends on receiving financial institution and region.

Meet Visa at IPR Global 2024

Joining as Platinum sponsors, you can meet Visa at our annual IPR Global event, where you can dive into deep conversations, explore potential partnerships, and discover the latest trends in the industry from leading influencers.

The top decision-makers will be there, so don’t miss this golden opportunity. Our spaces are limited, so seize your ticket now before it runs out at: https://global2024.ipr-events.com/

We look forward to seeing you!