New White-Label Online Platform: Redesigned to Scale Customer Loyalty and Growth

Add powerful money transfer capabilities to your website — without the complexity.

Our new Online Remittance Manager (ORM) is a fully white-label web application that lets your customers send money securely and easily — all under your brand, without leaving your site.

Built on a foundation of powerful features, now enhanced with a seamless new design.

Your brand will sit proudly on a modern, intuitive platform that makes sending money simple — helping you build loyalty and drive growth.

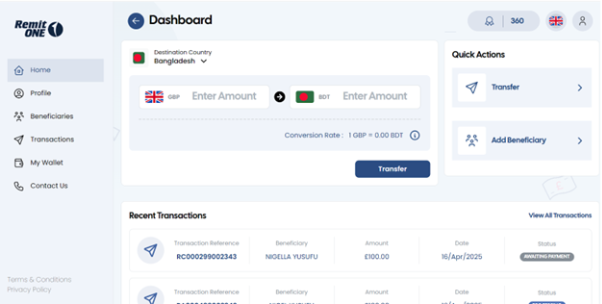

Instant, Simple Money Transfers

From the moment customers log in, they see what matters most: Send Money.

Quick Actions let them add beneficiaries without hunting through menus.

Recent transactions are easy to review at a glance.

Navigation is streamlined on the left-hand side for effortless access.

How much time could your customers save with this design?

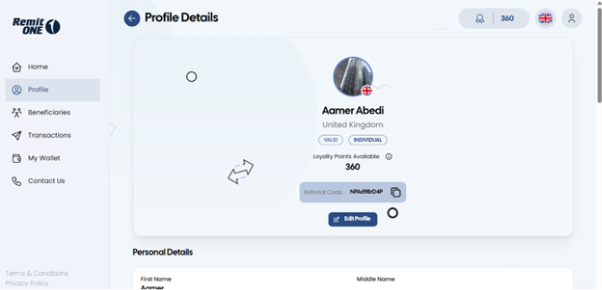

Enhanced Customer Profiles for Better Insights

The Profile section now gives a richer overview of each customer—helping you serve them better. Instantly see key details like available discount codes, submitted ID proofs, and whether they’ve completed their KYC checks—all in one place.

What would better visibility mean for your client relationships?

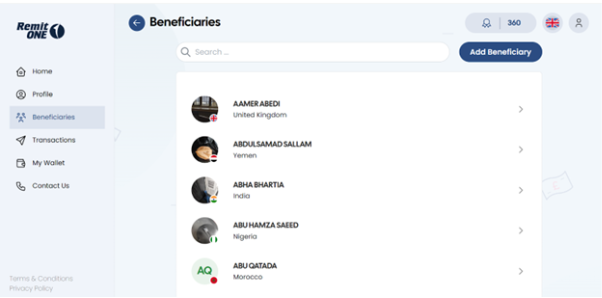

Quick Access to Saved Beneficiaries

The Beneficiaries section lists all saved contacts alphabetically, so customers can quickly find who they’re looking for. With the built-in search, there’s no need to scroll endlessly—just type, find, and send in seconds.

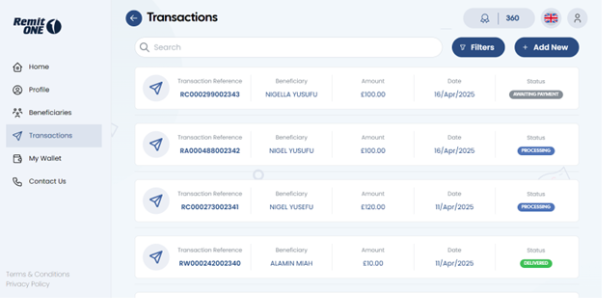

Detailed Transaction History with Smart Filters

Customers see every transfer in a clean timeline. Clicking on any transaction reveals a full breakdown—including fees, status, and more.

Smart filters make finding specific transactions easy: By date, type, or status.

And with the “Add New” button, they can jump straight into sending money again, with no backtracking needed.

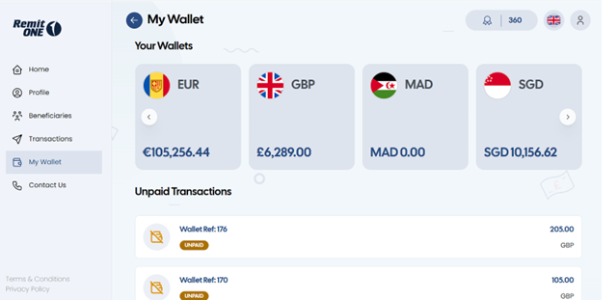

Multi-Currency Wallets Made Easy

The My Wallet section displays all the wallets your customer holds across different regions, along with the balance in each one. The left and right toggle arrows offer a smooth way to scroll through the full list—making it easy to manage multiple wallets without overwhelming the screen. It’s a user-friendly experience that keeps everything organised and accessible.

Below, customers can also view a history of unpaid transactions, so nothing slips through.

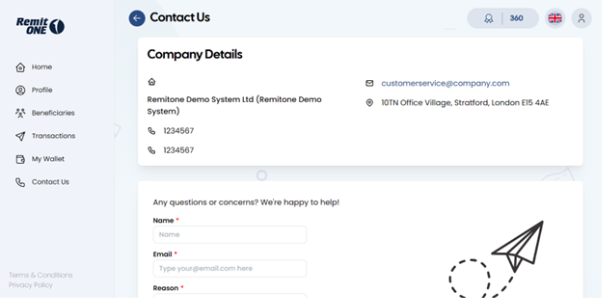

Easy Customer Support Access

Finally, we’ve reached the Contact Us page—an essential space where customers can reach out whenever they need support. It’s not just a lifeline for them, but also a valuable channel for you to stay informed about any issues and respond quickly.

At the top, customers will find your company’s contact details, with an enquiry form below as a convenient alternative for getting in touch.

Ready to impress your customers with a smarter, sleeker platform?

Our redesigned Online Platform and Mobile App aren’tjust better looking — they’re built to help you:

- Deliver a world-class experience

- Scale faster

- Work smarter

Book a demo today to explore the platform firsthand, get expert answers to your questions, and discover how to turn clicks into conversions — and customers into loyal fans.

How to Expand Your SEND Operations in the UK and Europe—Without the Regulatory Hassle

The remittance market in Europe is valued at €133.7 billion annually, with the UK market contributing an additional £23 billion. With over 27 million non-EU citizens in Europe and 10 million migrants in the UK, the potential for businesses to tap into these markets is immense. World Bank Open Data

However, expanding SEND operations across these regions can be a complex and costly process, with significant regulatory hurdles and the need for local bank accounts. RemitONE RaaS (Remittance-as-a-Service) eliminates these challenges by offering a simplified, plug-and-play solution that enables businesses to quickly and efficiently launch and expand their remittance services in the UK and Europe—without the regulatory headaches. With RemitONE, you can fast-track your market entry and scale your operations in just a few weeks, bypassing the complexities of obtaining local regulatory licenses or setting up bank accounts, that can take 12-24 months.

This solution is ideal for fintechs, money transfer operators (MTOs), banks, and other financial service providers looking to monetise cross-border payment corridors, expand their offerings without the burden of complex compliance requirements and launch operations rapidly.

The key benefits of RemitONE RaaS include:

- Cost Efficiency: Significantly reduce upfront costs by eliminating regulatory licenses, bank fees, and administrative expenses.

- Ease of Operation: Simplify your operations by consolidating all remittance functions into one platform, eliminating the need for multiple providers or contracts.

- Market Expansion: Enter over 180 payout countries quickly and tap into new cross-border payment corridors, building brand recognition among diaspora communities.

- Revenue Opportunities: Monetise every transaction with minimal operational overhead, while expanding into new markets without the cost of infrastructure.

With RemitONE RaaS, you can effortlessly expand your SEND operations in the UK and Europe, without the traditional regulatory barriers. To find out how RemitONE can support your business growth, book an exploratory call today using the link below.