Power Up Your Platform: The Top RemitONE Features Driving Our Clients’ Success

What if the growth you’re chasing is already built into your system?

If you’re using the RemitONE Money Transfer Platform, we want to make sure you’re getting the most out of it to unlock its full potential.

Packed into your platform are powerful tools designed to boost transactions, build loyalty, reduce risk, and help you move faster. But if you’re not fully unlocking them, you’re missing opportunities.

Today, we’ll be sharing our clients features that consistently drive results and keep them ahead of the curve.

Let’s show you what’s possible.

Loyalty Manager: Keep Customers Coming Back

If you’re looking to boost retention and give your remitters a reason to keep choosing you—this is the feature to activate.

Loyalty Manager™ turns every transaction into an opportunity to reward your remitters. With this popular feature, your customers earn loyalty points every time they send money or refer a friend. These points can be redeemed to reduce transaction fees, which means every transfer becomes more affordable and more rewarding for them.

What makes it especially powerful is how customisable it is. You can set your own rules on how points are earned, based on what makes sense for your business, whether that’s based on transaction frequency, corridors, or even new customer referrals.

And when combined with Promotions Manager™, your customers can unlock even more by using loyalty points and promotions in a single transaction. The result? Greater satisfaction, higher engagement, and stronger brand loyalty.

Promotions Manager™: Smart Offers, More Transfers

If you’re running a money transfer business, you know that generic discounts don’t cut it. You need offers that actually move the needle — increasing transaction volumes, encouraging repeat usage, and giving customers a reason to stick with you.

That’s exactly what Promotions Manager™ is built for.

This feature puts you in full control, allowing you to set up intelligent, rule-based promotions that are targeted, timely, and effective. Whether it’s a festive seasonal discount for specific corridors, a reward for frequent senders, or a special deal for partners, this feature helps you craft promotions that match your business goals and your audience’s behaviour.

- Target smarter: Choose who sees your promotions based on corridors, transaction history, or user type.

- Incentivise more sends: Set up thresholds like “send 3 times, get a discount” to increase transaction frequency.

- Run timely offers: Activate short-term promos for holidays, local events, or marketing pushes.

- Maximise ROI: Avoid blanket discounts and focus on what works, boosting transactions without wasting budget.

It’s not just about discounts; it’s about strategy. Promotions Manager™ helps you reward the right behaviour, at the right time, with the right offer, building stronger customer loyalty and driving more transactions.

Risk Manager™ : Spot Risks Before They Become Problems

Risk is everywhere when you’re moving money across borders, but staying compliant doesn’t have to mean slowing down your operations or manually digging through data.

What clients love about our Risk Manager™ is it doesn’t just flag risks — it thinks ahead.

It gives you a dynamic, real-time view of who your riskiest customers are based on what they actually do — not just who they say they are. From sending to high-risk regions to sudden spikes in transaction volumes, our dynamic risk scoring system tracks behaviour patterns, adapts in real-time, and assigns weighted risk scores to both remitters and beneficiaries. The result? You can spot red flags early, act fast, and stay ahead.

It’s not just for compliance teams either, the Risk Score Rules Engine lets you set custom rules that reflect your business needs. And with detailed audit trails and downloadable reports, you’ll always be ready when the regulator comes knocking.

If you’re already juggling tight regulations and evolving risks, then it might be time to activate Risk Manager™ and make your life a whole lot easier.

Maker Checker: Double Verification for Safer Transfers

Mistakes in money transfers can cost more than just time; they can damage trust. Maker Checker adds a second layer of control to your operations by requiring one team member to create a transaction, and another to verify it. It’s a simple way to reduce errors, prevent fraud, and keep your financial processes rock solid and secure.

Built for compliance, peace of mind, and flawless execution.

Get more out of RemitONE — with hands-on expert support

Sometimes the real game-changer isn’t a new feature, it’s having someone by your side who knows your system and understands your goals to help you move faster.

That’s exactly what our Client Success Support offers. It’s a personalised support experience built for teams who want to go further with RemitONE. You’ll have direct access to a dedicated Technical Customer Success Manager who becomes an extension of your team, someone who already understands your setup and can help you troubleshoot issues faster, scale with confidence, and get more out of the platform.

Whether it’s navigating technical challenges, implementing new features, or simply having a regular sounding board for improvements, VIC Support is designed to make your day-to-day easier and more effective. You’ll spend less time stuck in queues and more time getting things done.

It’s a flexible service shaped around your workflow, from quick weekly catch-ups to in-depth strategy calls. Whatever your rhythm, we’ll match it, so your team can keep moving.

Let’s take some weight off your shoulders and help unlock your full potential.

You’re sitting on the growth your competitors are already using.

These tools aren’t “nice-to- haves” they’re how leading money service businesses (MSBs) are pulling ahead. More transactions. More loyalty. More support.

If you’re already using RemitONE, it’s time to unlock the full power of your platform.

And if you’re not with us yet? Then let’s show you what’s possible.

Book a free demo and see how the world’s leading MSBs use our platform to grow every single day.

Book here: https://calendly.com/remitone-oussama/free-30min-consultation-website

Episode 1: Trump’s Threats to Cross-Border Payments – What It Means for Your Money Service Business

Donald Trump’s return to office has reignited policy debates, with ripple effects already reaching the cross-border payments space. From remittance tax proposals to tighter compliance and crypto shifts, these changes could reshape how money moves in and out of the U.S.

But what do these proposed policies mean in practice—and should MSBs be preparing for disruption or opportunity?

We dive into all this and more in the first episode of our IPR Podcast: Talking Innovation in Payments & Remittances.

Will Deportations of Migrants Impact Remittances? Here’s What the Data Says

Mexicans, a large diaspora and major US remittance senders, may face stricter immigration policies, putting this financial lifeline at risk. The “Remain in Mexico” program has led to nearly 11,000 migrants being sent back, potentially reducing the number of workers in the U.S. and, with them, the flow of cross-border payments. Since Trump’s arrival, 38,000 arrests and 207,000 deportations have been made, according to ICE.

Despite his promise to deport 11 million people, the complexity of the process appears to make that goal unlikely. It could also open a window for some undocumented migrants to secure legal status. However, even large-scale deportation efforts may not significantly alter overall volumes due to the typically lower transaction size of undocumented remitters. The real concern? A remittance tax.

Will a Remittance Tax on US-Latin America Transfers Disrupt the Market?

The remittance tax from the US to Latin American regions is intended to minimise illegal immigration but can cause a significant dent in transactions, impacting money transfer operators, banks, and other players in the payments ecosystem by reducing revenue and lowering demand in certain corridors.

It could also shift the balance for countries like Mexico, El Salvador, and Haiti—where remittances inject nearly $150 billion annually. Families who depend on these funds risk losing critical income. Money Service Businesses (MSBs) may have no choice but to raise fees, potentially driving customers toward alternative solutions like digital wallets and crypto. Interestingly, Trump seems to support crypto, so could this be the turning point that finally makes it more secure and mainstream?

Recent developments in the One Big Beautiful Bill Act have introduced significant updates to the tax proposal. The Senate-approved version has lowered the tax rate to 1% from earlier higher proposals and now limits the tax to remittances funded through traditional cash-funded methods while exempting digital transactions. This change could reduce the burden for many non-U.S. citizens who send money digitally but will impact cash senders more heavily, including some minority groups and the elderly.

The tax also now applies to both U.S. nationals and non-nationals, whereas previously only non-nationals were affected—broadening its impact. A clause that once allowed senders to reclaim remittance taxes has also been removed.

Trump and Crypto: A Game-Changer for Cross-Border Payments?

While Trump has halted any action to progress America’s CBDC, he’s taken more steps to advance the crypto movement, especially stablecoins, which has added a new dimension to the discussion. In a tweet, he unveiled the U.S. Crypto Strategic Reserve, which will include XRP, SOL, and ADA, with Bitcoin (BTC), Ethereum (ETH), and other key cryptocurrencies that will be added to “the heart of the Reserve.” Since the announcement, the value of the first three coins surged by 62%.

The two messages posted by Donald Trump on Sunday, March 2, on his X Social account.

So, what does this mean? Cryptocurrencies offer the potential for faster, cheaper, and more accessible cross-border transfers, reducing traditional fees and delays. While stablecoins—pegged to the dollar—aim to provide price stability, but can still fluctuate alongside the US dollar’s value, which introduces some risks. The broader crypto ecosystem’s growth could open new alternatives for senders, though volatility and regulatory clarity remain key factors to watch.

Stricter Compliance: A Roadblock for Remittances?

The designation of cartels as terrorist organisations, combined with tighter immigration policies, is set to intensify compliance pressures on MSBs, who must now exercise even greater due diligence to avoid any unintended links to sanctioned groups.

For migrants, this means longer wait times, extra fees, and fewer options to send money home. If traditional corridors start shutting down, people will have no choice but to look elsewhere, whether that’s the age-old hawala system or the rising use of crypto.

Keeping up with ever-changing regulations is more than just a headache—it’s a matter of survival. A single compliance slip-up can trigger heavy fines or force a business to shut its doors entirely. Yet, many companies still juggle multiple software tools, manually stitching together fragmented systems to stay compliant.

Our Liveness feature utilises biometric-powered selfie checks, through which remitters can instantly confirm their identity—cutting fraud risks while keeping regulators satisfied. It’s this kind of innovation that makes compliance less of a burden and more of a competitive advantage.

So, if you want to streamline your operations and power your growth, book a demo with one of our experts: https://calendly.com/remitone-oussama/free-30min-consultation-website

Watch the full podcast for the complete insights and strategies.

In this article, we’ve only covered a handful of key points. For a deeper understanding and practical steps to help your business adapt, tune into the full discussion — and don’t forget to subscribe so you’re always on top of all the industry news.

Youtube: https://www.youtube.com/watch?v=zMZm4THw03k

Spotify: https://open.spotify.com/episode/7beXO7FlCs8GyImd6BUypf

Apple podcasts: https://podcasts.apple.com/us/podcast/trumps-remittance-tax-threat-or-opportunity/id1822769031?i=1000716221708

Introducing The IPR Podcast: Talking Innovation in Payments & Remittances

We’re excited to announce the launch of The IPR Podcast, a brand-new series dedicated to bold conversations happening in cross-border payments.

Hosted by Aamer Abedi, this podcast is built for fintech leaders, money transfer operators, banks, and anyone shaping the future of financial services. Each episode features conversations with industry experts on the trends and technologies changing the game — and what they really mean for your business.

You’ll hear stories from the frontlines, discover new ideas, and walk away with strategies you can put into action.

Episode 1: Trump’s Tariffs — What Could They Mean for Your Business?

Next week, we kick off with a timely deep dive into proposed remittance tariffs in the US and how they could affect:

- Why certain corridors could become unprofitable

- How rising costs may affect customer loyalty

- What MTOs can do now to adapt and stay competitive

Subscribe now and be the first to tune in.

Spotify: https://open.spotify.com/episode/7tZYluLixpm6MhwbLQxjzL?si=rqhOGDoHRmuHdFJZUJatZA

Youtube: https://www.youtube.com/playlist?list=PLLqIwD4TK69h8higA91Ba9a1o1GU3sH2c

Apple Podcasts: https://podcasts.apple.com/us/podcast/welcome-to-the-ipr-podcast-talking-innovation-in/id1822769031?i=1000714502161

Be Part of the Conversation

Got thoughts, questions, or ideas for future episodes? We’d love to hear from you, email us at: marketing@ipr-events.com

Want to be a guest?

We’re looking for people shaping the future of payments and remittances. If you’ve got insights or experiences worth sharing, reach out to us at: marketing@ipr-events.com

New White-Label Online Platform: Redesigned to Scale Customer Loyalty and Growth

Add powerful money transfer capabilities to your website — without the complexity.

Our new Online Remittance Manager (ORM) is a fully white-label web application that lets your customers send money securely and easily — all under your brand, without leaving your site.

Built on a foundation of powerful features, now enhanced with a seamless new design.

Your brand will sit proudly on a modern, intuitive platform that makes sending money simple — helping you build loyalty and drive growth.

Instant, Simple Money Transfers

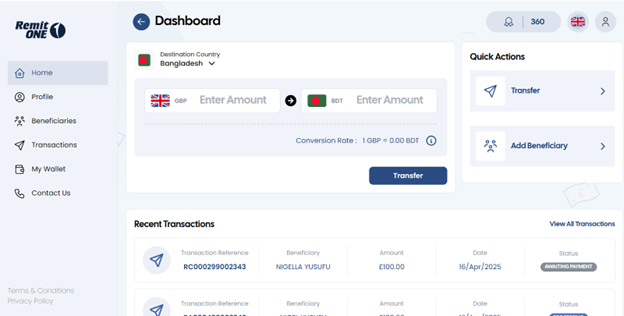

From the moment customers log in, they see what matters most: Send Money.

Quick Actions let them add beneficiaries without hunting through menus.

Recent transactions are easy to review at a glance.

Navigation is streamlined on the left-hand side for effortless access.

How much time could your customers save with this design?

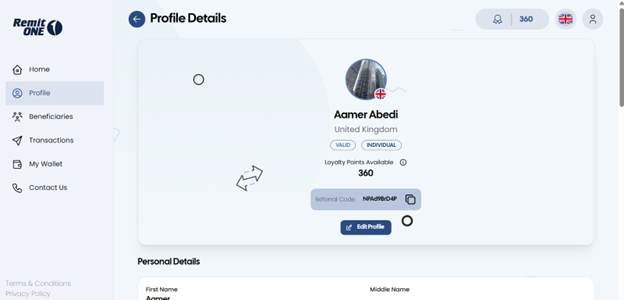

Enhanced Customer Profiles for Better Insights

The Profile section now gives a richer overview of each customer—helping you serve them better. Instantly see key details like available discount codes, submitted ID proofs, and whether they’ve completed their KYC checks—all in one place.

What would better visibility mean for your client relationships?

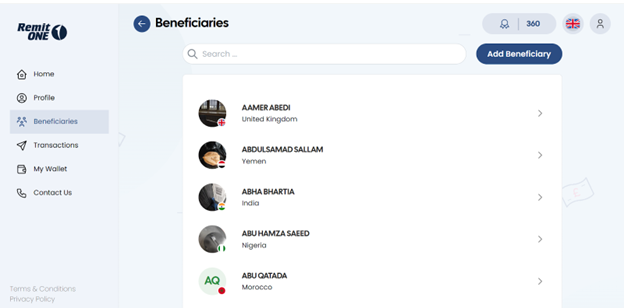

Quick Access to Saved Beneficiaries

The Beneficiaries section lists all saved contacts alphabetically, so customers can quickly find who they’re looking for. With the built-in search, there’s no need to scroll endlessly—just type, find, and send in seconds.

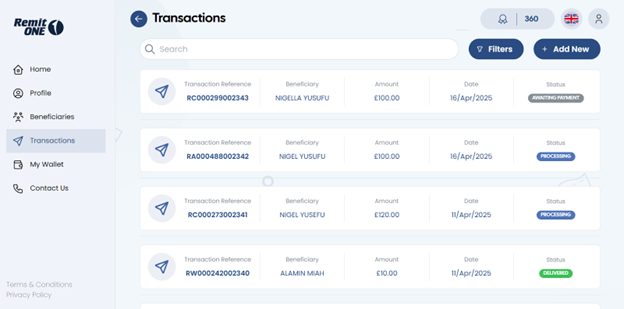

Detailed Transaction History with Smart Filters

Customers see every transfer in a clean timeline. Clicking on any transaction reveals a full breakdown—including fees, status, and more.

Smart filters make finding specific transactions easy: By date, type, or status.

And with the “Add New” button, they can jump straight into sending money again, with no backtracking needed.

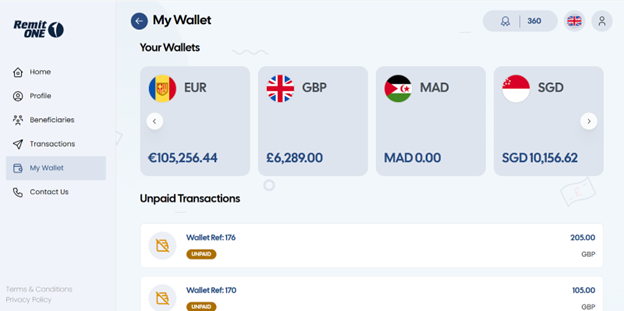

Multi-Currency Wallets Made Easy

The My Wallet section displays all the wallets your customer holds across different regions, along with the balance in each one. The left and right toggle arrows offer a smooth way to scroll through the full list—making it easy to manage multiple wallets without overwhelming the screen. It’s a user-friendly experience that keeps everything organised and accessible.

Below, customers can also view a history of unpaid transactions, so nothing slips through.

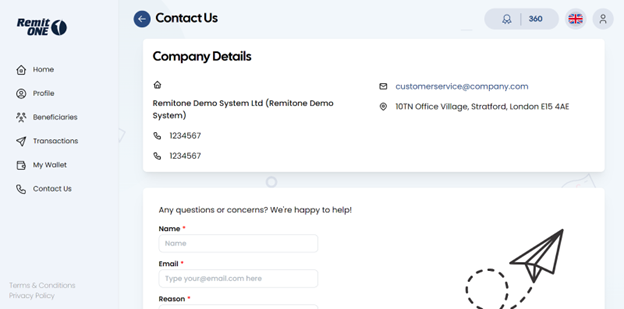

Easy Customer Support Access

Finally, we’ve reached the Contact Us page—an essential space where customers can reach out whenever they need support. It’s not just a lifeline for them, but also a valuable channel for you to stay informed about any issues and respond quickly.

At the top, customers will find your company’s contact details, with an enquiry form below as a convenient alternative for getting in touch.

Ready to impress your customers with a smarter, sleeker platform?

Our redesigned Online Platform and Mobile App aren’tjust better looking — they’re built to help you:

- Deliver a world-class experience

- Scale faster

- Work smarter

Book a demo today to explore the platform firsthand, get expert answers to your questions, and discover how to turn clicks into conversions — and customers into loyal fans.

How to Build a Leaner, Smarter Money Service Business in 2025

In an era of rapid regulatory change, rising customer expectations, and digital disruption, how can money service businesses (MSBs)—companies that facilitate the transfer, exchange, or payment of money—not only survive but thrive?

In our recent webinar, we gathered our top experts and unpacked the most pressing challenges facing MSBs today and shared proven strategies to help you scale, streamline compliance, and embrace innovation.

Here are the top takeaways:

1. Scale Smarter with our All-in-one Hub

A major pain point for MSBs is integrating with multiple systems and partners from send and payout providers to value-add services like ID verification platforms, open banking tools, and payment gateways.

RemitONE Hub™ solves this by offering two flexible options: connect via a single API or use our ready-made interface. Either way, you gain instant access to a global network of payment companies with the likes of Visa, Mastercard, Orange, MoneyGram, and many more.

With access to over 2.5 billion bank accounts and 3 billion wallets, the RemitONE Hub™ gives you the tools to scale without stress. You stay in control of your payouts, partner terms, and operations—all from one place.

We’ll help match you with the right partners based on your target corridors and budget to help meet your goals. What normally takes years, we help you achieve it in a few months.

2. Shortcut to Launch into New Corridors

Expanding to new corridors can feel like a maze of licences, banks, and paperwork. But it doesn’t have to be that way.

With our Remittance-as-a-Service (RaaS), you can plug into our network of licensed partners across the UK, EU—and soon, the US and Canada. That means you can go live faster, spend less upfront, and stay fully compliant—without going it alone

3. Stay Compliant with Compliance Manager™ (COM)

Compliance and fraud prevention remain top priorities for MSBs. Our Compliance Manager™ (COM) automates 80% of those repetitive manual checks, runs real-time KYC/AML screening across 350+ global sanctions lists, and helps you monitor risk scores, transaction patterns, and suspicious activity.

And it’s not just for MSBs. For central banks and regulators, COM offers live visibility into incoming and outgoing remittance flows—making it easier to track volumes accurately and close those reporting gaps.

In short? You stay compliant, catch fraud early, and get to focus on growing your business.

4. Reduce Costs and Settlement Delays with Open Banking

We know how frustrating slow settlements and high fees can be—especially when you’re trying to keep things efficient. That’s why we support open banking. You can tap into direct bank-to-bank payments, which means faster processing times, fewer card-related fees, and reduced friction that often comes with traditional payment methods. We’ve already rolled this out across the UK and Europe through our partners, and it’s making a real difference.

Even in countries without open banking, we provide alternative integrations with local processors.

5. Offer Multifunctional Wallets for the Future of Finance

Let’s be honest—digital wallets aren’t optional anymore. They’re a core part of how people move money today, and we’re making sure our clients are ready for that shift.

We support everything from peer-to-peer transfers, bill payments, airtime top-ups, prepaid cards, and wallet-to-wallet transactions. Whether your customers are paying for groceries, sending money to family, or topping up Netflix—we’ve got it covered.

We’ve also made sure our wallets connect to telcos, banks, and blockchain partners all with compliance built in from the get-go.

It’s all part of how we’re helping MSBs stay relevant, inclusive, and ready for whatever comes next.

6. Leverage a Flexible Platform Built for Growth

One recurring theme throughout the webinar: flexibility is key. Whether you’re a startup finding your footing, a licensed MTO looking to scale, a send or payout partner, a central bank, or a sub-account issuer like an e-money institution, your needs will keep evolving. That’s why we’ve built our platform to move with you. Our white-label solution adapts to your regulatory landscape, your operations, and your goals—without locking you into one way of working.

Because here’s the thing: if your platform isn’t flexible, you can’t adapt. And if you can’t adapt, you’ll get stuck—while your competitors sprint ahead.

Worse still, you’ll waste valuable time patching together workarounds instead of moving forward. We’ve seen it too many times, which is why we’ve made it our mission to keep things open, partner-friendly, and ready for what’s next.

Real growth happens when your platform moves with you—not against you.

Ready to Future-Proof Your Business?

The remittance and payments landscape is shifting fast, and the businesses that thrive are the ones that stay agile, compliant, and connected.

At RemitONE, we’re not just building software. We’re helping MSBs grow smarter, launch faster, and operate with confidence, no matter where you’re headed next.

If any of these challenges sound familiar, or if you’re curious about what’s possible with the right tech and support behind you, we’d love to talk.

Book a free consultation call with our expert consultant or drop us an email for any questions at: sales@remitone.com

Trump’s Threats to Cross-Border Payments: What It Means for Your Business

It’s been a short while since Trump stormed back into office, and he’s already shaken things up with his hard-hitting policies—and, as always, he’s not one to shy away from bold and upfront decisions. But with every action comes a ripple effect, and in the world of cross-border payments, those ripples are turning into shockwaves. From proposed remittance taxes to intensified compliance risks, Trump’s latest moves are shaking up how money flows in and out of America.

So, what does this mean for businesses, migrants, and economies relying on these payments? Let’s find out.

- Will Deportations of Migrants Impact Remittances? Here’s What the Data Says

Mexicans, a huge diaspora, and one of the major remittances senders in the US, but we may see stricter immigration policies putting this financial lifeline at risk. The “Remain in Mexico” program has already led to nearly 11,000 migrants being sent back, potentially reducing the number of workers in the U.S. and, with them, the flow of cross-border payments. Since Trump’s arrival, 23,000 arrests have been made and 18,000 deportations, whilst it has risen significantly compared to the Biden administration it still remains lower than the peak levels seen during the early crackdown of Trump’s first term.

So, what does this tell us? When Trump first took office, deportations surged as part of his hardline immigration stance. But over time, the wave slowed down. Now, despite his promise to deport 11 million people, the sheer complexity of the process appears to make that goal unlikely. In fact, this could even open a window for some undocumented migrants to secure legal status. But let’s say, hypothetically, mass deportations would happen—would remittances take a massive hit? Not necessarily. Many undocumented migrants are low-value remitters, meaning their contributions wouldn’t cause a drastic drop. What would shake remittance flows, though, is something much bigger: a tax on remittances.

- Will a Remittance Tax on US-Latin America Transfers Disrupt the Market?

The proposed 10% remittance tax from the US to Latin American regions is an effort to minimise illegal immigration but can cause a significant dent on transactions, impacting money transfer operators, banks, and other players in the payments ecosystem by reducing revenue and lowering demand in certain corridors.

For countries like Mexico, El Salvador, and Haiti—where remittances inject nearly $150 billion annually, this could be a devastating blow. Families who depend on these funds risk losing critical income, putting entire economies under strain.

If implemented, Money Service Businesses (MSBs) may have no choice but to raise fees, potentially driving customers toward alternative solutions like digital wallets and crypto. Interestingly, Trump seems to support crypto, so could this be the turning point that finally makes it more secure and mainstream?

- Trump and Stablecoins: A Game-Changer for Cross-Border Payments?

There’s hope on the horizon—Trump’s pro-stablecoin stance could be the catalyst to reshape cross-border payments. While Trump has halted any action to progress America’s CBDC, he’s taken more steps to advance the crypto movement. In a tweet, he unveiled the U.S. Crypto Strategic Reserve, which will include XRP, SOL, and ADA, with Bitcoin (BTC), Ethereum (ETH), and other key cryptocurrencies that will be added to “the heart of the Reserve.” Since the announcement, the value of the first three coins surged by 62%, while BTC and ETH have climbed up by 10%. This momentum is pushing forward Trump’s goal of making the U.S. the “crypto capital of the world.”

Two posts by Donald Trump on Sunday, March 3, 2025, on his Truth Social account.

So, what does this mean for remittances? Stablecoins offer faster, cheaper, and more accessibility, eliminating high fees and long processing times, making this a more attractive alternative to existing transfer methods to senders.

Of course, regulation follows. Trump’s administration has called for a federal regulatory framework for digital assets to bring clarity. If well executed, this could boost financial inclusion and drive crypto adoption, but if it becomes too strict, it can do the opposite, where it stifles innovation and progression.

- Crypto in Crisis: What’s shaking the market?

The cryptocurrency market took a plunge over the weekend, and while crypto is no stranger to volatility, this time the drop wasn’t just about digital assets—it was about politics, economics, and the shifting global financial landscape.

A major trigger was the Trump administration’s new tariff hikes on imports from Mexico and Canada, which sent investors retreating from risky assets like Bitcoin, creating a domino effect across the sector. Then there was the regulatory uncertainty. The U.S. government’s new restrictions on crypto exchanges and stablecoins fuelled distrust, prompting even more selloffs. On top of that, fresh inflation data and Trump’s aggressive trade policies led to a reassessment of potential Federal Reserve interest rate cuts, putting even more pressure on risky assets like crypto.

Ironically, part of the turmoil can be traced back to Trump’s own cryptocurrency summit on March 7. The announcement of a strategic bitcoin reserve—a government-controlled stash of digital assets initially caused Bitcoin’s price to drop by 6%. While the move signalled greater government involvement in crypto, it left many investors questioning what that would actually mean in practice. The market’s uncertainty around this policy likely contributed to the larger crash that followed.

- Stricter Compliance: A Roadblock for Remittances?

The designation of cartels as terrorist organisations, combined with tighter immigration policies, is set to intensify compliance pressures on MSBs. They must now exercise even greater due diligence to avoid any unintended links to sanctioned groups.

For migrants, this means longer wait times, extra fees, and fewer options to send money home. If traditional corridors start shutting down, people will have no choice but to look elsewhere, whether that’s the age-old hawala system or the rising use of crypto and stablecoins, a shift that could play right into Trump’s pro-digital currency agenda.

Whereas for giants like Western Union and MoneyGram, who move billions to Latin America, the stakes are high. Stricter AML (Anti-Money Laundering) and KYC (Know Your Customer) regulations will be unavoidable, but for some financial institutions, the risk might be too much. We’ve seen this play out before where banks pulled out of Somalia’s remittance corridors when terrorist groups gained traction, leaving thousands stranded without access to funds. Could Latin America perhaps face the same fate?

Keeping up with ever-changing regulations is more than just a headache—it’s a matter of survival. A single compliance slip-up can trigger heavy fines or, worse, force a business to shut its doors entirely. Yet, many companies still juggle multiple software tools, manually stitching together fragmented systems to stay compliant.

This approach isn’t just inefficient; it’s risky. When regulations shift overnight, you need a solution that evolves with them. That’s why we built an all-in-one platform with compliance at its core. Unlike other providers, we continuously adapt to market trends and regulatory changes, ensuring you aren’t left scrambling when new rules emerge.

Take our Liveness feature for example. With biometric-powered selfie checks, remitters can instantly confirm their identity—cutting fraud risks while keeping regulators satisfied. Plus, through our platform, regulators and central banks can track all inbound and outbound transactions, ensuring total transparency.

It’s this kind of innovation that makes compliance less of a burden and more of a competitive advantage.

So if you want to streamline your operations and power your growth, book a free demo with us and let’s discover how.

RemitONE Partners with Ding to Bring Global Mobile Top-Up Solutions to Its Platform

RemitONE, the leading global provider of money transfer technology, is proud to announce its partnership with Ding, the world’s leading mobile top-up specialist. This integration enables RemitONE clients to access 800+ mobile operators across 150+ countries, offering seamless solutions for mobile top-ups, bill payments, gift cards, and more—all through the RemitONE platform.

Why Ding?

With over 9 million customers and 65 million transactions annually, Ding is a trusted partner worldwide, enhancing remittance services by:

- Improving customer experience with fast, secure, and simple solutions.

- Meeting the growing demand for mobile and digital services.

- Delivering new revenue opportunities for service providers.

Introducing Ding Checkout

Ding recently launched Ding Checkout, a digital solution designed for effortless web and app integration. Industry leaders such as MoneyGram and Western Union already utilise Ding Checkout to elevate their service offerings and better serve their customers.

What This Partnership Means for You

Through this collaboration, RemitONE clients can now leverage Ding’s robust mobile and data top-up solutions—trusted by the world’s largest remittance firms—all fully integrated into the RemitONE platform.

Enhance Your Services Today

Take advantage of Ding’s innovative global solutions to elevate your offerings. Contact sales@remitone.com to learn more, and we’ll introduce you to the Ding team, who can guide you through accessing 800+ mobile operators worldwide.

About RemitONE

RemitONE is the leading provider of money transfer software solutions for banks, telcos, and money transfer operators (MTOs) worldwide. With multi-channel access, including agent networks, online, and mobile, RemitONE empowers organisations to streamline and scale their remittance operations.

About Ding

Ding is the world’s leading mobile top-up platform, connecting over 800 mobile operators across 150+ countries. With a focus on simplicity, security, and speed, Ding complements traditional remittance services with cutting-edge digital solutions. https://www.ding.com/

For enquiries, contact: sales@remitone.com

Unlock Faster, More Secure Payments with RemitONE’s Open Banking Solution

We’re excited to introduce the latest enhancement to our RemitONE Money Transfer Platform: the RemitONE Open Banking Solution. Competitively priced and designed to offer businesses a faster, more secure, and seamless payment experience, this powerful new feature ensures maximum value for our clients through advanced open banking capabilities.

Open banking is revolutionising the financial industry by allowing businesses to connect directly with their customers’ bank accounts to initiate payments. By bypassing intermediaries such as card networks, open banking delivers numerous benefits:

Key Benefits of the RemitONE Open Banking Solution:

- Faster Transactions: Payments are processed almost instantly, providing businesses with quicker access to funds and improving cash flow.

- Enhanced Security: Secure, direct payments minimise the risk of fraud and chargebacks, giving both businesses and customers peace of mind.

- Cost Efficiency: Open banking eliminates many fees associated with traditional card payments, making it a cost-effective option for businesses of all sizes.

- Streamlined Customer Experience: Customers can authorise payments through their mobile banking apps, ensuring a smooth and frictionless checkout process.

Our RemitONE Open Banking Solution, powered by RemitONE’s award-winning technology, seamlessly integrates into the RemitONE Money Transfer Platform. This plug-and-play solution allows clients to quickly enable open banking without the need for complex technical integrations.

This enhancement underscores RemitONE’s commitment to staying at the forefront of payment innovation, equipping our clients to thrive in a rapidly evolving digital economy.

Get Started Today

Take advantage of this feature to unlock the full potential of open banking for your business. Book an exploratory call today using the link below to learn how you can implement this solution and deliver a superior payment experience to your customers!

How to Expand Your SEND Operations in the UK and Europe—Without the Regulatory Hassle

The remittance market in Europe is valued at €133.7 billion annually, with the UK market contributing an additional £23 billion. With over 27 million non-EU citizens in Europe and 10 million migrants in the UK, the potential for businesses to tap into these markets is immense. World Bank Open Data

However, expanding SEND operations across these regions can be a complex and costly process, with significant regulatory hurdles and the need for local bank accounts. RemitONE RaaS (Remittance-as-a-Service) eliminates these challenges by offering a simplified, plug-and-play solution that enables businesses to quickly and efficiently launch and expand their remittance services in the UK and Europe—without the regulatory headaches. With RemitONE, you can fast-track your market entry and scale your operations in just a few weeks, bypassing the complexities of obtaining local regulatory licenses or setting up bank accounts, that can take 12-24 months.

This solution is ideal for fintechs, money transfer operators (MTOs), banks, and other financial service providers looking to monetise cross-border payment corridors, expand their offerings without the burden of complex compliance requirements and launch operations rapidly.

The key benefits of RemitONE RaaS include:

- Cost Efficiency: Significantly reduce upfront costs by eliminating regulatory licenses, bank fees, and administrative expenses.

- Ease of Operation: Simplify your operations by consolidating all remittance functions into one platform, eliminating the need for multiple providers or contracts.

- Market Expansion: Enter over 180 payout countries quickly and tap into new cross-border payment corridors, building brand recognition among diaspora communities.

- Revenue Opportunities: Monetise every transaction with minimal operational overhead, while expanding into new markets without the cost of infrastructure.

With RemitONE RaaS, you can effortlessly expand your SEND operations in the UK and Europe, without the traditional regulatory barriers. To find out how RemitONE can support your business growth, book an exploratory call today using the link below.

The Top 5 Cross-Border Payment Trends That Shaped 2024

What a year it’s been for the world of payments! From breakthroughs in tech to surprising shifts in consumer behaviour, 2024 has kept us on our toes. Whether it’s the ways we send money, secure transactions, or even think about digital currencies, this year has been nothing short of transformative. But what were the key trends that stood out and reshaped the landscape? Let’s dive in and explore the innovations that made waves—and will set the stage of what’s to come.

- AI and Biometric Verification in Payments: The Future of Secure Payments

As fraudsters get more sophisticated, the payments industry is fighting back with AI and biometrics, creating a formidable defence for identity verification. According to PYMNTS Intelligence, 51% of global users now rely on biometrics to verify online payments—proof that this technology is becoming a trusted norm. But its influence stretches beyond payments; biometric systems are also making waves in airports, stadiums, and event venues.

Biometrics is even transforming the remittance sector. By simplifying onboarding and checkout, it ensures faster, more secure cross-border transactions while reducing friction—a win for users and compliance alike. In Vietnam, for example, embedding biometric verification led to a remarkable 72% drop in fraud-related accounts. As digital apps become the preferred method for money transfers, biometric verification seamlessly complements the transition to smooth, app-based experiences.

Advanced biometric systems are integrating features like liveness detection (to prevent spoofing). This is why we have been proactive and introduced earlier in the year our RemitONE Liveness Feature™, which uses liveness testing and facial biometrics to detect fraud, like deepfakes or silicone masks when scanning faces. It ensures biometric data is from a real, physically present person. Integrating it into your onboarding process reduces financial risks and safeguards your company’s reputation.

To activate this feature, reach out to us at sales@remitone.com.

- Real-time payments: The Fast Lane Keeps Getting Faster

In 2024, the demand for instant, hassle-free transactions kept real-time payments (RTP) on a steep growth curve. Thanks to advances in open banking and cloud tech, payment systems have become faster, safer, and more user-friendly than ever.

Just last month in the U.S., RTP set a jaw-dropping record with 1.46 million transactions in a single day. Globally, India remains the frontrunner, clocking 130 billion RTP transactions in 2023. And the momentum shows no signs of slowing down—according to ACI Worldwide, RTP is projected to grow by $285.8 billion and bring over 167 million more people into the banking ecosystem by 2028.

The story doesn’t end there. Developing economies are doubling down on mobile-first approaches, boosted by smartphone adoption and supportive regulations, creating the perfect storm for RTP expansion. But with great speed comes greater risk—fraudsters are evolving too. In response, AI-powered security tools are stepping up, delivering real-time fraud detection and prevention to keep transactions safe.

Real-time payments are reshaping the financial landscape, and if 2024 is any indication, the future is all about immediacy, security, and inclusivity.

- Collaborations & Partnerships: Driving innovation

In 2024, the cross-border payments space thrived on groundbreaking collaborations, each aiming to make global money transfers faster, easier, and more inclusive. Here’s a snapshot of some standout partnerships:

- Visa and Revolut: These two giants teamed up to launch Instant Card Transfers, offering real-time payments in over 78 countries. With just a card number, users can now send money globally at reduced fees and lightning speed. This move is a game-changer, especially for small businesses and freelancers managing international payments.

- Tarabut Acquires Vyne: MENA-based Tarabut acquired UK’s Vyne to supercharge its account-to-account (A2A) payments. This step aligns perfectly with regulatory shifts in Saudi Arabia and the UAE, simplifying cross-border payments for both businesses and consumers in the region.

- Mastercard and Equity Bank: Strengthening ties with Equity Bank, Mastercard enabled seamless cross-border transfers to over 30 countries across Kenya and Sub-Saharan Africa. By removing landing fees and ensuring recipients receive full-value remittances, this partnership addresses affordability and accessibility for underserved markets.

- Nium and Kinexys: Nium and Kinexys (powered by J.P. Morgan), have taken their partnership to the next level, making international payments to Malaysia, Thailand, and Hong Kong smoother than ever. By validating bank account information in real time, they’re tackling failed payment errors head-on.

No business thrives in isolation—collaboration is often the key to unlocking new opportunities and driving innovation. By working together, businesses can combine strengths. But let’s face it, finding the right partners can be a challenge, which is why we provide the RemitONE Hub™, where we can connect you with our trusted network of MTOs, banks, telcos, and payment gateways to elevate your business.

Whether you’re looking to enhance your operations or break into new markets, collaboration is the way forward. So, if you’re interested in discovering our network then just send us a quick email at sales@remitone.com.

- CBDCs: Are we getting there?

Central Bank Digital Currencies (CBDCs) saw significant momentum globally, with 134 countries, representing 98% of global GDP, exploring their potential. Among the 44 active pilot projects, China’s digital yuan (e-CNY) stood out, processing transactions worth $986 billion this year, up from $253 billion in 2023. Projects such as mBridge—a cross-border CBDC initiative involving Saudi Arabia, UAE, Thailand, and China (including Hong Kong)—highlight growing efforts to enhance international financial systems.

Frontrunners like Nigeria, Jamaica, and the Bahamas focused on expanding their retail CBDCs to improve financial inclusion, although adoption remains slow. Meanwhile, in the West, the U.S. joined global pilots like Project Agorá, and the EU made strides with its digital euro initiative, both addressing key regulatory and interoperability challenges.

As we head into 2025, the spotlight will be on whether CBDCs can overcome hurdles like privacy concerns, cybersecurity risks, and geopolitical rivalries to deliver their promise of reshaping global finance.

- Countries embracing Cryptocurrency and Blockchain

The adoption of Blockchain and cryptocurrency soared this year, with many countries taking bold steps toward integrating these technologies into their economies. A report from TripleA revealed that over 560 million people worldwide now own cryptocurrency, marking a 34% increase from the previous year. ChainAnalysis findings found India, Indonesia, and Vietnam led the charge, driven by the growing need for financial inclusion, particularly in areas with high inflation or currency instability.

One of the standout developments is the growing trend of integrating blockchain with AI and privacy-enhancing tools like zero-knowledge proofs, which aim to make blockchain interactions more secure and confidential. This combination is increasing confidence in decentralised systems, making them more attractive to both businesses and governments. For instance, the UAE continues to lead with projects like the Dubai Blockchain Strategy, aiming to make the city fully blockchain-powered. They’ve already achieved significant milestones by migrating all applicable government transactions to the blockchain platform, enhancing transparency and reducing bureaucracy.

Other countries in Central and Southern Asia, like Indonesia and the Philippines, are also embracing crypto, with growing merchant services and DeFi applications. This grassroots adoption, particularly in lower-middle-income (LMI) nations, shows how crypto is helping bridge financial gaps for millions.

The trend is expected to continue upward, with further integration of blockchain into national economies and the rise of regulatory clarity. Many countries are now adjusting their frameworks to better accommodate crypto use while mitigating risks. The European Union’s MiCA regulation, for example, is paving the way for more institutional involvement. Expect to see more countries adopting blockchain for government-backed digital currencies and public services, while stablecoins remain crucial in regions like Sub-Saharan Africa for remittances and payments.

This year has proven to be a milestone year in the evolution of the payments landscape. As we prepare for the challenges and opportunities of the future, one thing is clear innovation will continue to be the driving force behind progress in payments and finance. With tools like our biometric liveness feature and a global network to tap into, we’re here to help you innovate, expand, and stay secure.

Ready to elevate your game? Get in touch with us at sales@remitone.com to learn how our solutions can help you stay ahead in this fast-evolving landscape.