AI Agents in Cross-Border Payments: What They Mean for Money Service Businesses

AI in cross-border payments is moving past chatbots and predictive tools. The real leap is AI agents – systems that can perform tasks end-to-end, much like a human operator. For money service businesses (MSBs), this shift opens a path to automation that was once unthinkable.

From Chatbots to AI Agents

Chatbots are reactive. They answer queries, provide FAQs, and make customer service more efficient. Useful, yes — but limited.

AI agents, however, are proactive digital workers. They don’t just respond, they execute.

An AI agent in payments could:

- Verify documents and check expiry dates

- Screen payments against sanction lists

- Flag missing or suspicious details

- Update records across multiple systems

- Trigger transactions once all conditions are met

These aren’t futuristic ideas. They’re already happening.

Real-World Adoption

Western Union has tested AI to cut back-office workloads. Goldman Sachs is exploring AI for regulatory checks. Other financial institutions are quietly building pilot projects.

This tells us one thing: AI agents are no longer theory. They’re moving into real operations.

For MSBs, this isn’t just about efficiency. It’s about survival. Manual processes eat into margins, slow down customer onboarding, and create bottlenecks. AI agents reduce costs, free up staff, and scale seamlessly.

👉 Explore how RemitONE’s AI solutions automate compliance and onboarding.

What This Means for MSBs

Smaller providers often compete on agility. But manual compliance checks, document verification, and routine approvals limit that agility.

AI agents can take on these repetitive but critical tasks — giving MSBs the bandwidth to grow without doubling headcount.

Examples:

- Onboarding new customers in minutes, not hours.

- Running compliance checks automatically in the background.

- Reducing transaction delays caused by missing data.

By adopting early, MSBs can compete with larger players on speed and scale.

Where to Start

Going “all in” on AI across every process is risky. The smarter approach is targeted integration. Start with repetitive, rule-based workflows where an AI agent can show immediate value.

High-value starting points:

- Document verification

- Sanctions screening

- Customer onboarding

Once proven, these workflows can be expanded to cover more complex tasks.

👉 See how RemitONE’s AI bolt-ons integrate with existing systems.

The Takeaway

AI agents won’t replace people. They’ll supplement teams, taking on the heavy lifting so humans can focus on strategy and judgement.

For MSBs, the choice is clear: either automate now and scale, or risk falling behind as competitors adopt AI-driven processes.

Ready to cut compliance workloads and scale faster?

Book a free strategy call to see how AI bolt-ons can fit your operations.

Episode 2: How to Start a Money Transfer Business – A Practical Guide for Founders | The IPR Podcast

The global cross-border payments industry continues to evolve, presenting new opportunities for remittance startups and financial institutions. But what does it really take to launch or expand a money transfer business in today’s landscape shaped by complex regulations, rising compliance expectations, and rapidly advancing technology?

In Episode 2 of The IPR Podcast RemitONE’s CMO Aamer Abedi sits down with Oussama Kseibati, Head of Business Solutions, to provide a clear, actionable roadmap for anyone looking to enter the cross-border payments space. Drawing from over 15 years of industry experience, Oussama outlines a five-step framework that founders can follow to build a compliant, scalable, and competitive Money Service Business (MSB).

Whether you’re launching from scratch or expanding into a new region, this episode offers foundational guidance to help you navigate the journey.

Understanding the Five Core Steps

Step 1: Research, Market Fit, and Business Planning

Every successful business begins with research. In the case of remittances, this means understanding your target corridors, your competition, your potential client base, and the unique value you aim to deliver. Oussama recommends starting small, focusing on one or two corridors you’re familiar with, perhaps tied to your own community or existing business network. This strategic focus allows you to manage cash flow, compliance, and relationships more efficiently before gradually expanding to new regions or services.

A well-structured business plan plays a key role in setting up for success. It should include realistic forecasting, cost structures, and clearly defined revenue streams, particularly understanding how FX margins and payout partnerships will contribute to your profit.

Step 2: Software That Meets Regulatory Needs

Technology is at the heart of modern money service businesses. From onboarding and identity verification to compliance screening and transaction processing, a reliable software infrastructure is essential. A robust platform should not only support regulatory needs (e.g. OFAC, UN, MAS, and HM Treasury checks) but also provide a seamless user experience for customers.

Oussama points out that choosing the right software provider can also give founders access to built-in integrations with payout partners, payment gateways, and compliance tools. Opting for an end-to-end platform such as RemitONE can reduce development time, streamline operations, and help ensure your system is aligned with regulatory requirements from day one.

Step 3: Apply for the Appropriate Licence

Depending on your jurisdiction and the nature of your services, you’ll need to apply for a financial licence, commonly known as an EMI (Electronic Money Institution) licence in the UK/EU, or equivalent.

Founders should consider their service model carefully:

- Do you intend to hold client funds in wallets?

- Are your transaction volumes expected to grow rapidly?

- Will you operate in a single country or multiple regions?

For many, a Small Payment Institution (SPI) licence offers a more accessible entry point. It allows you to operate legally while building up transaction history and operational credibility, which can later support applications for higher-tier licences like API or EMI.

Step 4: Secure a Client Bank Account

Opening a bank account for safeguarding client funds can be one of the more challenging steps, especially in regions where traditional banks view remittance providers as high-risk. This has led to a wave of “de-risking,” where financial institutions have withdrawn services from MSBs altogether.

However, there are solutions. Letters of intent from banks, demonstrating willingness to provide an account once licensed, can support your application with regulators. Additionally, new digital-first banks and fintech-focused institutions are becoming more open to MSB clients, especially those operating with transparency and good controls in place.

The client account ensures that funds remain protected until the transaction is completed, adding an extra layer of security for both regulators and customers.

Step 5: Partner with Reliable Payout Networks

Once you’ve established your business model, tech infrastructure, and licence, you’ll need to connect with payout partners such as banks, MTOs, or telcos in the payout country, who will complete the final end of the transaction.

Payout partners are critical for determining your transaction fees, exchange rates, and service reliability. In the early stages, pre-funding is common, meaning you’ll need to deposit funds in advance with these partners to enable instant payouts.

Here too, a well-connected technology provider can simplify the process by offering access to pre-integrated partners or facilitating introductions to established networks.

The Role of End-to-End Platforms in Supporting MSBs

Remittance businesses today require more than just a digital interface. A complete solution should connect every part of the remittance chain—from onboarding and KYC to payment gateways, FX providers, compliance systems, and settlement tools.

RemitONE’s platform, for example, supports founders throughout this journey by offering tools for transaction monitoring, sanctions screening, automated compliance, and built-in integrations with various payment partners. The goal is to give new entrants the ability to launch quickly, scale with confidence, and maintain compliance across jurisdictions.

Watch the full podcast for the complete insights and strategies.

YouTube: https://youtu.be/2GChfkdhaMg?si=aWj4NuQvRXl9Ly7W

Spotify: https://open.spotify.com/episode/3dAbpgiDWyKklj3Guteo2F?si=569b6d23ade94344

Apple Podcasts: https://podcasts.apple.com/us/podcast/how-to-start-a-money-transfer-business/id1822769031?i=1000718661978

If you’re exploring the possibility of launching your own MSB or expanding into new corridors, speak to one of our consultants. Book a free session here: https://calendly.com/remitone-oussama/free-30min-consultation-website

For questions or guidance, reach out to sales@remitone.com.

Meet RemitONE team in Riyadh, Saudi Arabia: Unlock AI-powered growth

We’re heading to the Money20/20 event in Saudi Arabia to connect with ambitious businesses looking to scale. Aamer Abedi, our CMO, Oussama Kseibati, Head of Business Solutions, along with our partner Anwar Al Murshed from DTCC, will be in Riyadh 15th – 19th, September to explore cross-border payment opportunities with our AI, open banking and blockchain solutions.

Whether you’re expanding into sending markets like the UK and Europe or navigating complex compliance demands, our AI-powered solution can help you grow and unlock new revenue.

We provide the building blocks to future-proof your operations, even if remittances aren’t your core offering, with tools such as:

- Automated KYC/AML

- Scalable payout infrastructure to new sending markets

- Value-added services including airtime, top-ups and utility bill payments

To arrange a place and time, please email us at: marketing@remitone.com

About RemitONE

RemitONE is an award-winning, leading provider of money transfer software solutions for banks, telcos, and money transfer operators (MTOs) worldwide. With multi-channel access, including agent networks, online, and mobile, RemitONE empowers organisations to streamline and scale their remittance operations.

Power Up Your Platform: The Top RemitONE Features Driving Our Clients’ Success

What if the growth you’re chasing is already built into your system?

If you’re using the RemitONE Money Transfer Platform, we want to make sure you’re getting the most out of it to unlock its full potential.

Packed into your platform are powerful tools designed to boost transactions, build loyalty, reduce risk, and help you move faster. But if you’re not fully unlocking them, you’re missing opportunities.

Today, we’ll be sharing our clients features that consistently drive results and keep them ahead of the curve.

Let’s show you what’s possible.

Loyalty Manager: Keep Customers Coming Back

If you’re looking to boost retention and give your remitters a reason to keep choosing you—this is the feature to activate.

Loyalty Manager™ turns every transaction into an opportunity to reward your remitters. With this popular feature, your customers earn loyalty points every time they send money or refer a friend. These points can be redeemed to reduce transaction fees, which means every transfer becomes more affordable and more rewarding for them.

What makes it especially powerful is how customisable it is. You can set your own rules on how points are earned, based on what makes sense for your business, whether that’s based on transaction frequency, corridors, or even new customer referrals.

And when combined with Promotions Manager™, your customers can unlock even more by using loyalty points and promotions in a single transaction. The result? Greater satisfaction, higher engagement, and stronger brand loyalty.

Promotions Manager™: Smart Offers, More Transfers

If you’re running a money transfer business, you know that generic discounts don’t cut it. You need offers that actually move the needle — increasing transaction volumes, encouraging repeat usage, and giving customers a reason to stick with you.

That’s exactly what Promotions Manager™ is built for.

This feature puts you in full control, allowing you to set up intelligent, rule-based promotions that are targeted, timely, and effective. Whether it’s a festive seasonal discount for specific corridors, a reward for frequent senders, or a special deal for partners, this feature helps you craft promotions that match your business goals and your audience’s behaviour.

- Target smarter: Choose who sees your promotions based on corridors, transaction history, or user type.

- Incentivise more sends: Set up thresholds like “send 3 times, get a discount” to increase transaction frequency.

- Run timely offers: Activate short-term promos for holidays, local events, or marketing pushes.

- Maximise ROI: Avoid blanket discounts and focus on what works, boosting transactions without wasting budget.

It’s not just about discounts; it’s about strategy. Promotions Manager™ helps you reward the right behaviour, at the right time, with the right offer, building stronger customer loyalty and driving more transactions.

Risk Manager™ : Spot Risks Before They Become Problems

Risk is everywhere when you’re moving money across borders, but staying compliant doesn’t have to mean slowing down your operations or manually digging through data.

What clients love about our Risk Manager™ is it doesn’t just flag risks — it thinks ahead.

It gives you a dynamic, real-time view of who your riskiest customers are based on what they actually do — not just who they say they are. From sending to high-risk regions to sudden spikes in transaction volumes, our dynamic risk scoring system tracks behaviour patterns, adapts in real-time, and assigns weighted risk scores to both remitters and beneficiaries. The result? You can spot red flags early, act fast, and stay ahead.

It’s not just for compliance teams either, the Risk Score Rules Engine lets you set custom rules that reflect your business needs. And with detailed audit trails and downloadable reports, you’ll always be ready when the regulator comes knocking.

If you’re already juggling tight regulations and evolving risks, then it might be time to activate Risk Manager™ and make your life a whole lot easier.

Maker Checker: Double Verification for Safer Transfers

Mistakes in money transfers can cost more than just time; they can damage trust. Maker Checker adds a second layer of control to your operations by requiring one team member to create a transaction, and another to verify it. It’s a simple way to reduce errors, prevent fraud, and keep your financial processes rock solid and secure.

Built for compliance, peace of mind, and flawless execution.

Get more out of RemitONE — with hands-on expert support

Sometimes the real game-changer isn’t a new feature, it’s having someone by your side who knows your system and understands your goals to help you move faster.

That’s exactly what our Technical Customer Success (TCS) offers. It’s a personalised support experience built for teams who want to go further with RemitONE. You’ll have direct access to a dedicated Technical Customer Success Manager who becomes an extension of your team, someone who already understands your setup and can help you troubleshoot issues faster, scale with confidence, and get more out of the platform.

Whether it’s navigating technical challenges, implementing new features, or simply having a regular sounding board for improvements, TCS is designed to make your day-to-day easier and more effective. You’ll spend less time stuck in queues and more time getting things done.

It’s a flexible service shaped around your workflow, from quick weekly catch-ups to in-depth strategy calls. Whatever your rhythm, we’ll match it, so your team can keep moving.

Let’s take some weight off your shoulders and help unlock your full potential.

You’re sitting on the growth your competitors are already using.

These tools aren’t “nice-to-haves” they’re how leading money service businesses (MSBs) are pulling ahead. More transactions. More loyalty. More support.

If you’re already using RemitONE, it’s time to unlock the full power of your platform.

And if you’re not with us yet? Then let’s show you what’s possible.

Book a free demo and see how the world’s leading MSBs use our platform to grow every single day.

New White-Label Online Platform: Redesigned to Scale Customer Loyalty and Growth

Add powerful money transfer capabilities to your website — without the complexity.

Our new Online Remittance Manager (ORM) is a fully white-label web application that lets your customers send money securely and easily — all under your brand, without leaving your site.

Built on a foundation of powerful features, now enhanced with a seamless new design.

Your brand will sit proudly on a modern, intuitive platform that makes sending money simple — helping you build loyalty and drive growth.

Instant, Simple Money Transfers

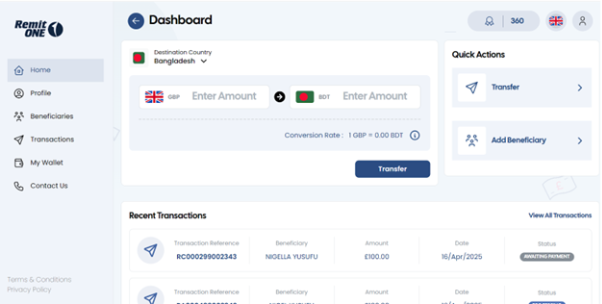

From the moment customers log in, they see what matters most: Send Money.

Quick Actions let them add beneficiaries without hunting through menus.

Recent transactions are easy to review at a glance.

Navigation is streamlined on the left-hand side for effortless access.

How much time could your customers save with this design?

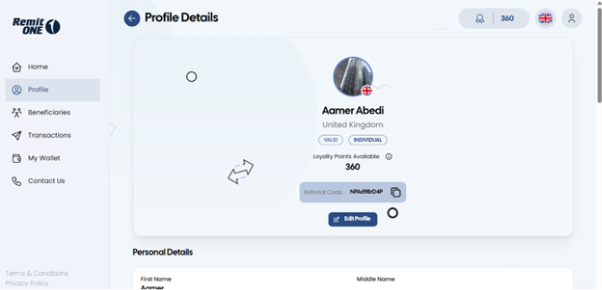

Enhanced Customer Profiles for Better Insights

The Profile section now gives a richer overview of each customer—helping you serve them better. Instantly see key details like available discount codes, submitted ID proofs, and whether they’ve completed their KYC checks—all in one place.

What would better visibility mean for your client relationships?

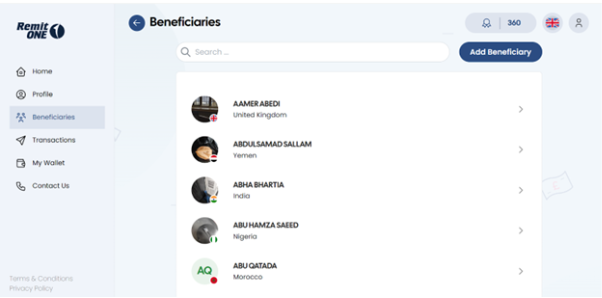

Quick Access to Saved Beneficiaries

The Beneficiaries section lists all saved contacts alphabetically, so customers can quickly find who they’re looking for. With the built-in search, there’s no need to scroll endlessly—just type, find, and send in seconds.

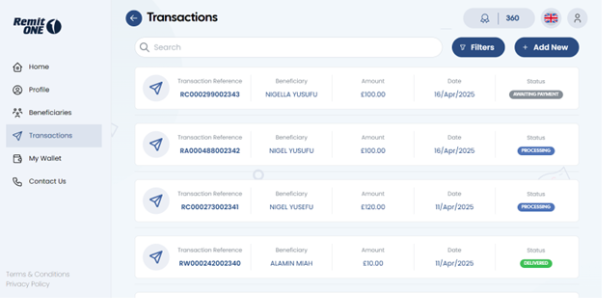

Detailed Transaction History with Smart Filters

Customers see every transfer in a clean timeline. Clicking on any transaction reveals a full breakdown—including fees, status, and more.

Smart filters make finding specific transactions easy: By date, type, or status.

And with the “Add New” button, they can jump straight into sending money again, with no backtracking needed.

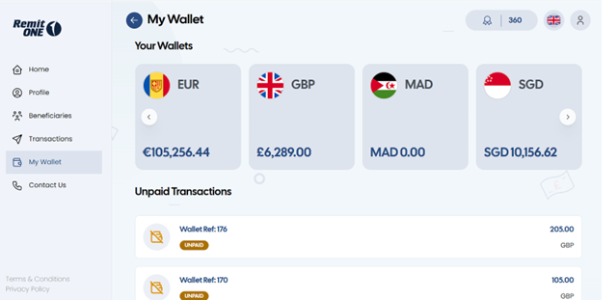

Multi-Currency Wallets Made Easy

The My Wallet section displays all the wallets your customer holds across different regions, along with the balance in each one. The left and right toggle arrows offer a smooth way to scroll through the full list—making it easy to manage multiple wallets without overwhelming the screen. It’s a user-friendly experience that keeps everything organised and accessible.

Below, customers can also view a history of unpaid transactions, so nothing slips through.

Easy Customer Support Access

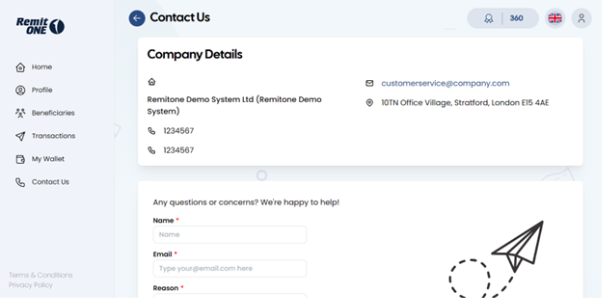

Finally, we’ve reached the Contact Us page—an essential space where customers can reach out whenever they need support. It’s not just a lifeline for them, but also a valuable channel for you to stay informed about any issues and respond quickly.

At the top, customers will find your company’s contact details, with an enquiry form below as a convenient alternative for getting in touch.

Ready to impress your customers with a smarter, sleeker platform?

Our redesigned Online Platform and Mobile App aren’tjust better looking — they’re built to help you:

- Deliver a world-class experience

- Scale faster

- Work smarter

Book a demo today to explore the platform firsthand, get expert answers to your questions, and discover how to turn clicks into conversions — and customers into loyal fans.

How to Build a Leaner, Smarter Money Service Business in 2025

In an era of rapid regulatory change, rising customer expectations, and digital disruption, how can money service businesses (MSBs)—companies that facilitate the transfer, exchange, or payment of money—not only survive but thrive?

In our recent webinar, we gathered our top experts and unpacked the most pressing challenges facing MSBs today and shared proven strategies to help you scale, streamline compliance, and embrace innovation.

Here are the top takeaways:

1. Scale Smarter with our All-in-one Hub

A major pain point for MSBs is integrating with multiple systems and partners from send and payout providers to value-add services like ID verification platforms, open banking tools, and payment gateways.

RemitONE Hub™ solves this by offering two flexible options: connect via a single API or use our ready-made interface. Either way, you gain instant access to a global network of payment companies with the likes of Visa, Mastercard, Orange, MoneyGram, and many more.

With access to over 2.5 billion bank accounts and 3 billion wallets, the RemitONE Hub™ gives you the tools to scale without stress. You stay in control of your payouts, partner terms, and operations—all from one place.

We’ll help match you with the right partners based on your target corridors and budget to help meet your goals. What normally takes years, we help you achieve it in a few months.

2. Shortcut to Launch into New Corridors

Expanding to new corridors can feel like a maze of licences, banks, and paperwork. But it doesn’t have to be that way.

With our Remittance-as-a-Service (RaaS), you can plug into our network of licensed partners across the UK, EU—and soon, the US and Canada. That means you can go live faster, spend less upfront, and stay fully compliant—without going it alone

3. Stay Compliant with Compliance Manager™ (COM)

Compliance and fraud prevention remain top priorities for MSBs. Our Compliance Manager™ (COM) automates 80% of those repetitive manual checks, runs real-time KYC/AML screening across 350+ global sanctions lists, and helps you monitor risk scores, transaction patterns, and suspicious activity.

And it’s not just for MSBs. For central banks and regulators, COM offers live visibility into incoming and outgoing remittance flows—making it easier to track volumes accurately and close those reporting gaps.

In short? You stay compliant, catch fraud early, and get to focus on growing your business.

4. Reduce Costs and Settlement Delays with Open Banking

We know how frustrating slow settlements and high fees can be—especially when you’re trying to keep things efficient. That’s why we support open banking. You can tap into direct bank-to-bank payments, which means faster processing times, fewer card-related fees, and reduced friction that often comes with traditional payment methods. We’ve already rolled this out across the UK and Europe through our partners, and it’s making a real difference.

Even in countries without open banking, we provide alternative integrations with local processors.

5. Offer Multifunctional Wallets for the Future of Finance

Let’s be honest—digital wallets aren’t optional anymore. They’re a core part of how people move money today, and we’re making sure our clients are ready for that shift.

We support everything from peer-to-peer transfers, bill payments, airtime top-ups, prepaid cards, and wallet-to-wallet transactions. Whether your customers are paying for groceries, sending money to family, or topping up Netflix—we’ve got it covered.

We’ve also made sure our wallets connect to telcos, banks, and blockchain partners all with compliance built in from the get-go.

It’s all part of how we’re helping MSBs stay relevant, inclusive, and ready for whatever comes next.

6. Leverage a Flexible Platform Built for Growth

One recurring theme throughout the webinar: flexibility is key. Whether you’re a startup finding your footing, a licensed MTO looking to scale, a send or payout partner, a central bank, or a sub-account issuer like an e-money institution, your needs will keep evolving. That’s why we’ve built our platform to move with you. Our white-label solution adapts to your regulatory landscape, your operations, and your goals—without locking you into one way of working.

Because here’s the thing: if your platform isn’t flexible, you can’t adapt. And if you can’t adapt, you’ll get stuck—while your competitors sprint ahead.

Worse still, you’ll waste valuable time patching together workarounds instead of moving forward. We’ve seen it too many times, which is why we’ve made it our mission to keep things open, partner-friendly, and ready for what’s next.

Real growth happens when your platform moves with you—not against you.

Ready to Future-Proof Your Business?

The remittance and payments landscape is shifting fast, and the businesses that thrive are the ones that stay agile, compliant, and connected.

At RemitONE, we’re not just building software. We’re helping MSBs grow smarter, launch faster, and operate with confidence, no matter where you’re headed next.

If any of these challenges sound familiar, or if you’re curious about what’s possible with the right tech and support behind you, we’d love to talk.

Book a free consultation call with our expert consultant or drop us an email for any questions at: sales@remitone.com

How Banks Can Reclaim Their Role in Cross-Border Payments with RemitONE

Banks, once the cornerstone of international payments, are finding themselves sidelined. Senders and receivers have now joined forces, pushing banks out of the equation.

But all is not lost. By embracing cutting-edge tools and software, banks can avoid being bypassed by larger MTOs and telcos. By connecting via a simple API to the RemitONE Hub™, they gain access to a multitude of MTOs, banks, and telcos worldwide, enabling them to send or receive various payment types, including cash, bank account, airtime, utility bills, and mobile wallet payments.

The Challenge: Banks on the Sidelines

The traditional banking model for international money transfers is facing significant disruption. People now have access to digital services that make transfers quick and easy with just a tap on their phone. Fintechs and money transfer operators (MTOs) help senders move money faster and cheaper, while aggregators and telecoms ensure it reaches even the most remote places.

Which leaves the lingering question: Where does that leave banks? How can they stay relevant in this shifting landscape?

The Solution: The RemitONE Hub™

RemitONE offers a powerful solution by acting as a bridge between banks and the wider fintech ecosystem.

The RemitONE Hub™ is a secure, flexible platform to manage and process money transfer transactions. Powered by modern technology, it offers real-time transaction monitoring, tracking, detailed reporting, and customisable features, all offered within a white-labeled solution.

What makes the RemitONE Hub™ stand out?

- Relevance: connects all key entities in the supply chain—MTOs, banks, and telecoms—ensuring that every participant benefits from the ecosystem.

- Flexibility: seamlessly integrates with existing systems, allowing banks to plug in with minimal disruption. Alternatively, it can replace outdated money transfer platforms, and infrastructure, offering unmatched adaptability.

- R1 EcoSystem™: gain access to the expansive RemitONE network to open doors into untapped corridors and unlock fresh revenue streams. Take a look at a quick snapshot below:

Here’s how RemitONE Hub™ reconnects banks to the global money transfer network:

1. Connecting Sending Partners

Sending Partners: The entity responsible for originating the fund transfer, whether through a digital platform or traditional method.

On the sending side, the RemitONE platform integrates with:

- Fintechs

- MTOs

- Aggregators

2. Empowering Receiving Partners

Receiving Partners: The entity that receives the funds on behalf of individuals or businesses, whether through a digital platform or traditional method.

On the receiving side, RemitONE connects banks to:

- Fintech

- MTOs

- Aggregators

- Telecom Operators

This interconnected framework ensures that banks remain an integral part of the financial journey, from sender to receiver.

With RemitONE’s all-in-one system, the complexity of managing multiple platforms is eliminated, saving your team valuable time and reducing the risk of human error. With fewer systems to manage, your processes become more efficient, allowing your bank to operate smoothly, stay ahead of competition, and remain fully compliant—staying firmly in the good books of regulators.

Conclusion: The Future of Banking in Cross-Border Payments

The financial world is moving forward, and so must banks. By embracing platforms like RemitONE, banks can transform potential challenges into opportunities, becoming central players in the global money transfer network once again.

We’ve already empowered leading banks like Stanbic Bank, Banco do Brasil, Attijariwafa, and UBA—and you can be next.

The RemitONE Hub™ is not just a solution; it’s a lifeline for banks striving to stay ahead in a rapidly digitising world. With its ability to connect banks to the innovators driving the money transfer revolution, RemitONE ensures that no one gets left behind.

Book a FREE consultation with our expert consultants, and let’s get your bank back in the cross-border payments game.

Driving Innovation and Customer Trust: The Role of Compliance, Speed, and Transparency in the Evolving Payments Landscape | IPR Global 2024

In today’s fast-evolving payments landscape, security, compliance, and customer expectations are more interconnected than ever. As businesses strive to innovate and meet the growing demand for faster, more transparent payment solutions, integrating compliance from the start is no longer a choice—it’s a necessity.

We gathered our panel of experts from top companies in the field to share their insights and strategies.

Panellists:

- Michael Bermingham, Co-Founder & Chief Business Officer, Nium

- Anastasia Serikova, VP, Head of Revenue and Growth, Visa Direct at Visa

- Kunal Choudhary, Money Transfers Strategy Lead, Worldpay

- Mitchell Fordham, Chief Revenue Officer & Co-founder, eSIM Go

Moderator:

- Oussama Kseibati, Business Development Officer, RemitONE

1. Balancing Innovation with Security: How Are Companies Integrating Compliance to Enhance Trust in the Payments Landscape?

In the evolving payments landscape, security and compliance aren’t just obstacles—they’re integral to innovation and customer trust. Michael highlighted that integrating compliance directly into product development can actually streamline processes rather than create friction. By building end-to-end solutions that embed compliance from the start, companies can meet regulatory standards, mitigate fraud risks, and open doors for more secure, seamless transactions. This approach not only can potentially position companies as leaders in compliance but also offers clients and partners a smoother, more reliable service.

Anastasia echoed Michael’s view, emphasising that products must work in close harmony with compliance. Open, continuous dialogue with regulators is crucial to ensuring that innovation and security progress together. Recent cross-border payment targets set by the Financial Stability Board—such as the goal for 75% of cross-border payments to arrive within an hour, with the remainder arriving within one business day by 2027. While challenging, it can push the industry to ultimately improve transparency and customer satisfaction.

2. Shifting Customer Expectations and the Impact of Seamless Payments and Remittances on Satisfaction

Customer expectations should naturally evolve as innovation progresses, highlighted Kunal. If they aren’t changing, something’s off. He broke this down into three key areas: transparency, speed, and convenience. Worldpay’s recent report found 84% of consumers want one-click payments, 67% prioritise ease of use when choosing a preferred payment method, and an impressive 97% say that fast payouts are crucial for a positive remittance experience. Integrating these elements into your payment processes is essential for a seamless customer journey.

When it comes to customer loyalty, fees are a major factor—73% of respondents consider them when choosing a remittance provider. Even more telling, 98% said transparency from the beginning of the transaction is key to keeping them loyal. In contrast, hidden fees or a lack of transparency can break trust, leading 20% of customers to abandon a transaction and seek alternatives. Failure to meet expectations on transparency or fees could leave customers feeling blindsided, eroding their confidence in the brand.

Michael added to Kunal’s point, highlighting the growing demand for real-time payments. Today’s customers want to know exactly where their money is at every step of the journey. While speed is crucial, transparency about the transaction’s status throughout the process is just as important. Customers are increasingly frustrated when they don’t have visibility into the status of their payments, which can detract from their overall satisfaction.

3. Case Studies: Leading Companies Elevating Customer Experience

Mitchell shared how Western Union is utilising eSIM technology to enhance customer convenience and loyalty. Through their digital wallet, the company offers eSIM options that allow customers to stay connected while travelling abroad, making it easier to manage finances, communicate with family, and access their services. This added benefit not only enriches the customer experience but also helps retain users by offering more value. Additionally, this approach allows Western Union to gather data that can be used to further refine and improve their services.

Worldpay, one of the largest payment acquirers, has a robust global infrastructure supporting over 180 markets and processing more than 50 billion transactions in multiple currencies. This vast expertise enables them to help merchants expand into new markets and enhance the customer experience, pointed out Kunal. Worldpay’s ability to innovate in fraud prevention through AI and machine learning helps ensure flag fraudulent activity beforehand and prevent it moving forward. While their focus on offering a wide range of payment options helps meet diverse customer needs. Their continued commitment to enhancing the payments experience through these technologies has enabled merchants to expand into new markets with greater confidence, benefiting both businesses and customers alike.

A growing trend in the payments industry, highlighted by Anastasia, is the increasing demand for faster, more transparent payments, particularly for Small to Medium Enterprises (SMEs). A notable example is Revolut’s instant payouts for businesses, a service powered by Visa Direct. This has been driven by the need for speed and clarity in payments.

4. Promoting Financial Inclusion Through Payments and Remittances in Underserved Regions

In regions like Latin America, particularly Brazil, the introduction of real-time payments through PIX has been a game-changer. This system allows users to send and receive payments instantly, bypassing traditional banking systems and making financial transactions more accessible. Additionally, the ability to store and use foreign currencies in digital wallets is helping underserved populations meet daily financial needs, especially in times of crisis. This has opened up new opportunities for individuals, such as remote workers and freelancers, who can now receive payments from employers across different regions without relying on traditional bank accounts.

Anastasia highlighted several initiatives powered by Visa that contribute to financial inclusion. She shared how Visa has facilitated rapid state payouts during crises, such as in Guatemala following a natural disaster. Through Visa’s payment rails, the government was able to distribute funds quickly to almost 3 million people. Looking ahead, Anastasia predicts that digital wallets are expected to play an even larger role in financial inclusion, making it easier for people in underserved regions to access financial services.

Mitchell also discussed the significant role of mobile operators in providing financial services to underserved regions, particularly through companies like MTN and Digicel. However, a more innovative approach where not only can money be transferred between phone numbers, but the mobile operator also provides a SIM card to the recipient. This creates opportunities to better understand user behaviour, track interests, and gather insights about customer segments. By offering mobile plans at affordable rates, these operators are able to deliver a range of services that offer more value than just low fees, which in turn helps foster stronger brand loyalty and financial inclusion.

What next?

At RemitONE, our commitment is to provide you with cutting-edge technology, compliance solutions, an expansive network, and expert guidance to navigate the ever-evolving landscape of remittances. Whether you’re just starting out or looking to scale your business, we’ve got you covered.

Want to see how RemitONE can elevate your business? Book a free consultation to discover how we can supercharge your business

Bank of Ceylon (UK) Limited and RemitONE Join Forces to Revolutionise UK-Sri Lanka Cross-Border Payments

September 2024: Bank of Ceylon (UK) Limited, a fully owned subsidiary of Bank of Ceylon Sri Lanka has prudently partnered with RemitONE, a global leader in cross-border payment technology solutions. This strategic alliance is expected to significantly improve Bank of Ceylon’s competitiveness in the UK-Sri Lanka corridor, heralding a new era in their 80-year history. The collaboration marks a pivotal moment in the bank’s ongoing efforts to digitalise its services and meet the evolving needs of its international customer base. The collaboration is particularly momentous as the bank approaches its 75th anniversary on 1st October 2024, marking a significant milestone in its longstanding legacy.

The partnership addresses Bank of Ceylon’s pressing need for an enhanced online presence and expanded customer reach. By adopting RemitONE’s cross-border payment software, the bank is set to advance its technological capabilities and offer a more streamlined, user-friendly service to its loyal customers.

For RemitONE, this collaboration represents a strategic expansion into the South Asian market, reinforcing its position as an innovator in cross-border payment solutions. The partnership underscores both entities’ commitment to embracing digital transformation in the rapidly evolving financial services sector and helping facilitate money transfers for customers at affordable rates.

As international cross-border payments continue to play a crucial role in Sri Lanka’s economy, this partnership is set to deliver substantial benefits to both individual customers and the broader financial ecosystem. Soon, Bank of Ceylon customers can look forward to a more accessible, secure, and seamless money transfer experience.

About RemitONE

RemitONE is the leading provider of money transfer software solutions for banks, telcos, and money transfer operators (MTOs) worldwide. Organisations of all sizes use the RemitONE platforms to run their money transfer operations with ease and efficiency by reaching out to their customers via multiple channels including agent, online and mobile.

For more information on RemitONE, please email sales@remitone.com.

Flutterwave: Simplifying Cross-Border Settlement for Multinationals in Africa

This article is brought to you in partnership with Flutterwave, written by Sid Gautam, SVP–Enterprise at Flutterwave.

Having trouble transferring money for your business from Africa across borders? You’re not alone. International business transactions can seem like an overwhelming task due to the hidden fees and complications that are frequently involved with cross-border settlements. No more worries, Flutterwave provides an easy and cost-effective answer to your international settlement needs.

Recently named Fast Company’s Most Innovative Company in Europe, Middle East, and Africa, Flutterwave stands out as Africa’s leading payments technology company, providing an efficient and transparent cross-border payment solution. The company has established a solid reputation with over 630 million transactions worth more than $31 billion in total payment volume, and 20 million+ API calls per day.

Seamless Onboarding Processes

On the eight-year journey of simplifying payments for multinationals in Africa and beyond, Flutterwave has learned and we have adapted our onboarding processes to be straightforward with 24/7 support always available throughout the process. Our Know Your Business (KYB) process is enhanced to get you set up quickly and efficiently. This follows with other important mechanisms needed to ensure your operations are live and running in no time within stipulated regulatory requirements.

Extensive Reach and Settlement Expertise

Leveraging an extensive payment infrastructure network spanning over 30 African countries with a presence in the UK, US, and EU, Flutterwave is the cross-border payment partner of choice in Africa. Our settlement solution facilitates seamless payment operations for multinationals across Africa and African businesses growing globally.

Currently, we serve merchants across several industries: payments, hospitality, ride-hailing, aviation, gaming, logistics, and digital infrastructure to mention a few. With support for multiple currencies as well as local and international payment methods such as mobile money, bank transfers, cards, and Google Pay, your larger enterprise will be in the capable hands of our cross-border payment solutions facilitating fast, transparent, and cost-effective payment solutions.

Regulatory Compliance and Maximum Security

At Flutterwave, operation excellence and minimizing counterparty risk are our top priorities. Strict adherence to regulatory compliance through owned licenses and a network of partners across several countries within and outside Africa means cross-border transactions are settled within relevant payment policies and regulations. To ensure maximum security for merchants’ data and funds, we have risk and compliance systems and teams across several countries carrying out extensive compliance checks to mitigate anti-money laundering (AML) and combating the financing of terrorism (CFT) risks.

We also invest heavily in payment infrastructure security such as maintaining the highest PCI-DSS & ISO 27001 certifications, in line with global best practices. This ensures that whether managing B2B first-party treasury flows or third-party supplier payouts, Flutterwave’s cross-border payments adapt to specific business needs legally and securely.

In Conclusion: with Flutterwave, enterprises can streamline their cross-border settlements, ensuring speed, transparency, and cost-effectiveness. Join global merchants such as Uber, Worldpay, Piggyvest, Bamboo, Air Peace, Microsoft, and Flywire running their cross-border settlement efficiently and securely from Africa to the world and vice versa. Let’s talk!