RemitONE partners with GBG for global identity verification and AML compliance solutions

21st September, 2023: RemitONE is thrilled to announce its strategic partnership with GBG, a global expert in digital location, identity verification, and fraud prevention software. This collaboration empowers Money Transfer Organisations (MTOs) worldwide to effectively verify customer identities across the globe, maintain regulatory compliance, and streamline customer onboarding.

Now, RemitONE users can seamlessly harness GBG’s cutting-edge capabilities through the renowned RemitONE Money Transfer Platform. This partnership addresses critical challenges faced by MTOs, including:

- Onboarding a diverse and global customer base

- Confidently onboarding good customers and managing high-risk individuals and businesses by verifying customers on an ongoing basis for politically exposed persons (PEPs) and sanctions checks

- Ensuring compliance with anti-money laundering (AML) regulations

- Cost efficiency

RemitONE partners with GBG as they are the global leaders in identity verification and fraud prevention. GBG’s solutions are one of the most cost-effective on the market and make compliance easy for RemitONE’s clients.

In GBG’s recent Global State of Digital Identity 2023 report, only 30% of businesses said that they screen customers against PEPs and sanctions lists. Find out more key insights here: GBG’s Global State of Digital Identity 2023 report

Take advantage of the RemitONE and GBG partnership by contacting marketing@remitone.com

About RemitONE

RemitONE is the leading provider of money transfer software solutions for banks, telcos, and money transfer operators (MTOs) worldwide. Organisations of all sizes use the RemitONE platform to run their remittance operations with ease and efficiency by reaching out to their customers via multiple channels including agent, online and mobile.

About GBG

GBG is the leading expert in global digital identity. Combining their powerful technology, the most accurate data coverage, and talented team to deliver award-winning location intelligence, identity verification and fraud prevention solutions.

With over 30 years’ experience, GBG bring together a team of over 1,250 dedicated experts with local industry insight from around the world to make it easy for businesses to identify and verify customers and locations, protecting everyone, everywhere from fraud.

Learn more at www.gbgplc.com and follow us on LinkedIn and Twitter (@gbgplc).

For more information on RemitONE, please email marketing@remitone.com

Video | Managing Anti Money Laundering (AML) and Compliance for your Money Service Business

To ensure the smooth and secure operation of your business, it’s essential to be diligent in navigating AML requirements while remaining compliant with the latest regulations in your operational regions. In our third instalment of the ‘How to Start Series,’ Ibrahim delves into one of the fundamental pillars of your Money Service Business (MSB): Anti-Money Laundering (AML) and Compliance, he guides you through the essential steps such as:

- Implementing a risk-based strategy tailored to your products/services.

- Establishing a comprehensive AML and compliance framework, including its key components

- Selecting the appropriate software technology that has the right capability to support your needs

Find out the insightful strategies to safeguard your MSB against potential threats, watch the full video now.

Ready to dive deeper into launching your own MSB?

Contact our expert consulting team at RemitONE today and organise a free 30-minute consultation. Let us guide you towards success and help you get your money service business up and running as fast as possible. Schedule a free consultation with our experts:

IPR Training: AML and Compliance for Money Service Businesses Key Takeaways

In a rapidly evolving financial landscape, combating money laundering (AML) and ensuring compliance has become highly essential for money service businesses (MSBs). Two weeks ago, we hosted our second Innovation in Payments and Remittances (IPR) training session, focusing on AML and compliance strategies tailored to the unique needs of MSBs.

In this article, we’ll delve deeper into the key highlights discussed during the session for you to gain key insights from.

If you couldn’t attend the live sessions, don’t worry as you can still sign up at a reduced rate and access them on-demand.

It’s a great opportunity to enhance your expertise, earn CPD points, and secure a certification. You can register online here: https://payments2023.ipr-events.com/register

Now let’s dive right in and explore some of the key takeaways from the 2-day sessions.

1. Differentiating Terrorist Financing and Money Laundering: Recognising Patterns

Distinguishing between Terrorist Financing and Money laundering is vital in developing targeted prevention strategies. The training session highlighted that while both activities involve illicit financial transactions, they often exhibit different characteristics. Terrorist financing can be sourced through legitimate funding, unlike money laundering where its origin is from criminal activities and financial crime.

Money laundering frequently involves larger amounts aimed at concealing the illegal origins of funds whilst Terrorist financing comprises of small, discrete transactions intended to avoid suspicion.

Noticing these unusual large or small transactions can be a key indicator of potential terrorist financing, allowing businesses to act quickly and prevent the flow of funds to harmful causes.

Furthermore, MSBs should set up appropriate monitoring mechanisms and transaction thresholds to better identify and report suspicious activities that align with the specific patterns of these crimes. This way MSBs can reduce the likelihood of criminal activity being carried out through their business.

2. Structured KYC Procedures: Gateway to prevent Money Laundering risks

As the starting point for any business relationship, a structured and rigorous KYC process enables MSBs to verify the identity of their customers, assess the legitimacy of their transactions, and detect potential red flags. By obtaining and verifying relevant information such as customer identification, source of funds, and purpose of transactions, MSBs can create a comprehensive customer profile that aids in identifying suspicious activities. Effective KYC practices also enable MSBs to establish a strong foundation for ongoing due diligence and monitoring.

Recognising that every MSB operates within a distinct operational context, it’s crucial to design risk assessments that address the specific needs and characteristics of each business. This approach ensures that potential vulnerabilities are identified and addressed effectively. By analysing factors such as transaction volume, customer profiles, geographic scope, and business relationships, MSBs can develop risk assessment frameworks that accurately reflect their exposure to money laundering and other financial crimes.

RemitONE’s Compliance Manager™ (COM) features a set of compliance features to ensure enhanced detection of fraudulent money. Some of the features include:

- Linked Transaction Detection: will detect multiple transactions sent by the same remitter to different beneficiaries or multiple remitters to the same beneficiary. This will help you notice any suspicious activity you need to alert authorities of immediately.

- NameMatch™: Eliminating the need for manual cross-referencing against international sanction lists, our technology streamlines the process, ensuring greater efficiency. The system cross-checks against multiple sanction lists and accommodates the addition of custom lists. Moreover, seamless integration with external Compliance List Services, such as Reuters’ WorldCheck, Experian, and GBG, widens the spectrum of available lists, encompassing PEP lists as well.

- Dynamic risk scoring: Conduct personalised risk assessments utilising assigned scores ranging from 0 to 100 for Remitters and Beneficiaries. This score continually adjusts in response to a range of variables, encompassing factors like source country, nationality, individual versus corporate affiliations, and name screening outcomes.

If you’re interested to integrate COM™ into your system contact us at sales@remitone.com.

3. A Compliance Officer/MLRO is crucial

Delving deeper, Ibrahim emphasised the fundamental role of a Compliance Officer or Money Laundering Reporting Officer (MLRO) in combatting money laundering. There are four essential components he advised to keep in mind when selecting the right candidate:

- Qualifications: The compliance officer must possess a strong foundation, supported by relevant qualifications and certifications. Their background should reflect a deep understanding of AML practices to effectively help them navigate the complexities of compliance. They should have a minimum of one year of practical experience in the field and hold credentials related to AML/compliance, endorsed by international standard organisations.

- Championing Independence: Independence is key as the compliance officer controls AML policies, risk assessment, internal controls, and training. Furthermore, their decision-making process should remain uninfluenced by other team members, as external interference can cloud their perspective and make them compromise compliance.

- Dedication Demanded: the compliance officer should be a dedicated, full-time member of the team to ensure a high level of monitoring. While certain operational aspects can be outsourced, the oversight and management of these functions, particularly in jurisdictions like the UK, remain firmly the responsibility of the compliance officer.

Sign up for IPR Training Sessions – Offering CPD Points and Certification

We have more exciting upcoming events you can sign up for. Discover the full schedule of events and reserve your spot now at: https://www.ipr-events.com/.

Remember, tickets are limited and allocated on a first-come, first-served basis. To ensure your participation please secure your seats early.

Don’t miss out on these exclusive opportunities to expand your knowledge, connect with industry experts, and stay at the forefront of cutting-edge developments.

We look forward to seeing you in our IPR training sessions!

Top 5 takeaways from the RemitONE Compliance for Money Transfers panel at IMTC EMEA 2021

Earlier in the year, a few of the key players in the remittance industry digitally gathered together to discuss a wide range of key topics within the field of money transfer compliance in a panel hosted by RemitONE. The panel included deep dives into anti-money laundering practices, responding to suspicious activity, OFAC compliance (Office of Foreign Assets Control), and much more.

Moderator:

Oussama Kseibati, Head of Services at RemitONE

Panellists:

- Ibrahim Muhammad, Independent Payments Consultant, Al Fardan

- Nadeem Qureshi, CTO, USI Money

To condense the panel into a few paragraphs would be a tricky task indeed, so we’ve decided to focus on five of the key takeaways that our panellists settled on during their discussion.

1. Cybercrime requires a threefold solution – Ibrahim

There are two different types of financial crime. Broadly speaking, on one hand, there are crimes related to money laundering, terrorist financing, fraud and cybercrime. On the other hand, there is financial crime related to bribery and corruption. When it comes to the money service sector it’s the former type of crime that’s been on the rise recently, thanks to the pandemic and the increased digitisation of companies.

How do we prevent these attacks? It’s a threefold solution. First, companies need to ensure the right people are in charge of their systems – this means people with a clear understanding of risk assessment. Second, they need to put well-documented processes in place, guided by policies and procedures. And finally, the systems need to be robust enough to identify, prevent and deter financial crime.

2. Plugins have made all the difference – Nadeem

The availability of plugins is gradually taking us away from an environment of weekly updates and into a more active, real-time environment. What used to take weeks can now take place in the space of days or even hours, with lists being updated and names being added constantly.

Working with something which is real-time means it’s so much easier to identify a weakness faster. These days you have customers registering and processing within a matter of minutes. But as we’re working towards that more efficient way of processing, it’s vital that the system is robust and is set to your needs as opposed to the system needs.

3. There are two sides to the story – Oussama

There are two main sides to the new compliance regulations that we’re seeing. It’s not just where you yourself operate, it might also be where and whom you’re sending to. What kind of regulations do they have and what are their maximum receive amounts, for example?

We have to understand this because there’s an ever-changing landscape right now with new rules and regulations being set all the time. Unless you’re on top of those changes, then you’re always going to be putting yourself at risk when partnering with someone. It’s also worth noting that a lot of the regulations come from the central banks and they will have their own lists and connections that you’ll need to take into account.

4. Transaction monitoring and risk profiling are key – Ibrahim

Transaction monitoring is a key part of KYC and should always be an ongoing process. When we onboard the customer, that doesn’t necessarily mean we’ve 100% verified them. It’s the ongoing transactional behaviour of the customer that allows us to do that and this is where profiling plays such an important role.

You need to do a proper risk profile or categorisation based on the transactional behaviour of your customers and categorise these customers into different risk profiles at both the customer level and the transactional level. Of course, there are multiple systems, including RemitONE’s, that can facilitate the onboarding process and ensure that the customers are who they claim to be. But they can also track where money is going so that, for example, if the destination country is high-risk then additional checks can be put in place and appropriate limits can be set.

5. Creating an effective monitoring programme is all about asking the right questions – Nadeem

The first thing to do when building a transaction monitoring programme is to really look at whether you’re a B2B, B2C or B2B2C service. Once you can answer that question and are able to identify your customers, it’s much easier to break everything down. After this, you need to answer the question of the dual jurisdiction process – the rules and regulations in the sending and receiving countries.

Finally, once the system is configured, you need to ask whether or not it needs to be looked at a little deeper. Because so often you’ll rush to go live and there will be a tech anomaly that was overlooked or a parameter that wasn’t set right. Once you can confidently answer all of these questions, only then can you create something in terms of a robust framework, whether it’s for monitoring or compliance.

We’d like to extend a huge thanks to Ibrahim, Nadeem and Oussama for their time and insights.

What next?

Now that you’ve read our article we want to help you get the most out of it and deep dive into the trends and predictions shared.

Tap into our experts and schedule a free 30min consultation.

AML and CFT Guide for Money Transfer Start-Ups

Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT), are terms mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent, detect, and report money laundering and terrorist financing activities.

Every regulated entity should have appropriate AML as well as CFT checks and controls in line with the regulatory framework of the jurisdiction where the entity operates from.

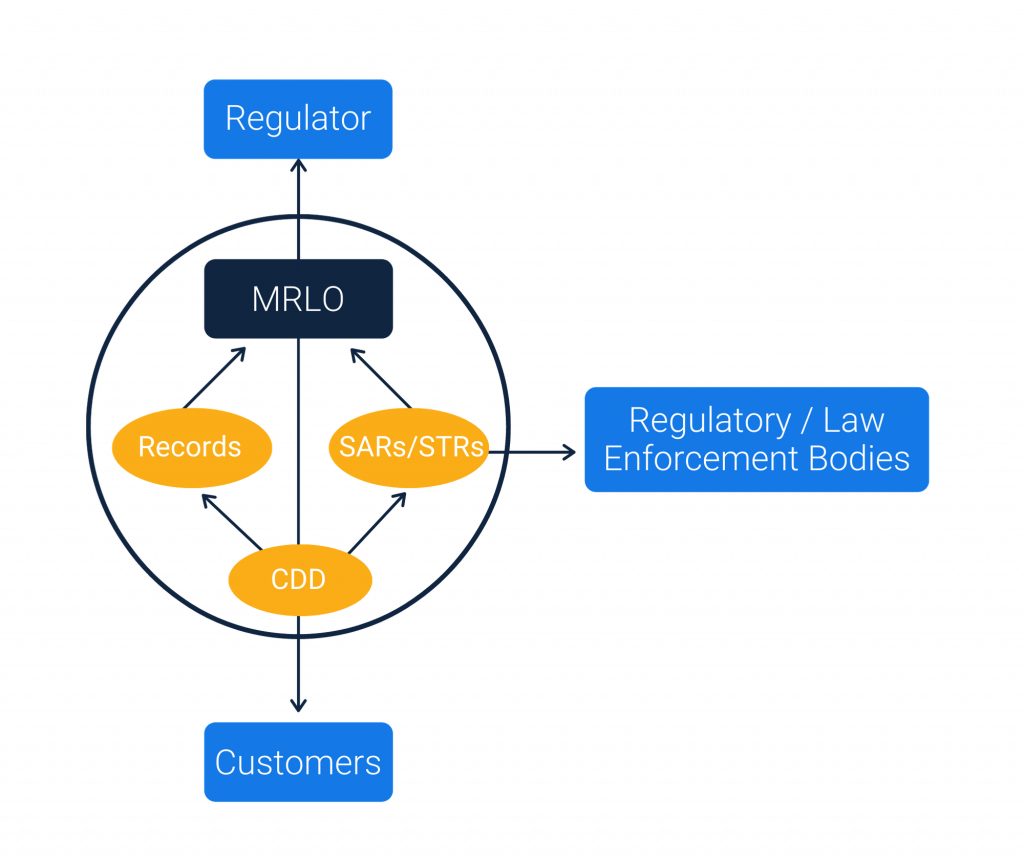

To make it easier for Start-Ups, please find below the diagram of the AML/CFT Ecosystem:

The ecosystem shown above shows the five core responsibilities of Money Transfer Start-Ups:

1. Onboard a Money Laundering Reporting Officer (MLRO)

First and foremost, all start-ups must have a dedicated Money Laundering Reporting Officer (MLRO) who is responsible for managing all compliance activities within the organisation. Depending upon the type and size of the business, there could be one or more members within the compliance team.

Aside from the MLRO, it is important that other stakeholders such as Directors, Senior Managers and even Shareholders familiarise themselves with the Payment Services and AML regulations within the jurisdiction where the business is registered.

2. Customer Due Diligence (CDD)

Each entity is responsible to identify the customers that they deal with. This step is known as the Know Your Customer (KYC). The MLRO has to identify the checks and controls that need to be in place to capture all the information needed from the customers as part of the KYC process.

Apart from KYC, the entity must also maintain the Customer Due Diligence which is mainly to do with checking the customers registering against the watch lists and the transaction patterns of the customers.

3. Suspicious Activity Reporting (SAR)

The entity is required to conduct appropriate investigations whenever an event such as a transaction monitoring alert or a sanctions match occurs. The MLRO has to validate such investigations further and need to report to the local regulatory bodies in the form of Suspicious Activity Reporting (SAR) or Suspicious Transaction Reporting (STR).

4. Record Keeping

The entity is responsible to maintain records of all their customers and transactions for a minimum period of 5 years or as per the guidelines of the local regulatory bodies. The MLRO has to ensure that the data captured from customers for identification and transaction purposes are stored securely and accessible to the authorized individuals of the entity whenever needed. Apart from customers and transactions data, the entity should also maintain the records of all the SARs/STRs.

5. Registering and Reporting to Regulators

The entity is responsible to have the registration done with the relevant regulatory bodies in the jurisdiction where the entity operates from. The entity should also be aware of all the reporting obligations in order to submit reports related to the customers or transactions data to the relevant regulatory bodies in the jurisdiction.

Whether you are a start-up or an established Money Service Business, it is very important that the AML policies and procedures are clearly incorporated within your business model. For more information, advice and support, please contact us.

RemitONE provides proven compliance products for Money Service Businesses and Central Banks and would be delighted to help your business. Contact marketing@remitone.com or call +44 (0) 208 099 5795.