Power Up Your Platform: The Top RemitONE Features Driving Our Clients’ Success

What if the growth you’re chasing is already built into your system?

If you’re using the RemitONE Money Transfer Platform, we want to make sure you’re getting the most out of it to unlock its full potential.

Packed into your platform are powerful tools designed to boost transactions, build loyalty, reduce risk, and help you move faster. But if you’re not fully unlocking them, you’re missing opportunities.

Today, we’ll be sharing our clients features that consistently drive results and keep them ahead of the curve.

Let’s show you what’s possible.

Loyalty Manager: Keep Customers Coming Back

If you’re looking to boost retention and give your remitters a reason to keep choosing you—this is the feature to activate.

Loyalty Manager™ turns every transaction into an opportunity to reward your remitters. With this popular feature, your customers earn loyalty points every time they send money or refer a friend. These points can be redeemed to reduce transaction fees, which means every transfer becomes more affordable and more rewarding for them.

What makes it especially powerful is how customisable it is. You can set your own rules on how points are earned, based on what makes sense for your business, whether that’s based on transaction frequency, corridors, or even new customer referrals.

And when combined with Promotions Manager™, your customers can unlock even more by using loyalty points and promotions in a single transaction. The result? Greater satisfaction, higher engagement, and stronger brand loyalty.

Promotions Manager™: Smart Offers, More Transfers

If you’re running a money transfer business, you know that generic discounts don’t cut it. You need offers that actually move the needle — increasing transaction volumes, encouraging repeat usage, and giving customers a reason to stick with you.

That’s exactly what Promotions Manager™ is built for.

This feature puts you in full control, allowing you to set up intelligent, rule-based promotions that are targeted, timely, and effective. Whether it’s a festive seasonal discount for specific corridors, a reward for frequent senders, or a special deal for partners, this feature helps you craft promotions that match your business goals and your audience’s behaviour.

- Target smarter: Choose who sees your promotions based on corridors, transaction history, or user type.

- Incentivise more sends: Set up thresholds like “send 3 times, get a discount” to increase transaction frequency.

- Run timely offers: Activate short-term promos for holidays, local events, or marketing pushes.

- Maximise ROI: Avoid blanket discounts and focus on what works, boosting transactions without wasting budget.

It’s not just about discounts; it’s about strategy. Promotions Manager™ helps you reward the right behaviour, at the right time, with the right offer, building stronger customer loyalty and driving more transactions.

Risk Manager™ : Spot Risks Before They Become Problems

Risk is everywhere when you’re moving money across borders, but staying compliant doesn’t have to mean slowing down your operations or manually digging through data.

What clients love about our Risk Manager™ is it doesn’t just flag risks — it thinks ahead.

It gives you a dynamic, real-time view of who your riskiest customers are based on what they actually do — not just who they say they are. From sending to high-risk regions to sudden spikes in transaction volumes, our dynamic risk scoring system tracks behaviour patterns, adapts in real-time, and assigns weighted risk scores to both remitters and beneficiaries. The result? You can spot red flags early, act fast, and stay ahead.

It’s not just for compliance teams either, the Risk Score Rules Engine lets you set custom rules that reflect your business needs. And with detailed audit trails and downloadable reports, you’ll always be ready when the regulator comes knocking.

If you’re already juggling tight regulations and evolving risks, then it might be time to activate Risk Manager™ and make your life a whole lot easier.

Maker Checker: Double Verification for Safer Transfers

Mistakes in money transfers can cost more than just time; they can damage trust. Maker Checker adds a second layer of control to your operations by requiring one team member to create a transaction, and another to verify it. It’s a simple way to reduce errors, prevent fraud, and keep your financial processes rock solid and secure.

Built for compliance, peace of mind, and flawless execution.

Get more out of RemitONE — with hands-on expert support

Sometimes the real game-changer isn’t a new feature, it’s having someone by your side who knows your system and understands your goals to help you move faster.

That’s exactly what our Technical Customer Success (TCS) offers. It’s a personalised support experience built for teams who want to go further with RemitONE. You’ll have direct access to a dedicated Technical Customer Success Manager who becomes an extension of your team, someone who already understands your setup and can help you troubleshoot issues faster, scale with confidence, and get more out of the platform.

Whether it’s navigating technical challenges, implementing new features, or simply having a regular sounding board for improvements, TCS is designed to make your day-to-day easier and more effective. You’ll spend less time stuck in queues and more time getting things done.

It’s a flexible service shaped around your workflow, from quick weekly catch-ups to in-depth strategy calls. Whatever your rhythm, we’ll match it, so your team can keep moving.

Let’s take some weight off your shoulders and help unlock your full potential.

You’re sitting on the growth your competitors are already using.

These tools aren’t “nice-to-haves” they’re how leading money service businesses (MSBs) are pulling ahead. More transactions. More loyalty. More support.

If you’re already using RemitONE, it’s time to unlock the full power of your platform.

And if you’re not with us yet? Then let’s show you what’s possible.

Book a free demo and see how the world’s leading MSBs use our platform to grow every single day.

Book here: https://calendly.com/remitone-oussama/free-30min-consultation-website

New White-Label Online Platform: Redesigned to Scale Customer Loyalty and Growth

Add powerful money transfer capabilities to your website — without the complexity.

Our new Online Remittance Manager (ORM) is a fully white-label web application that lets your customers send money securely and easily — all under your brand, without leaving your site.

Built on a foundation of powerful features, now enhanced with a seamless new design.

Your brand will sit proudly on a modern, intuitive platform that makes sending money simple — helping you build loyalty and drive growth.

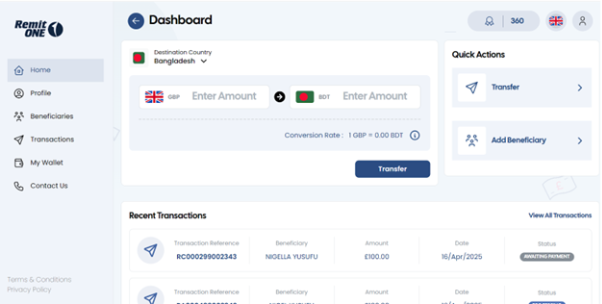

Instant, Simple Money Transfers

From the moment customers log in, they see what matters most: Send Money.

Quick Actions let them add beneficiaries without hunting through menus.

Recent transactions are easy to review at a glance.

Navigation is streamlined on the left-hand side for effortless access.

How much time could your customers save with this design?

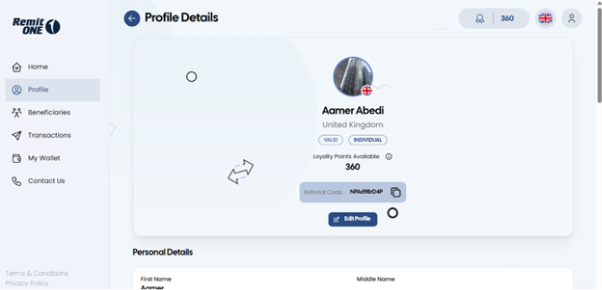

Enhanced Customer Profiles for Better Insights

The Profile section now gives a richer overview of each customer—helping you serve them better. Instantly see key details like available discount codes, submitted ID proofs, and whether they’ve completed their KYC checks—all in one place.

What would better visibility mean for your client relationships?

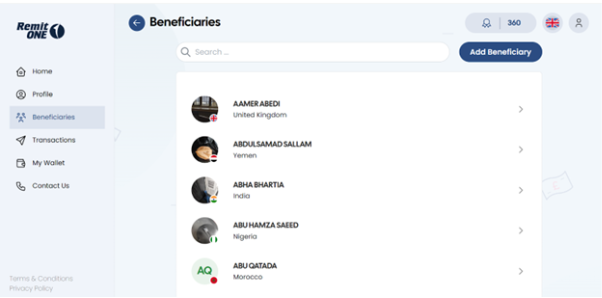

Quick Access to Saved Beneficiaries

The Beneficiaries section lists all saved contacts alphabetically, so customers can quickly find who they’re looking for. With the built-in search, there’s no need to scroll endlessly—just type, find, and send in seconds.

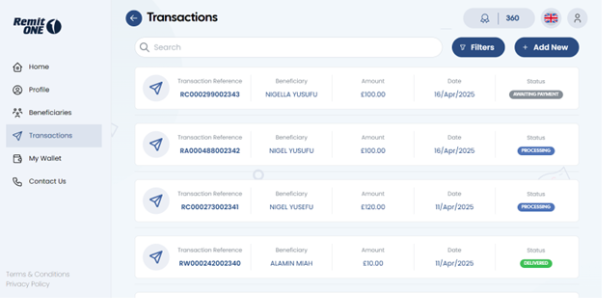

Detailed Transaction History with Smart Filters

Customers see every transfer in a clean timeline. Clicking on any transaction reveals a full breakdown—including fees, status, and more.

Smart filters make finding specific transactions easy: By date, type, or status.

And with the “Add New” button, they can jump straight into sending money again, with no backtracking needed.

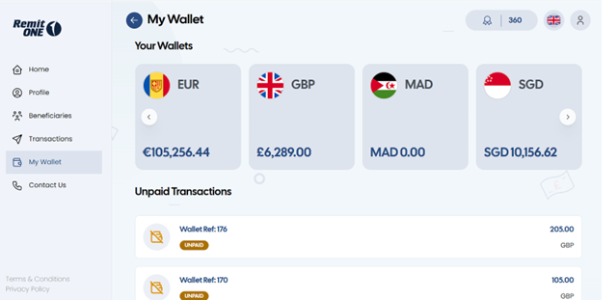

Multi-Currency Wallets Made Easy

The My Wallet section displays all the wallets your customer holds across different regions, along with the balance in each one. The left and right toggle arrows offer a smooth way to scroll through the full list—making it easy to manage multiple wallets without overwhelming the screen. It’s a user-friendly experience that keeps everything organised and accessible.

Below, customers can also view a history of unpaid transactions, so nothing slips through.

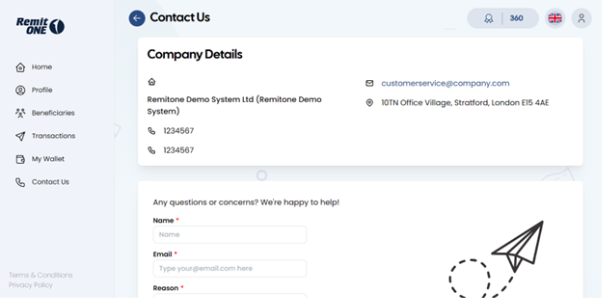

Easy Customer Support Access

Finally, we’ve reached the Contact Us page—an essential space where customers can reach out whenever they need support. It’s not just a lifeline for them, but also a valuable channel for you to stay informed about any issues and respond quickly.

At the top, customers will find your company’s contact details, with an enquiry form below as a convenient alternative for getting in touch.

Ready to impress your customers with a smarter, sleeker platform?

Our redesigned Online Platform and Mobile App aren’tjust better looking — they’re built to help you:

- Deliver a world-class experience

- Scale faster

- Work smarter

Book a demo today to explore the platform firsthand, get expert answers to your questions, and discover how to turn clicks into conversions — and customers into loyal fans.

How to Build a Leaner, Smarter Money Service Business in 2025

In an era of rapid regulatory change, rising customer expectations, and digital disruption, how can money service businesses (MSBs)—companies that facilitate the transfer, exchange, or payment of money—not only survive but thrive?

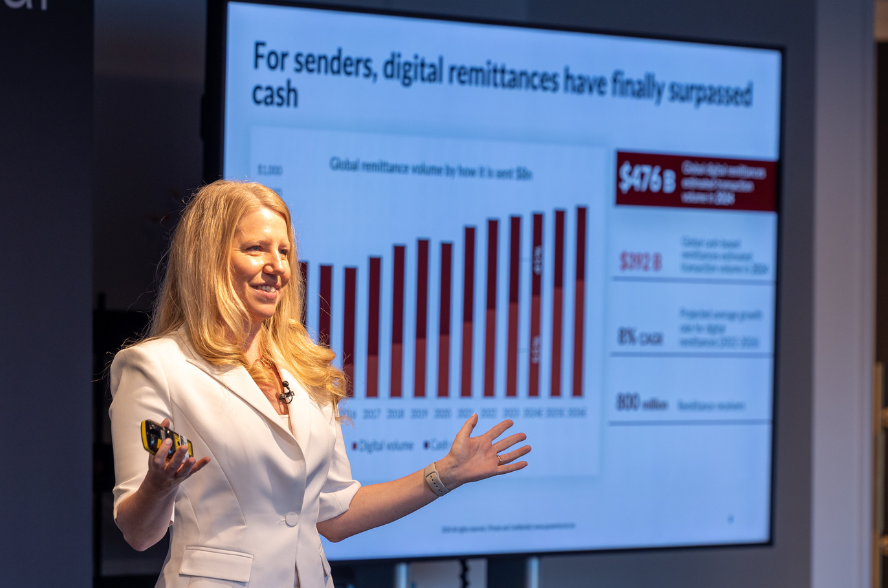

In our recent webinar, we gathered our top experts and unpacked the most pressing challenges facing MSBs today and shared proven strategies to help you scale, streamline compliance, and embrace innovation.

Here are the top takeaways:

1. Scale Smarter with our All-in-one Hub

A major pain point for MSBs is integrating with multiple systems and partners from send and payout providers to value-add services like ID verification platforms, open banking tools, and payment gateways.

RemitONE Hub™ solves this by offering two flexible options: connect via a single API or use our ready-made interface. Either way, you gain instant access to a global network of payment companies with the likes of Visa, Mastercard, Orange, MoneyGram, and many more.

With access to over 2.5 billion bank accounts and 3 billion wallets, the RemitONE Hub™ gives you the tools to scale without stress. You stay in control of your payouts, partner terms, and operations—all from one place.

We’ll help match you with the right partners based on your target corridors and budget to help meet your goals. What normally takes years, we help you achieve it in a few months.

2. Shortcut to Launch into New Corridors

Expanding to new corridors can feel like a maze of licences, banks, and paperwork. But it doesn’t have to be that way.

With our Remittance-as-a-Service (RaaS), you can plug into our network of licensed partners across the UK, EU—and soon, the US and Canada. That means you can go live faster, spend less upfront, and stay fully compliant—without going it alone

3. Stay Compliant with Compliance Manager™ (COM)

Compliance and fraud prevention remain top priorities for MSBs. Our Compliance Manager™ (COM) automates 80% of those repetitive manual checks, runs real-time KYC/AML screening across 350+ global sanctions lists, and helps you monitor risk scores, transaction patterns, and suspicious activity.

And it’s not just for MSBs. For central banks and regulators, COM offers live visibility into incoming and outgoing remittance flows—making it easier to track volumes accurately and close those reporting gaps.

In short? You stay compliant, catch fraud early, and get to focus on growing your business.

4. Reduce Costs and Settlement Delays with Open Banking

We know how frustrating slow settlements and high fees can be—especially when you’re trying to keep things efficient. That’s why we support open banking. You can tap into direct bank-to-bank payments, which means faster processing times, fewer card-related fees, and reduced friction that often comes with traditional payment methods. We’ve already rolled this out across the UK and Europe through our partners, and it’s making a real difference.

Even in countries without open banking, we provide alternative integrations with local processors.

5. Offer Multifunctional Wallets for the Future of Finance

Let’s be honest—digital wallets aren’t optional anymore. They’re a core part of how people move money today, and we’re making sure our clients are ready for that shift.

We support everything from peer-to-peer transfers, bill payments, airtime top-ups, prepaid cards, and wallet-to-wallet transactions. Whether your customers are paying for groceries, sending money to family, or topping up Netflix—we’ve got it covered.

We’ve also made sure our wallets connect to telcos, banks, and blockchain partners all with compliance built in from the get-go.

It’s all part of how we’re helping MSBs stay relevant, inclusive, and ready for whatever comes next.

6. Leverage a Flexible Platform Built for Growth

One recurring theme throughout the webinar: flexibility is key. Whether you’re a startup finding your footing, a licensed MTO looking to scale, a send or payout partner, a central bank, or a sub-account issuer like an e-money institution, your needs will keep evolving. That’s why we’ve built our platform to move with you. Our white-label solution adapts to your regulatory landscape, your operations, and your goals—without locking you into one way of working.

Because here’s the thing: if your platform isn’t flexible, you can’t adapt. And if you can’t adapt, you’ll get stuck—while your competitors sprint ahead.

Worse still, you’ll waste valuable time patching together workarounds instead of moving forward. We’ve seen it too many times, which is why we’ve made it our mission to keep things open, partner-friendly, and ready for what’s next.

Real growth happens when your platform moves with you—not against you.

Ready to Future-Proof Your Business?

The remittance and payments landscape is shifting fast, and the businesses that thrive are the ones that stay agile, compliant, and connected.

At RemitONE, we’re not just building software. We’re helping MSBs grow smarter, launch faster, and operate with confidence, no matter where you’re headed next.

If any of these challenges sound familiar, or if you’re curious about what’s possible with the right tech and support behind you, we’d love to talk.

Book a free consultation call with our expert consultant or drop us an email for any questions at: sales@remitone.com

Trump’s Threats to Cross-Border Payments: What It Means for Your Business

It’s been a short while since Trump stormed back into office, and he’s already shaken things up with his hard-hitting policies—and, as always, he’s not one to shy away from bold and upfront decisions. But with every action comes a ripple effect, and in the world of cross-border payments, those ripples are turning into shockwaves. From proposed remittance taxes to intensified compliance risks, Trump’s latest moves are shaking up how money flows in and out of America.

So, what does this mean for businesses, migrants, and economies relying on these payments? Let’s find out.

- Will Deportations of Migrants Impact Remittances? Here’s What the Data Says

Mexicans, a huge diaspora, and one of the major remittances senders in the US, but we may see stricter immigration policies putting this financial lifeline at risk. The “Remain in Mexico” program has already led to nearly 11,000 migrants being sent back, potentially reducing the number of workers in the U.S. and, with them, the flow of cross-border payments. Since Trump’s arrival, 23,000 arrests have been made and 18,000 deportations, whilst it has risen significantly compared to the Biden administration it still remains lower than the peak levels seen during the early crackdown of Trump’s first term.

So, what does this tell us? When Trump first took office, deportations surged as part of his hardline immigration stance. But over time, the wave slowed down. Now, despite his promise to deport 11 million people, the sheer complexity of the process appears to make that goal unlikely. In fact, this could even open a window for some undocumented migrants to secure legal status. But let’s say, hypothetically, mass deportations would happen—would remittances take a massive hit? Not necessarily. Many undocumented migrants are low-value remitters, meaning their contributions wouldn’t cause a drastic drop. What would shake remittance flows, though, is something much bigger: a tax on remittances.

- Will a Remittance Tax on US-Latin America Transfers Disrupt the Market?

The proposed 10% remittance tax from the US to Latin American regions is an effort to minimise illegal immigration but can cause a significant dent on transactions, impacting money transfer operators, banks, and other players in the payments ecosystem by reducing revenue and lowering demand in certain corridors.

For countries like Mexico, El Salvador, and Haiti—where remittances inject nearly $150 billion annually, this could be a devastating blow. Families who depend on these funds risk losing critical income, putting entire economies under strain.

If implemented, Money Service Businesses (MSBs) may have no choice but to raise fees, potentially driving customers toward alternative solutions like digital wallets and crypto. Interestingly, Trump seems to support crypto, so could this be the turning point that finally makes it more secure and mainstream?

- Trump and Stablecoins: A Game-Changer for Cross-Border Payments?

There’s hope on the horizon—Trump’s pro-stablecoin stance could be the catalyst to reshape cross-border payments. While Trump has halted any action to progress America’s CBDC, he’s taken more steps to advance the crypto movement. In a tweet, he unveiled the U.S. Crypto Strategic Reserve, which will include XRP, SOL, and ADA, with Bitcoin (BTC), Ethereum (ETH), and other key cryptocurrencies that will be added to “the heart of the Reserve.” Since the announcement, the value of the first three coins surged by 62%, while BTC and ETH have climbed up by 10%. This momentum is pushing forward Trump’s goal of making the U.S. the “crypto capital of the world.”

Two posts by Donald Trump on Sunday, March 3, 2025, on his Truth Social account.

So, what does this mean for remittances? Stablecoins offer faster, cheaper, and more accessibility, eliminating high fees and long processing times, making this a more attractive alternative to existing transfer methods to senders.

Of course, regulation follows. Trump’s administration has called for a federal regulatory framework for digital assets to bring clarity. If well executed, this could boost financial inclusion and drive crypto adoption, but if it becomes too strict, it can do the opposite, where it stifles innovation and progression.

- Crypto in Crisis: What’s shaking the market?

The cryptocurrency market took a plunge over the weekend, and while crypto is no stranger to volatility, this time the drop wasn’t just about digital assets—it was about politics, economics, and the shifting global financial landscape.

A major trigger was the Trump administration’s new tariff hikes on imports from Mexico and Canada, which sent investors retreating from risky assets like Bitcoin, creating a domino effect across the sector. Then there was the regulatory uncertainty. The U.S. government’s new restrictions on crypto exchanges and stablecoins fuelled distrust, prompting even more selloffs. On top of that, fresh inflation data and Trump’s aggressive trade policies led to a reassessment of potential Federal Reserve interest rate cuts, putting even more pressure on risky assets like crypto.

Ironically, part of the turmoil can be traced back to Trump’s own cryptocurrency summit on March 7. The announcement of a strategic bitcoin reserve—a government-controlled stash of digital assets initially caused Bitcoin’s price to drop by 6%. While the move signalled greater government involvement in crypto, it left many investors questioning what that would actually mean in practice. The market’s uncertainty around this policy likely contributed to the larger crash that followed.

- Stricter Compliance: A Roadblock for Remittances?

The designation of cartels as terrorist organisations, combined with tighter immigration policies, is set to intensify compliance pressures on MSBs. They must now exercise even greater due diligence to avoid any unintended links to sanctioned groups.

For migrants, this means longer wait times, extra fees, and fewer options to send money home. If traditional corridors start shutting down, people will have no choice but to look elsewhere, whether that’s the age-old hawala system or the rising use of crypto and stablecoins, a shift that could play right into Trump’s pro-digital currency agenda.

Whereas for giants like Western Union and MoneyGram, who move billions to Latin America, the stakes are high. Stricter AML (Anti-Money Laundering) and KYC (Know Your Customer) regulations will be unavoidable, but for some financial institutions, the risk might be too much. We’ve seen this play out before where banks pulled out of Somalia’s remittance corridors when terrorist groups gained traction, leaving thousands stranded without access to funds. Could Latin America perhaps face the same fate?

Keeping up with ever-changing regulations is more than just a headache—it’s a matter of survival. A single compliance slip-up can trigger heavy fines or, worse, force a business to shut its doors entirely. Yet, many companies still juggle multiple software tools, manually stitching together fragmented systems to stay compliant.

This approach isn’t just inefficient; it’s risky. When regulations shift overnight, you need a solution that evolves with them. That’s why we built an all-in-one platform with compliance at its core. Unlike other providers, we continuously adapt to market trends and regulatory changes, ensuring you aren’t left scrambling when new rules emerge.

Take our Liveness feature for example. With biometric-powered selfie checks, remitters can instantly confirm their identity—cutting fraud risks while keeping regulators satisfied. Plus, through our platform, regulators and central banks can track all inbound and outbound transactions, ensuring total transparency.

It’s this kind of innovation that makes compliance less of a burden and more of a competitive advantage.

So if you want to streamline your operations and power your growth, book a free demo with us and let’s discover how.

How Banks Can Reclaim Their Role in Cross-Border Payments with RemitONE

Banks, once the cornerstone of international payments, are finding themselves sidelined. Senders and receivers have now joined forces, pushing banks out of the equation.

But all is not lost. By embracing cutting-edge tools and software, banks can avoid being bypassed by larger MTOs and telcos. By connecting via a simple API to the RemitONE Hub™, they gain access to a multitude of MTOs, banks, and telcos worldwide, enabling them to send or receive various payment types, including cash, bank account, airtime, utility bills, and mobile wallet payments.

The Challenge: Banks on the Sidelines

The traditional banking model for international money transfers is facing significant disruption. People now have access to digital services that make transfers quick and easy with just a tap on their phone. Fintechs and money transfer operators (MTOs) help senders move money faster and cheaper, while aggregators and telecoms ensure it reaches even the most remote places.

Which leaves the lingering question: Where does that leave banks? How can they stay relevant in this shifting landscape?

The Solution: The RemitONE Hub™

RemitONE offers a powerful solution by acting as a bridge between banks and the wider fintech ecosystem.

The RemitONE Hub™ is a secure, flexible platform to manage and process money transfer transactions. Powered by modern technology, it offers real-time transaction monitoring, tracking, detailed reporting, and customisable features, all offered within a white-labeled solution.

What makes the RemitONE Hub™ stand out?

- Relevance: connects all key entities in the supply chain—MTOs, banks, and telecoms—ensuring that every participant benefits from the ecosystem.

- Flexibility: seamlessly integrates with existing systems, allowing banks to plug in with minimal disruption. Alternatively, it can replace outdated money transfer platforms, and infrastructure, offering unmatched adaptability.

- R1 EcoSystem™: gain access to the expansive RemitONE network to open doors into untapped corridors and unlock fresh revenue streams. Take a look at a quick snapshot below:

Here’s how RemitONE Hub™ reconnects banks to the global money transfer network:

1. Connecting Sending Partners

Sending Partners: The entity responsible for originating the fund transfer, whether through a digital platform or traditional method.

On the sending side, the RemitONE platform integrates with:

- Fintechs

- MTOs

- Aggregators

2. Empowering Receiving Partners

Receiving Partners: The entity that receives the funds on behalf of individuals or businesses, whether through a digital platform or traditional method.

On the receiving side, RemitONE connects banks to:

- Fintech

- MTOs

- Aggregators

- Telecom Operators

This interconnected framework ensures that banks remain an integral part of the financial journey, from sender to receiver.

With RemitONE’s all-in-one system, the complexity of managing multiple platforms is eliminated, saving your team valuable time and reducing the risk of human error. With fewer systems to manage, your processes become more efficient, allowing your bank to operate smoothly, stay ahead of competition, and remain fully compliant—staying firmly in the good books of regulators.

Conclusion: The Future of Banking in Cross-Border Payments

The financial world is moving forward, and so must banks. By embracing platforms like RemitONE, banks can transform potential challenges into opportunities, becoming central players in the global money transfer network once again.

We’ve already empowered leading banks like Stanbic Bank, Banco do Brasil, Attijariwafa, and UBA—and you can be next.

The RemitONE Hub™ is not just a solution; it’s a lifeline for banks striving to stay ahead in a rapidly digitising world. With its ability to connect banks to the innovators driving the money transfer revolution, RemitONE ensures that no one gets left behind.

Book a FREE consultation with our expert consultants, and let’s get your bank back in the cross-border payments game.

Driving Innovation and Customer Trust: The Role of Compliance, Speed, and Transparency in the Evolving Payments Landscape | IPR Global 2024

In today’s fast-evolving payments landscape, security, compliance, and customer expectations are more interconnected than ever. As businesses strive to innovate and meet the growing demand for faster, more transparent payment solutions, integrating compliance from the start is no longer a choice—it’s a necessity.

We gathered our panel of experts from top companies in the field to share their insights and strategies.

Panellists:

- Michael Bermingham, Co-Founder & Chief Business Officer, Nium

- Anastasia Serikova, VP, Head of Revenue and Growth, Visa Direct at Visa

- Kunal Choudhary, Money Transfers Strategy Lead, Worldpay

- Mitchell Fordham, Chief Revenue Officer & Co-founder, eSIM Go

Moderator:

- Oussama Kseibati, Business Development Officer, RemitONE

1. Balancing Innovation with Security: How Are Companies Integrating Compliance to Enhance Trust in the Payments Landscape?

In the evolving payments landscape, security and compliance aren’t just obstacles—they’re integral to innovation and customer trust. Michael highlighted that integrating compliance directly into product development can actually streamline processes rather than create friction. By building end-to-end solutions that embed compliance from the start, companies can meet regulatory standards, mitigate fraud risks, and open doors for more secure, seamless transactions. This approach not only can potentially position companies as leaders in compliance but also offers clients and partners a smoother, more reliable service.

Anastasia echoed Michael’s view, emphasising that products must work in close harmony with compliance. Open, continuous dialogue with regulators is crucial to ensuring that innovation and security progress together. Recent cross-border payment targets set by the Financial Stability Board—such as the goal for 75% of cross-border payments to arrive within an hour, with the remainder arriving within one business day by 2027. While challenging, it can push the industry to ultimately improve transparency and customer satisfaction.

2. Shifting Customer Expectations and the Impact of Seamless Payments and Remittances on Satisfaction

Customer expectations should naturally evolve as innovation progresses, highlighted Kunal. If they aren’t changing, something’s off. He broke this down into three key areas: transparency, speed, and convenience. Worldpay’s recent report found 84% of consumers want one-click payments, 67% prioritise ease of use when choosing a preferred payment method, and an impressive 97% say that fast payouts are crucial for a positive remittance experience. Integrating these elements into your payment processes is essential for a seamless customer journey.

When it comes to customer loyalty, fees are a major factor—73% of respondents consider them when choosing a remittance provider. Even more telling, 98% said transparency from the beginning of the transaction is key to keeping them loyal. In contrast, hidden fees or a lack of transparency can break trust, leading 20% of customers to abandon a transaction and seek alternatives. Failure to meet expectations on transparency or fees could leave customers feeling blindsided, eroding their confidence in the brand.

Michael added to Kunal’s point, highlighting the growing demand for real-time payments. Today’s customers want to know exactly where their money is at every step of the journey. While speed is crucial, transparency about the transaction’s status throughout the process is just as important. Customers are increasingly frustrated when they don’t have visibility into the status of their payments, which can detract from their overall satisfaction.

3. Case Studies: Leading Companies Elevating Customer Experience

Mitchell shared how Western Union is utilising eSIM technology to enhance customer convenience and loyalty. Through their digital wallet, the company offers eSIM options that allow customers to stay connected while travelling abroad, making it easier to manage finances, communicate with family, and access their services. This added benefit not only enriches the customer experience but also helps retain users by offering more value. Additionally, this approach allows Western Union to gather data that can be used to further refine and improve their services.

Worldpay, one of the largest payment acquirers, has a robust global infrastructure supporting over 180 markets and processing more than 50 billion transactions in multiple currencies. This vast expertise enables them to help merchants expand into new markets and enhance the customer experience, pointed out Kunal. Worldpay’s ability to innovate in fraud prevention through AI and machine learning helps ensure flag fraudulent activity beforehand and prevent it moving forward. While their focus on offering a wide range of payment options helps meet diverse customer needs. Their continued commitment to enhancing the payments experience through these technologies has enabled merchants to expand into new markets with greater confidence, benefiting both businesses and customers alike.

A growing trend in the payments industry, highlighted by Anastasia, is the increasing demand for faster, more transparent payments, particularly for Small to Medium Enterprises (SMEs). A notable example is Revolut’s instant payouts for businesses, a service powered by Visa Direct. This has been driven by the need for speed and clarity in payments.

4. Promoting Financial Inclusion Through Payments and Remittances in Underserved Regions

In regions like Latin America, particularly Brazil, the introduction of real-time payments through PIX has been a game-changer. This system allows users to send and receive payments instantly, bypassing traditional banking systems and making financial transactions more accessible. Additionally, the ability to store and use foreign currencies in digital wallets is helping underserved populations meet daily financial needs, especially in times of crisis. This has opened up new opportunities for individuals, such as remote workers and freelancers, who can now receive payments from employers across different regions without relying on traditional bank accounts.

Anastasia highlighted several initiatives powered by Visa that contribute to financial inclusion. She shared how Visa has facilitated rapid state payouts during crises, such as in Guatemala following a natural disaster. Through Visa’s payment rails, the government was able to distribute funds quickly to almost 3 million people. Looking ahead, Anastasia predicts that digital wallets are expected to play an even larger role in financial inclusion, making it easier for people in underserved regions to access financial services.

Mitchell also discussed the significant role of mobile operators in providing financial services to underserved regions, particularly through companies like MTN and Digicel. However, a more innovative approach where not only can money be transferred between phone numbers, but the mobile operator also provides a SIM card to the recipient. This creates opportunities to better understand user behaviour, track interests, and gather insights about customer segments. By offering mobile plans at affordable rates, these operators are able to deliver a range of services that offer more value than just low fees, which in turn helps foster stronger brand loyalty and financial inclusion.

What next?

At RemitONE, our commitment is to provide you with cutting-edge technology, compliance solutions, an expansive network, and expert guidance to navigate the ever-evolving landscape of remittances. Whether you’re just starting out or looking to scale your business, we’ve got you covered.

Want to see how RemitONE can elevate your business? Book a free consultation to discover how we can supercharge your business

We’re Attending CrossTech World 2024 | 19-21 November 2024

We’re excited to announce that the RemitONE team will be heading to Miami, USA, for the upcoming CrossTech World 2024 event. This is an incredible opportunity for us to connect with potential partners and reconnect with our valued clients who have supported and grown with us along the way.

If you’re attending CrossTech, we’d love to meet up and explore how RemitONE’s cutting-edge software and tools could elevate your business. Whether you’re interested in expanding into new markets through our extensive network of banks, telecoms, and money transfer operators, or keen on participating in our upcoming events—such as those focused on emerging opportunities in Saudi Arabia. Let’s make the most of this event together.

To schedule a meeting with the RemitONE team in advance, simply reach out to us at sales@remitone.com.

We’re looking forward to connecting with industry peers and exploring new avenues for meaningful collaboration.

IPR Global 2024 Highlights: Industry Leaders Unite to Shape the Future of Cross-Border Payments

Last month, we hosted our annual Innovation in Payments and Remittances (IPR) Global 2024 event, where top industry leaders and companies gathered across the cross-border payments industry to network, exchange ideas, and share their expertise. Known for fostering innovation and collaboration, IPR Global connected money transfer operators, banks, industry experts, and more to explore the latest trends and challenges to drive and innovate the industry.

Global Representation and Diversity

IPR Global was even bigger this year, with over 280 attendees across 20+ regions. Our dynamic speaker lineups truly showcased our commitment to diversity, bringing together representatives from around the world, which sparked engaging discussions and offered fresh perspectives on global financial challenges.

The two-day conference was packed with a dynamic mix of keynote speeches, networking opportunities, and panel discussions. Attendees gained valuable insights into emerging technologies, regulatory landscapes, and market trends shaping the future of cross-border payments.

Some key takeaways included:

- How blockchain and cryptocurrencies are making transfers faster and more cost-effective

- Strategies for enhancing financial inclusion in underserved markets

- How to leverage AI for fraud prevention and compliance

The event was wrapped up with our prestigious IPR Awards ceremony, where we acknowledged and celebrated the outstanding achievements in innovation, customer service, and social impact across the sector.

Attendee Experience

“As a 40-year industry executive in the International Payments space I found IPR to be a vital and valuable event for remittance providers around the world. The content was spot on around industry insight, trends, challenges, and opportunities. Ding’s involvement at IPR was solidified by the commitment from money transfer operators around the world that our offering is essential to support their revenue growth and product expansion capabilities.” – Bob Dowd, Senior VP, Ding

“It’s the collaborative environment and the open forum where we can all share ideas that truly makes IPR a great experience and a fantastic event to be a part of.” – Holly Crowell, Financial Services Partnership Manager, Worldpay

Sponsor Support

IPR Global 2024 was made possible by the industry-leading sponsors, including Visa Direct, Worldpay, Nium, Vyne, and many more. Their contributions not only elevated the event experience but also demonstrated the collaborative spirit driving that is propelling the industry forward.

Looking Ahead: IPR Global 2025

Building on this year’s success, RemitONE is thrilled to announce that IPR 2025 will be expanding to the rapidly growing region of Riyadh, Saudi Arabia. IPR Global, Riyadh will offer even greater opportunities for industry professionals to connect, grow, and collaboratively shape the future of cross-border payments like never before.

For more information about IPR Global, Riyadh 2025 or to express interest in attending, sponsoring, or speaking, please contact: sales@remitone.com

Join us as we continue to drive innovation and collaboration in the world of international payments and remittances.

RemitONE and Stanbic Bank Partner to Accelerate Cross-Border Payments across Africa

September 2024: RemitONE, a global leader in cross-border payment technology solutions, is pleased to announce a strategic partnership with Stanbic Bank, one of Ghana’s largest banks and most prominent financial institutions. This collaboration will leverage RemitONE’s cutting-edge payment infrastructure to enhance Stanbic Bank’s cross-border payment services, empowering customers across Africa.

In response to the growing demand for seamless and affordable cross-border payments, Stanbic Bank has prioritised enhancing its money transfer services as part of its broader business expansion strategy. By partnering with RemitONE, Stanbic Bank aims to modernise its money transfer offerings and provide its customers with a more accessible, secure, and efficient money transfer experience.

By integrating RemitONE’s state-of-the-art digital payment technology into its online and mobile banking platforms, Stanbic Bank will offer customers an unparalleled money transfer experience – starting with transfers in Ghana and Nigeria, and soon extending to other Western, Eastern and Southern African countries.

The partnership between RemitONE and Stanbic Bank is expected to deliver substantial benefits to both individual customers and the broader financial ecosystem in Africa. Customers can look forward to a streamlined and cost-effective cross-border payment experience, while the collaboration will also contribute to the overall growth and development of the African remittance market.

About RemitONE

RemitONE is the leading provider of money transfer software solutions for banks, telcos, and money transfer operators (MTOs) worldwide. Organisations of all sizes use the RemitONE platforms to run their money transfer operations with ease and efficiency by reaching out to their customers via multiple channels including agent, online and mobile.

For more information on RemitONE, please email sales@remitone.com.

Innovation in Payments and Remittances (IPR) Global 2024 Award Winners!

Earlier in the month, we gathered the top global companies in the Remittance and Payments space in our annual IPR Global 2024 event. On day two, we hosted our award ceremony to honour the game-changers and trailblazers who are pushing the industry forward in exciting new ways.

The RemitONE team is excited to unveil the winners who took home the trophy, along with the honourable mentions — those who came close and deserve recognition for their impressive efforts:

Company of the Year 2024

Winner: Flutterwave

Honourable mention: Jamuna Bank PLC. Bangladesh

Social Impact Award 2024

Winner: Ding

Honourable mention: United Bank Limited

Exceptional Customer Experience Award 2024

Winner: Cauridor

Honourable mention: Neo Money Transfer

Start-up of the Year Award 2024

Winner: Sikoia

Honourable mention: WeWire

Innovation Award 2024

Winner: Uniteller Financial Services

Honourable mention: Tiketi Rafiki

All entries were thoroughly evaluated by our esteemed judges comprised of global senior experts in the payments and remittance industry:

- Leon Isaacs, CEO & Founder, DMA Global

- Kathryn Tomasofsky, Executive Director, MSBA

- Osama Al Rahma, Advisor, Board of Foreign Exchange & Remittance Group (FERG)

- Veronica Studsgaard, Founder & Chairman, IAMTN

After the initial assessment, the award finalists were unveiled in August 2024. This was followed by the second stage, during which the judging panel reviewed all the finalist entries and selected the winners in each category through an anonymous scoring method.

From left to right pictured: (Top left) Alpha Diallo, Marta Pillon and Rob Ayers, (Top middle) Lindsay Lehr, Bob Dowd and Olivia Biviano, (Top right) Alberta Guerra and Lindsay Lehr, (Bottom left) Leon Isaacs, Sid Gautam, Shikesha Panton, Noel Ozoemena and Sadat Choudhury, (Bottom right) Bob Dowd, Olivia Biviano, Alpha Diallo, Marta Pillon, Albert Guerra, Noel Ozoemena and Shikesha Panton.

About Innovation in Payments and Remittances (IPR)

In 2018, RemitONE launched Innovation in Payments and Remittances (IPR) to bring together various industry supply chain members to drive positive change. Through events and research reports, IPR unites senior business leaders dedicated to enhancing the industry, enabling them to think big, share best practices, engage, learn, discover, create opportunities and shape change. With the power of collective insight, we can push innovation and industry growth boundaries and benefit from better outcomes.

The IPR events are organised throughout the year to help industry stakeholders, visionaries and business leaders make informed decisions that ultimately benefit the consumers.

About RemitONE

RemitONE is the leading provider of end-to-end money transfer solutions for banks, money transfer operators (MTOs) and fintech start-ups worldwide. Our award-winning money transfer, compliance software products and consulting services – including MSB licensing, bank account provisioning and connections to our clients and partners – are tailored for the global money transfer market.

Organisations of all sizes use our platforms to run their remittance operations with ease and efficiency by reaching out to their customers via multiple channels, including agent, online and mobile.

For more information, or to access all the photos from the IPR Awards ceremony, please contact marketing@remitone.com