Episode 3: How AI is Transforming Cross-Border Payments | The IPR Podcast

AI is transforming cross-border payments in real time. In Episode 3 of the IPR podcast, Dr. Senaka Fernando, a leading voice in digital transformation, reveals how AI agents can be the key to automating compliance, speeding up transactions, and even preventing fraud before it happens. From startups automating onboarding to banks upgrading systems without disruption.

Want to see how your business can stay ahead in the AI-powered payments game? Watch the full episode for practical strategies and real-world insights you can start using today.

At RemitONE, we’ve been developing new AI Agent tools designed to help you:

- Automate KYC/AML processes

- Expand payout infrastructure into new sending markets

- Offer value-added services like airtime, top-ups, and utility bill payments

Want to see how this can boost revenue for your business? Book a free call with our team.

Money 20/20 Middle East Key Takeaways: Embracing AI and Strategic Partnerships

Saudi Arabia’s fintech sector is experiencing rapid growth, driven by the nation’s Vision 2030 initiative. With over 260 licensed fintech firms and $860 million in venture capital funding in the first half of 2025, the Kingdom is positioning itself as a regional leader in financial technology.

It’s no surprise that Money20/20 Middle East 2025 drew thousands of innovators, investors, and financial leaders, sparking three days of collaboration. The event buzzed with new ideas, partnerships, and strategies that are shaping the future of finance in the region.

Here’s what stood out.

- Saudi Arabia: A Fintech Powerhouse

Unlike other editions, this year’s conference was centered on the Saudi market, where cross-border payments are becoming a major focus. Global names like Visa, Amex, Worldpay, and Habib Bank Limited were present, signalling strong international interest.

With robust investor backing and government support, fintechs in Saudi Arabia are driving change across payments, regtech, governance, and risk. This momentum cements the Kingdom as one of the most exciting and fast-moving fintech ecosystems worldwide.

- AI Integration: Transforming Financial Services

Artificial Intelligence (AI) was a core topic of many panels. The financial sector is projected to invest $28.3 million in AI technologies, contributing $135.2 billion to Saudi Arabia’s economy by 2030.

Agentic AI was also highlighted as a technology revolutionising how financial institutions operate. A common challenge for many Money Service Businesses (MSBs) is upgrading systems to adopt AI without disrupting existing operations. We’ve resolved this issue with our new AI bolt-on tools, including Agentic AI, designed to grow revenue without system migration.

👉 Explore how RemitONE’s AI bolt-ons can transform your operations.

- Strategic Partnerships: Accelerating Growth

Key partnerships are playing a huge role in accelerating fintech adoption in Saudi Arabia. This was clear at the event with several major collaborations: Visa expanded digital acceptance, Google Pay and Alipay teamed up with Saudi banks, and alliances like MoneyGram & D360 Bank and Thunes & Barq were taking cross-border payments to the next level.

These collaborations are streamlining digital payments, expanding access to global wallets, and enabling real-time cross-border transactions across hundreds of corridors. For MSBs, these partnerships are golden opportunities to scale faster and reach new markets.

Unlock the future of fintech in Saudi Arabia

Saudi Arabia’s fintech sector is set for strong growth, fuelled by AI integration and strategic partnerships. With the market projected to reach $4.5 billion by 2033, MSBs must embrace innovation, leverage AI, and forge strategic partnerships.

Our AI-powered tools make it simple to tap into Saudi Arabia’s fintech boom—unlock new revenue streams, scale your business, and stay ahead without operational disruption.

👉 See how AI can fuel your growth – book a free call to find out how

AI Agents in Cross-Border Payments: What They Mean for Money Service Businesses

AI in cross-border payments is moving past chatbots and predictive tools. The real leap is AI agents – systems that can perform tasks end-to-end, much like a human operator. For money service businesses (MSBs), this shift opens a path to automation that was once unthinkable.

From Chatbots to AI Agents

Chatbots are reactive. They answer queries, provide FAQs, and make customer service more efficient. Useful, yes — but limited.

AI agents, however, are proactive digital workers. They don’t just respond, they execute.

An AI agent in payments could:

- Verify documents and check expiry dates

- Screen payments against sanction lists

- Flag missing or suspicious details

- Update records across multiple systems

- Trigger transactions once all conditions are met

These aren’t futuristic ideas. They’re already happening.

Real-World Adoption

Western Union has tested AI to cut back-office workloads. Goldman Sachs is exploring AI for regulatory checks. Other financial institutions are quietly building pilot projects.

This tells us one thing: AI agents are no longer theory. They’re moving into real operations.

For MSBs, this isn’t just about efficiency. It’s about survival. Manual processes eat into margins, slow down customer onboarding, and create bottlenecks. AI agents reduce costs, free up staff, and scale seamlessly.

👉 Explore how RemitONE’s AI solutions automate compliance and onboarding.

What This Means for MSBs

Smaller providers often compete on agility. But manual compliance checks, document verification, and routine approvals limit that agility.

AI agents can take on these repetitive but critical tasks — giving MSBs the bandwidth to grow without doubling headcount.

Examples:

- Onboarding new customers in minutes, not hours.

- Running compliance checks automatically in the background.

- Reducing transaction delays caused by missing data.

By adopting early, MSBs can compete with larger players on speed and scale.

Where to Start

Going “all in” on AI across every process is risky. The smarter approach is targeted integration. Start with repetitive, rule-based workflows where an AI agent can show immediate value.

High-value starting points:

- Document verification

- Sanctions screening

- Customer onboarding

Once proven, these workflows can be expanded to cover more complex tasks.

👉 See how RemitONE’s AI bolt-ons integrate with existing systems.

The Takeaway

AI agents won’t replace people. They’ll supplement teams, taking on the heavy lifting so humans can focus on strategy and judgement.

For MSBs, the choice is clear: either automate now and scale, or risk falling behind as competitors adopt AI-driven processes.

Ready to cut compliance workloads and scale faster?

Book a free strategy call to see how AI bolt-ons can fit your operations.

Expand Your Money Service Business in Europe without Local Licences or Bank Setup

Most Banks and Money Transfer Operators (MTOs) that handle payouts rely on international partners to send them transactions. But what if you could manage both sides of the corridor and keep more margin?

Watch the short video to find out how:

Oussama breaks down how our Remittance-as-a-Service model lets you:

- Launch send operations from the UK and Europe in weeks

- Avoid waiting months for licences or bank approvals

- Get a white-labelled app and website

- Tap into ~€130B in remittances sent from Europe and ~£20B from the UK alone

Looking to grow across borders without the heavy costs? This could be the missing piece to help you do that.

Book a free call with our expert Oussama to explore how this can work for your business:

Episode 2: How to Start a Money Transfer Business – A Practical Guide for Founders | The IPR Podcast

The global cross-border payments industry continues to evolve, presenting new opportunities for remittance startups and financial institutions. But what does it really take to launch or expand a money transfer business in today’s landscape shaped by complex regulations, rising compliance expectations, and rapidly advancing technology?

In Episode 2 of The IPR Podcast RemitONE’s CMO Aamer Abedi sits down with Oussama Kseibati, Head of Business Solutions, to provide a clear, actionable roadmap for anyone looking to enter the cross-border payments space. Drawing from over 15 years of industry experience, Oussama outlines a five-step framework that founders can follow to build a compliant, scalable, and competitive Money Service Business (MSB).

Whether you’re launching from scratch or expanding into a new region, this episode offers foundational guidance to help you navigate the journey.

Understanding the Five Core Steps

Step 1: Research, Market Fit, and Business Planning

Every successful business begins with research. In the case of remittances, this means understanding your target corridors, your competition, your potential client base, and the unique value you aim to deliver. Oussama recommends starting small, focusing on one or two corridors you’re familiar with, perhaps tied to your own community or existing business network. This strategic focus allows you to manage cash flow, compliance, and relationships more efficiently before gradually expanding to new regions or services.

A well-structured business plan plays a key role in setting up for success. It should include realistic forecasting, cost structures, and clearly defined revenue streams, particularly understanding how FX margins and payout partnerships will contribute to your profit.

Step 2: Software That Meets Regulatory Needs

Technology is at the heart of modern money service businesses. From onboarding and identity verification to compliance screening and transaction processing, a reliable software infrastructure is essential. A robust platform should not only support regulatory needs (e.g. OFAC, UN, MAS, and HM Treasury checks) but also provide a seamless user experience for customers.

Oussama points out that choosing the right software provider can also give founders access to built-in integrations with payout partners, payment gateways, and compliance tools. Opting for an end-to-end platform such as RemitONE can reduce development time, streamline operations, and help ensure your system is aligned with regulatory requirements from day one.

Step 3: Apply for the Appropriate Licence

Depending on your jurisdiction and the nature of your services, you’ll need to apply for a financial licence, commonly known as an EMI (Electronic Money Institution) licence in the UK/EU, or equivalent.

Founders should consider their service model carefully:

- Do you intend to hold client funds in wallets?

- Are your transaction volumes expected to grow rapidly?

- Will you operate in a single country or multiple regions?

For many, a Small Payment Institution (SPI) licence offers a more accessible entry point. It allows you to operate legally while building up transaction history and operational credibility, which can later support applications for higher-tier licences like API or EMI.

Step 4: Secure a Client Bank Account

Opening a bank account for safeguarding client funds can be one of the more challenging steps, especially in regions where traditional banks view remittance providers as high-risk. This has led to a wave of “de-risking,” where financial institutions have withdrawn services from MSBs altogether.

However, there are solutions. Letters of intent from banks, demonstrating willingness to provide an account once licensed, can support your application with regulators. Additionally, new digital-first banks and fintech-focused institutions are becoming more open to MSB clients, especially those operating with transparency and good controls in place.

The client account ensures that funds remain protected until the transaction is completed, adding an extra layer of security for both regulators and customers.

Step 5: Partner with Reliable Payout Networks

Once you’ve established your business model, tech infrastructure, and licence, you’ll need to connect with payout partners such as banks, MTOs, or telcos in the payout country, who will complete the final end of the transaction.

Payout partners are critical for determining your transaction fees, exchange rates, and service reliability. In the early stages, pre-funding is common, meaning you’ll need to deposit funds in advance with these partners to enable instant payouts.

Here too, a well-connected technology provider can simplify the process by offering access to pre-integrated partners or facilitating introductions to established networks.

The Role of End-to-End Platforms in Supporting MSBs

Remittance businesses today require more than just a digital interface. A complete solution should connect every part of the remittance chain—from onboarding and KYC to payment gateways, FX providers, compliance systems, and settlement tools.

RemitONE’s platform, for example, supports founders throughout this journey by offering tools for transaction monitoring, sanctions screening, automated compliance, and built-in integrations with various payment partners. The goal is to give new entrants the ability to launch quickly, scale with confidence, and maintain compliance across jurisdictions.

Watch the full podcast for the complete insights and strategies.

YouTube: https://youtu.be/2GChfkdhaMg?si=aWj4NuQvRXl9Ly7W

Spotify: https://open.spotify.com/episode/3dAbpgiDWyKklj3Guteo2F?si=569b6d23ade94344

Apple Podcasts: https://podcasts.apple.com/us/podcast/how-to-start-a-money-transfer-business/id1822769031?i=1000718661978

If you’re exploring the possibility of launching your own MSB or expanding into new corridors, speak to one of our consultants. Book a free session here: https://calendly.com/remitone-oussama/free-30min-consultation-website

For questions or guidance, reach out to sales@remitone.com.

Meet RemitONE team in Riyadh, Saudi Arabia: Unlock AI-powered growth

We’re heading to the Money20/20 event in Saudi Arabia to connect with ambitious businesses looking to scale. Aamer Abedi, our CMO, Oussama Kseibati, Head of Business Solutions, along with our partner Anwar Al Murshed from DTCC, will be in Riyadh 15th – 19th, September to explore cross-border payment opportunities with our AI, open banking and blockchain solutions.

Whether you’re expanding into sending markets like the UK and Europe or navigating complex compliance demands, our AI-powered solution can help you grow and unlock new revenue.

We provide the building blocks to future-proof your operations, even if remittances aren’t your core offering, with tools such as:

- Automated KYC/AML

- Scalable payout infrastructure to new sending markets

- Value-added services including airtime, top-ups and utility bill payments

To arrange a place and time, please email us at: marketing@remitone.com

About RemitONE

RemitONE is an award-winning, leading provider of money transfer software solutions for banks, telcos, and money transfer operators (MTOs) worldwide. With multi-channel access, including agent networks, online, and mobile, RemitONE empowers organisations to streamline and scale their remittance operations.

Power Up Your Platform: The Top RemitONE Features Driving Our Clients’ Success

What if the growth you’re chasing is already built into your system?

If you’re using the RemitONE Money Transfer Platform, we want to make sure you’re getting the most out of it to unlock its full potential.

Packed into your platform are powerful tools designed to boost transactions, build loyalty, reduce risk, and help you move faster. But if you’re not fully unlocking them, you’re missing opportunities.

Today, we’ll be sharing our clients features that consistently drive results and keep them ahead of the curve.

Let’s show you what’s possible.

Loyalty Manager: Keep Customers Coming Back

If you’re looking to boost retention and give your remitters a reason to keep choosing you—this is the feature to activate.

Loyalty Manager™ turns every transaction into an opportunity to reward your remitters. With this popular feature, your customers earn loyalty points every time they send money or refer a friend. These points can be redeemed to reduce transaction fees, which means every transfer becomes more affordable and more rewarding for them.

What makes it especially powerful is how customisable it is. You can set your own rules on how points are earned, based on what makes sense for your business, whether that’s based on transaction frequency, corridors, or even new customer referrals.

And when combined with Promotions Manager™, your customers can unlock even more by using loyalty points and promotions in a single transaction. The result? Greater satisfaction, higher engagement, and stronger brand loyalty.

Promotions Manager™: Smart Offers, More Transfers

If you’re running a money transfer business, you know that generic discounts don’t cut it. You need offers that actually move the needle — increasing transaction volumes, encouraging repeat usage, and giving customers a reason to stick with you.

That’s exactly what Promotions Manager™ is built for.

This feature puts you in full control, allowing you to set up intelligent, rule-based promotions that are targeted, timely, and effective. Whether it’s a festive seasonal discount for specific corridors, a reward for frequent senders, or a special deal for partners, this feature helps you craft promotions that match your business goals and your audience’s behaviour.

- Target smarter: Choose who sees your promotions based on corridors, transaction history, or user type.

- Incentivise more sends: Set up thresholds like “send 3 times, get a discount” to increase transaction frequency.

- Run timely offers: Activate short-term promos for holidays, local events, or marketing pushes.

- Maximise ROI: Avoid blanket discounts and focus on what works, boosting transactions without wasting budget.

It’s not just about discounts; it’s about strategy. Promotions Manager™ helps you reward the right behaviour, at the right time, with the right offer, building stronger customer loyalty and driving more transactions.

Risk Manager™ : Spot Risks Before They Become Problems

Risk is everywhere when you’re moving money across borders, but staying compliant doesn’t have to mean slowing down your operations or manually digging through data.

What clients love about our Risk Manager™ is it doesn’t just flag risks — it thinks ahead.

It gives you a dynamic, real-time view of who your riskiest customers are based on what they actually do — not just who they say they are. From sending to high-risk regions to sudden spikes in transaction volumes, our dynamic risk scoring system tracks behaviour patterns, adapts in real-time, and assigns weighted risk scores to both remitters and beneficiaries. The result? You can spot red flags early, act fast, and stay ahead.

It’s not just for compliance teams either, the Risk Score Rules Engine lets you set custom rules that reflect your business needs. And with detailed audit trails and downloadable reports, you’ll always be ready when the regulator comes knocking.

If you’re already juggling tight regulations and evolving risks, then it might be time to activate Risk Manager™ and make your life a whole lot easier.

Maker Checker: Double Verification for Safer Transfers

Mistakes in money transfers can cost more than just time; they can damage trust. Maker Checker adds a second layer of control to your operations by requiring one team member to create a transaction, and another to verify it. It’s a simple way to reduce errors, prevent fraud, and keep your financial processes rock solid and secure.

Built for compliance, peace of mind, and flawless execution.

Get more out of RemitONE — with hands-on expert support

Sometimes the real game-changer isn’t a new feature, it’s having someone by your side who knows your system and understands your goals to help you move faster.

That’s exactly what our Technical Customer Success (TCS) offers. It’s a personalised support experience built for teams who want to go further with RemitONE. You’ll have direct access to a dedicated Technical Customer Success Manager who becomes an extension of your team, someone who already understands your setup and can help you troubleshoot issues faster, scale with confidence, and get more out of the platform.

Whether it’s navigating technical challenges, implementing new features, or simply having a regular sounding board for improvements, TCS is designed to make your day-to-day easier and more effective. You’ll spend less time stuck in queues and more time getting things done.

It’s a flexible service shaped around your workflow, from quick weekly catch-ups to in-depth strategy calls. Whatever your rhythm, we’ll match it, so your team can keep moving.

Let’s take some weight off your shoulders and help unlock your full potential.

You’re sitting on the growth your competitors are already using.

These tools aren’t “nice-to-haves” they’re how leading money service businesses (MSBs) are pulling ahead. More transactions. More loyalty. More support.

If you’re already using RemitONE, it’s time to unlock the full power of your platform.

And if you’re not with us yet? Then let’s show you what’s possible.

Book a free demo and see how the world’s leading MSBs use our platform to grow every single day.

Episode 1: Trump’s Threats to Cross-Border Payments – What It Means for Your Money Service Business

Donald Trump’s return to office has reignited policy debates, with ripple effects already reaching the cross-border payments space. From remittance tax proposals to tighter compliance and crypto shifts, these changes could reshape how money moves in and out of the U.S.

But what do these proposed policies mean in practice—and should MSBs be preparing for disruption or opportunity?

We dive into all this and more in the first episode of our IPR Podcast: Talking Innovation in Payments & Remittances.

Will Deportations of Migrants Impact Remittances? Here’s What the Data Says

Mexicans, a large diaspora and major US remittance senders, may face stricter immigration policies, putting this financial lifeline at risk. The “Remain in Mexico” program has led to nearly 11,000 migrants being sent back, potentially reducing the number of workers in the U.S. and, with them, the flow of cross-border payments. Since Trump’s arrival, 38,000 arrests and 207,000 deportations have been made, according to ICE.

Despite his promise to deport 11 million people, the complexity of the process appears to make that goal unlikely. It could also open a window for some undocumented migrants to secure legal status. However, even large-scale deportation efforts may not significantly alter overall volumes due to the typically lower transaction size of undocumented remitters. The real concern? A remittance tax.

Will a Remittance Tax on US-Latin America Transfers Disrupt the Market?

The remittance tax from the US to Latin American regions is intended to minimise illegal immigration but can cause a significant dent in transactions, impacting money transfer operators, banks, and other players in the payments ecosystem by reducing revenue and lowering demand in certain corridors.

It could also shift the balance for countries like Mexico, El Salvador, and Haiti—where remittances inject nearly $150 billion annually. Families who depend on these funds risk losing critical income. Money Service Businesses (MSBs) may have no choice but to raise fees, potentially driving customers toward alternative solutions like digital wallets and crypto. Interestingly, Trump seems to support crypto, so could this be the turning point that finally makes it more secure and mainstream?

Recent developments in the One Big Beautiful Bill Act have introduced significant updates to the tax proposal. The Senate-approved version has lowered the tax rate to 1% from earlier higher proposals and now limits the tax to remittances funded through traditional cash-funded methods while exempting digital transactions. This change could reduce the burden for many non-U.S. citizens who send money digitally but will impact cash senders more heavily, including some minority groups and the elderly.

The tax also now applies to both U.S. nationals and non-nationals, whereas previously only non-nationals were affected—broadening its impact. A clause that once allowed senders to reclaim remittance taxes has also been removed.

Trump and Crypto: A Game-Changer for Cross-Border Payments?

While Trump has halted any action to progress America’s CBDC, he’s taken more steps to advance the crypto movement, especially stablecoins, which has added a new dimension to the discussion. In a tweet, he unveiled the U.S. Crypto Strategic Reserve, which will include XRP, SOL, and ADA, with Bitcoin (BTC), Ethereum (ETH), and other key cryptocurrencies that will be added to “the heart of the Reserve.” Since the announcement, the value of the first three coins surged by 62%.

The two messages posted by Donald Trump on Sunday, March 2, on his X Social account.

So, what does this mean? Cryptocurrencies offer the potential for faster, cheaper, and more accessible cross-border transfers, reducing traditional fees and delays. While stablecoins—pegged to the dollar—aim to provide price stability, but can still fluctuate alongside the US dollar’s value, which introduces some risks. The broader crypto ecosystem’s growth could open new alternatives for senders, though volatility and regulatory clarity remain key factors to watch.

Stricter Compliance: A Roadblock for Remittances?

The designation of cartels as terrorist organisations, combined with tighter immigration policies, is set to intensify compliance pressures on MSBs, who must now exercise even greater due diligence to avoid any unintended links to sanctioned groups.

For migrants, this means longer wait times, extra fees, and fewer options to send money home. If traditional corridors start shutting down, people will have no choice but to look elsewhere, whether that’s the age-old hawala system or the rising use of crypto.

Keeping up with ever-changing regulations is more than just a headache—it’s a matter of survival. A single compliance slip-up can trigger heavy fines or force a business to shut its doors entirely. Yet, many companies still juggle multiple software tools, manually stitching together fragmented systems to stay compliant.

Our Liveness feature utilises biometric-powered selfie checks, through which remitters can instantly confirm their identity—cutting fraud risks while keeping regulators satisfied. It’s this kind of innovation that makes compliance less of a burden and more of a competitive advantage.

So, if you want to streamline your operations and power your growth, book a demo with one of our experts: https://calendly.com/remitone-oussama/free-30min-consultation-website

Watch the full podcast for the complete insights and strategies.

In this article, we’ve only covered a handful of key points. For a deeper understanding and practical steps to help your business adapt, tune into the full discussion — and don’t forget to subscribe so you’re always on top of all the industry news.

Youtube: https://www.youtube.com/watch?v=zMZm4THw03k

Spotify: https://open.spotify.com/episode/7beXO7FlCs8GyImd6BUypf

Apple podcasts: https://podcasts.apple.com/us/podcast/trumps-remittance-tax-threat-or-opportunity/id1822769031?i=1000716221708

Introducing The IPR Podcast: Talking Innovation in Payments & Remittances

We’re excited to announce the launch of The IPR Podcast, a brand-new series dedicated to bold conversations happening in cross-border payments.

Hosted by Aamer Abedi, this podcast is built for fintech leaders, money transfer operators, banks, and anyone shaping the future of financial services. Each episode features conversations with industry experts on the trends and technologies changing the game — and what they really mean for your business.

You’ll hear stories from the frontlines, discover new ideas, and walk away with strategies you can put into action.

Episode 1: Trump’s Tariffs — What Could They Mean for Your Business?

Next week, we kick off with a timely deep dive into proposed remittance tariffs in the US and how they could affect:

- Why certain corridors could become unprofitable

- How rising costs may affect customer loyalty

- What MTOs can do now to adapt and stay competitive

Subscribe now and be the first to tune in.

Spotify: https://open.spotify.com/episode/7tZYluLixpm6MhwbLQxjzL?si=rqhOGDoHRmuHdFJZUJatZA

Youtube: https://www.youtube.com/playlist?list=PLLqIwD4TK69h8higA91Ba9a1o1GU3sH2c

Apple Podcasts: https://podcasts.apple.com/us/podcast/welcome-to-the-ipr-podcast-talking-innovation-in/id1822769031?i=1000714502161

Be Part of the Conversation

Got thoughts, questions, or ideas for future episodes? We’d love to hear from you, email us at: marketing@ipr-events.com

Want to be a guest?

We’re looking for people shaping the future of payments and remittances. If you’ve got insights or experiences worth sharing, reach out to us at: marketing@ipr-events.com

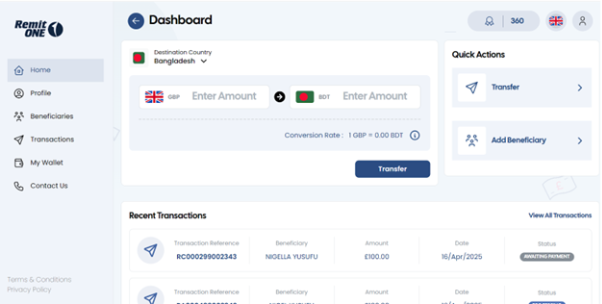

New White-Label Online Platform: Redesigned to Scale Customer Loyalty and Growth

Add powerful money transfer capabilities to your website — without the complexity.

Our new Online Remittance Manager (ORM) is a fully white-label web application that lets your customers send money securely and easily — all under your brand, without leaving your site.

Built on a foundation of powerful features, now enhanced with a seamless new design.

Your brand will sit proudly on a modern, intuitive platform that makes sending money simple — helping you build loyalty and drive growth.

Instant, Simple Money Transfers

From the moment customers log in, they see what matters most: Send Money.

Quick Actions let them add beneficiaries without hunting through menus.

Recent transactions are easy to review at a glance.

Navigation is streamlined on the left-hand side for effortless access.

How much time could your customers save with this design?

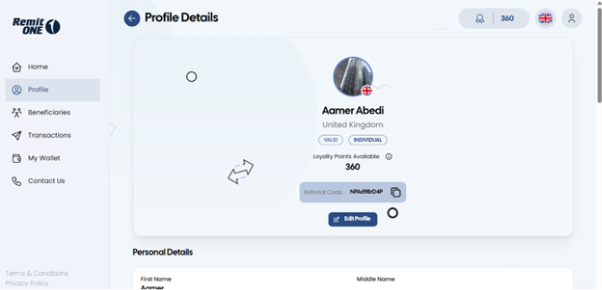

Enhanced Customer Profiles for Better Insights

The Profile section now gives a richer overview of each customer—helping you serve them better. Instantly see key details like available discount codes, submitted ID proofs, and whether they’ve completed their KYC checks—all in one place.

What would better visibility mean for your client relationships?

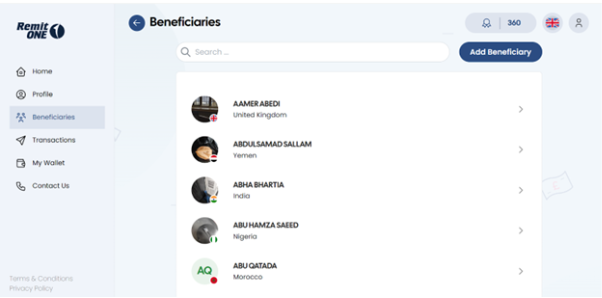

Quick Access to Saved Beneficiaries

The Beneficiaries section lists all saved contacts alphabetically, so customers can quickly find who they’re looking for. With the built-in search, there’s no need to scroll endlessly—just type, find, and send in seconds.

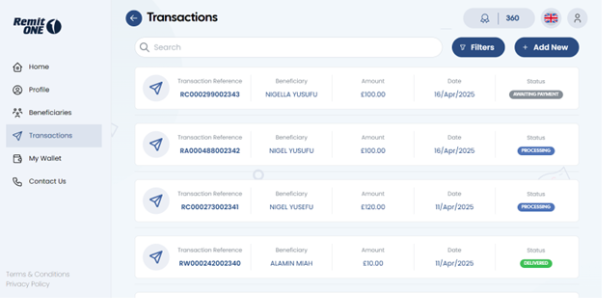

Detailed Transaction History with Smart Filters

Customers see every transfer in a clean timeline. Clicking on any transaction reveals a full breakdown—including fees, status, and more.

Smart filters make finding specific transactions easy: By date, type, or status.

And with the “Add New” button, they can jump straight into sending money again, with no backtracking needed.

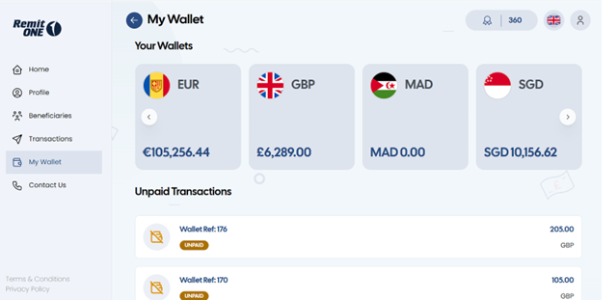

Multi-Currency Wallets Made Easy

The My Wallet section displays all the wallets your customer holds across different regions, along with the balance in each one. The left and right toggle arrows offer a smooth way to scroll through the full list—making it easy to manage multiple wallets without overwhelming the screen. It’s a user-friendly experience that keeps everything organised and accessible.

Below, customers can also view a history of unpaid transactions, so nothing slips through.

Easy Customer Support Access

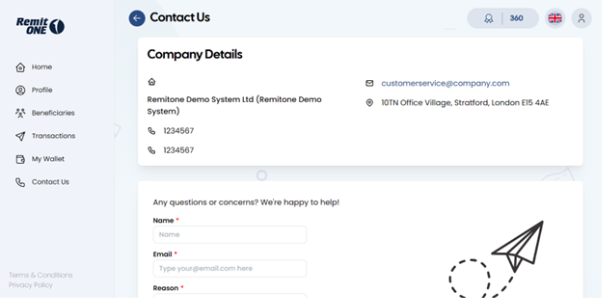

Finally, we’ve reached the Contact Us page—an essential space where customers can reach out whenever they need support. It’s not just a lifeline for them, but also a valuable channel for you to stay informed about any issues and respond quickly.

At the top, customers will find your company’s contact details, with an enquiry form below as a convenient alternative for getting in touch.

Ready to impress your customers with a smarter, sleeker platform?

Our redesigned Online Platform and Mobile App aren’tjust better looking — they’re built to help you:

- Deliver a world-class experience

- Scale faster

- Work smarter

Book a demo today to explore the platform firsthand, get expert answers to your questions, and discover how to turn clicks into conversions — and customers into loyal fans.